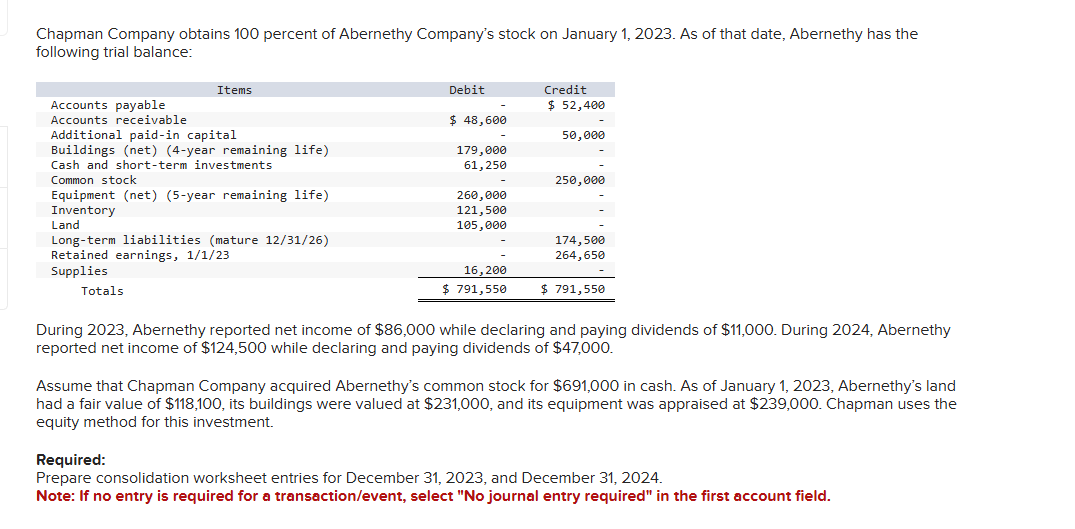

Question: begin { tabular } { | c | c | c | c | c | c | } hline No & date

begintabularcccccc

hline No & date & & & Debit & Credit

hline multirowt & December & Investment in Abernethy & times & &

hline & & Cash and shortterm investments & times & & times

hline & & & & &

hline multirowt & December & Common stock Abernethy & checkmark & &

hline & & Additional paidin capital & & &

hline & & Retained earnings & & &

hline & & Investment in Abernethy & checkmark & &

hline & & & & &

hline multirowt & December & Land & checkmark & &

hline & & Buildings & & &

hline & & Goodwill & & &

hline & & Equipment & & &

hline & & Investment in Abernethy & & &

hline & & & & &

hline multirowt & December & Equity in subsidiary earnings & checkmark & times &

hline & & Investment in Abernethy & & & times

hline & & & & &

hline multirowt & December & Investment in Abernethy & & &

hline & & Dividends declared & & &

hline & & & & &

hline multirowt & December & Depreciation expense & bigcirc & &

hline & & Equipment & & &

hline & & Buildings & bigcirc & &

hline & & & & &

hline multirowt & December & Equity in subsidiary earnings & boldsymbolx & times &

hline & & Investment in Abernethy & times & & times

hline & & & & &

hline multirowt & December & Common stock Abernethy & checkmark & &

hline & & Additional paidin capital & checkmark & &

hline

endtabularbegintabularcccccc

hline & December & Depreciation expense & checkmark & &

hline & & Equipment & & &

hline & & Buildings & checkmark & &

hline & & & & &

hline & December & Equity in subsidiary earnings & times & times &

hline & & Investment in Abernethy & times & & times

hline & & & & &

hline & December & Common stock Abernethy & & &

hline & & Additional paidin capital & & &

hline & & Retained earnings & checkmark & &

hline & & Investment in Abernethy & checkmark & &

hline & & & & &

hline & December & Land & checkmark & &

hline & & Buildings & & &

hline & & Goodwill & & &

hline & & Equipment & & &

hline & & Investment in Abernethy & checkmark & &

hline & & & & &

hline & December & Equity in subsidiary earnings & checkmark & &

hline & & Investment in Abernethy & & &

hline & & & & &

hline & December & Investment in Abernethy & & &

hline & & Dividends declared & & &

hline & & & & &

hline & December & Depreciation expense & checkmark & &

hline & & Equipment & & &

hline & & Buildings & & &

hline

endtabular Consolidation Worksheet Entries

Prepare entry C to convert parent's beginning retained earnings to full accrual basis.

Note: Enter debits before credits.

begintabularclcc

hline Date & multicolumnc Accounts & Debit & Credit

hline December & nvestment in Abernethy & &

hline & Cash and shortterm investments & &

hline & & &

hline & & &

hline & & &

hline & &

hline

endtabular Consolidation Worksheet Entries

Prepare entry C to convert parent's beginning retained earnings to full accrual basis.

Note: Enter debits before credits.

begintabularcccc

hline Date & multicolumnc Accounts & Debit & Credit

hline December & Equity in subsidiary earnings & &

hline & Investment in Abernethy & &

hline & & &

hline & & &

hline & & &

hline & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock