Question: begin { tabular } { | c | c | c | c | c | c | c | c | }

begintabularcccccccc

hline A & B & & C & & & D & E

hline & multicolumncIncome statement &

hline & & & & & & &

hline & All figures are in thousands & & & & & &

hline & & & & & & &

hline & EARNINGS & & & & & &

hline & Net sales & $ & & & & &

hline & Cost of sales & $ & & & & &

hline & Gross Profit & $ & & & & &

hline & Selling and general administrative expenses & $ & & & & &

hline & Operating income & $ & & & & &

hline & Investment income & $ & & & & &

hline & Other expense & $ & & & & &

hline & Earnings before income taxes EBIT & $ & & & & &

hline & Interest expenses & $ & & & & &

hline & Income taxes @ & $ & & & & &

hline & Net earnings & $ & & & & &

hline & & & & & & &

hline & & & & & & &

hline

endtabularbegintabularccccc

hline A & B & C & & D

hline & multicolumnlConsolidated Balance Sheet

hline & & & &

hline & All figures are in thousands & & &

hline & multicolumnlASSETS

hline & multicolumnlCurrent assets:

hline & Cash & Equivalents & $ & $ &

hline & Shortterm investments, at amortized cost & $ & $ &

hline & Accounts receivable & & &

hline & less allowance for doubtful accounts: $$ & $ & $ &

hline & multicolumnlInventories

hline & Finished goods & $ & $ &

hline & Raw materials and suppplies & $ & $ &

hline & & $ & $ &

hline & Dther current assets & $ & $ &

hline & Deferred income taxes current & $ & $ &

hline & Total current assets & $ & $ &

hline & Marketable equity securities at fair value & $ & $ &

hline & Deferred charges and other assets & $ & &

hline & Deferred income taxes noncurrent & $ & $ &

hline & multicolumnlProperty plant, and equipment at cost

hline & Land & $ & $ &

hline & Buildings and building equipment & $ & $ &

hline & Machinery and equipment & $ & $ &

hline & & $ & $ &

hline & Less accumulated depreciation & $ & $ &

hline & Net, property plant and equipment & $ & $ &

hline & TOTAL ASSETS & $ & $ &

hline

endtabular

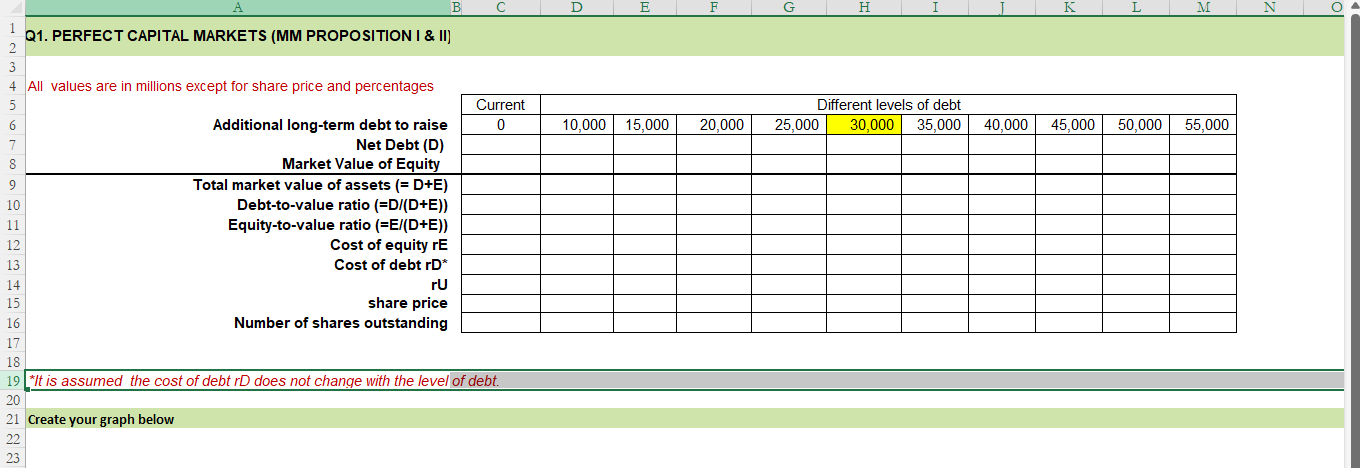

Capital Market Conditions

US Treasury yield curve

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock