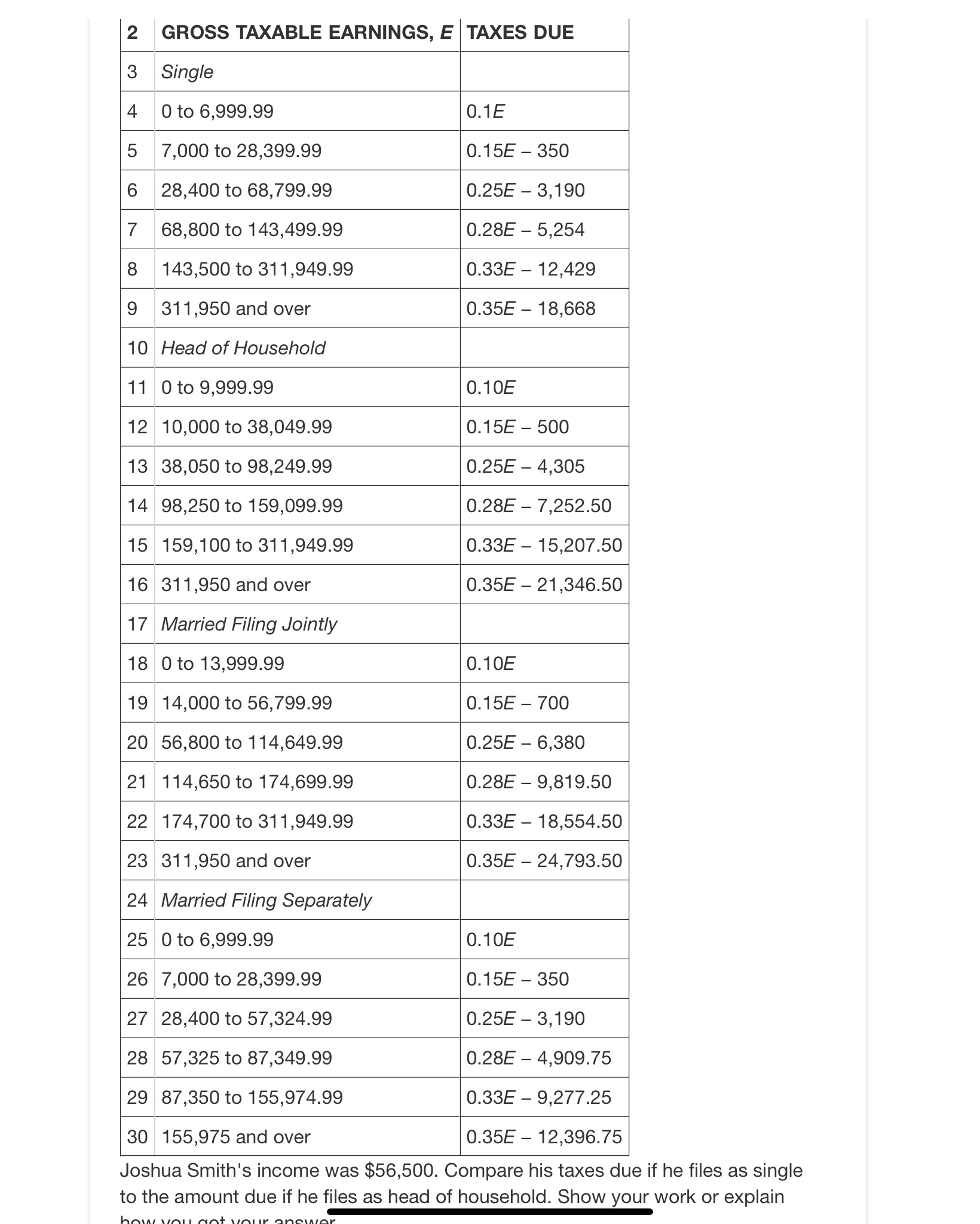

Question: begin { tabular } { | c | c | c | } hline 2 & GROSS TAXABLE EARNINGS, ( E

begintabularccc

hline & GROSS TAXABLE EARNINGS, E & TAXES DUE

hline & Single &

hline & to & E

hline & to & E

hline & to & E

hline & to & E

hline & to & E

hline & and over & E

hline & Head of Household &

hline & to & E

hline & to & E

hline & to & E

hline & to & E

hline & to & E

hline & and over & E

hline & Married Filing Jointly &

hline & to & E

hline & to & E

hline & to & E

hline & to & E

hline & to & E

hline & and over & E

hline & Married Filing Separately &

hline & to & E

hline & to & E

hline & to & E

hline & to & E

hline & to & E

hline & and over & E

hline

endtabular

Joshua Smith's income was $ Compare his taxes due if he files as single to the amount due if he files as head of household. Show your work or explain

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock