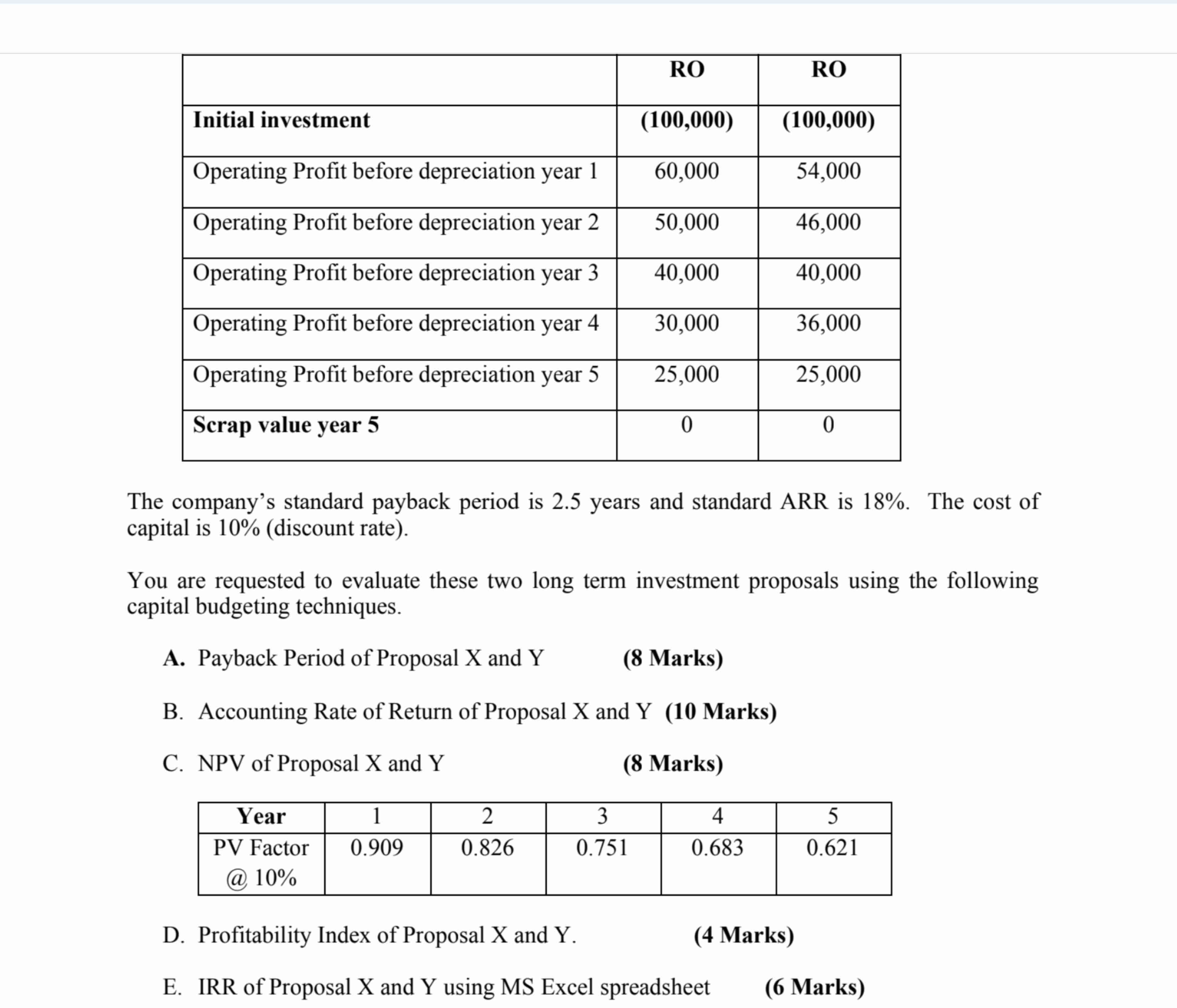

Question: begin { tabular } { | l | c | c | } hline & ( mathbf { R O }

begintabularlcc

hline & mathbfR O & mathbfR O

hline Initial investment & mathbf & mathbf

hline Operating Profit before depreciation year & &

hline Operating Profit before depreciation year & &

hline Operating Profit before depreciation year & &

hline Operating Profit before depreciation year & &

hline Operating Profit before depreciation year & &

hline Scrap value year & &

hline

endtabular

The company's standard payback period is years and standard ARR is The cost of capital is discount rate

You are requested to evaluate these two long term investment proposals using the following capital budgeting techniques.

A Payback Period of Proposal X and Y

Marks

B Accounting Rate of Return of Proposal X and Y Marks

C NPV of Proposal X and Y

Marks

begintabularcccccc

hline Year & & & & &

hline begintabularc

PV Factor

@

endtabular & & & & &

hline

endtabular

D Profitability Index of Proposal X and Y

Marks

E IRR of Proposal X and Y using MS Excel spreadsheet

Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock