Question: begin { tabular } { | l | l | l | l | l | } hline & multicolumn { 2

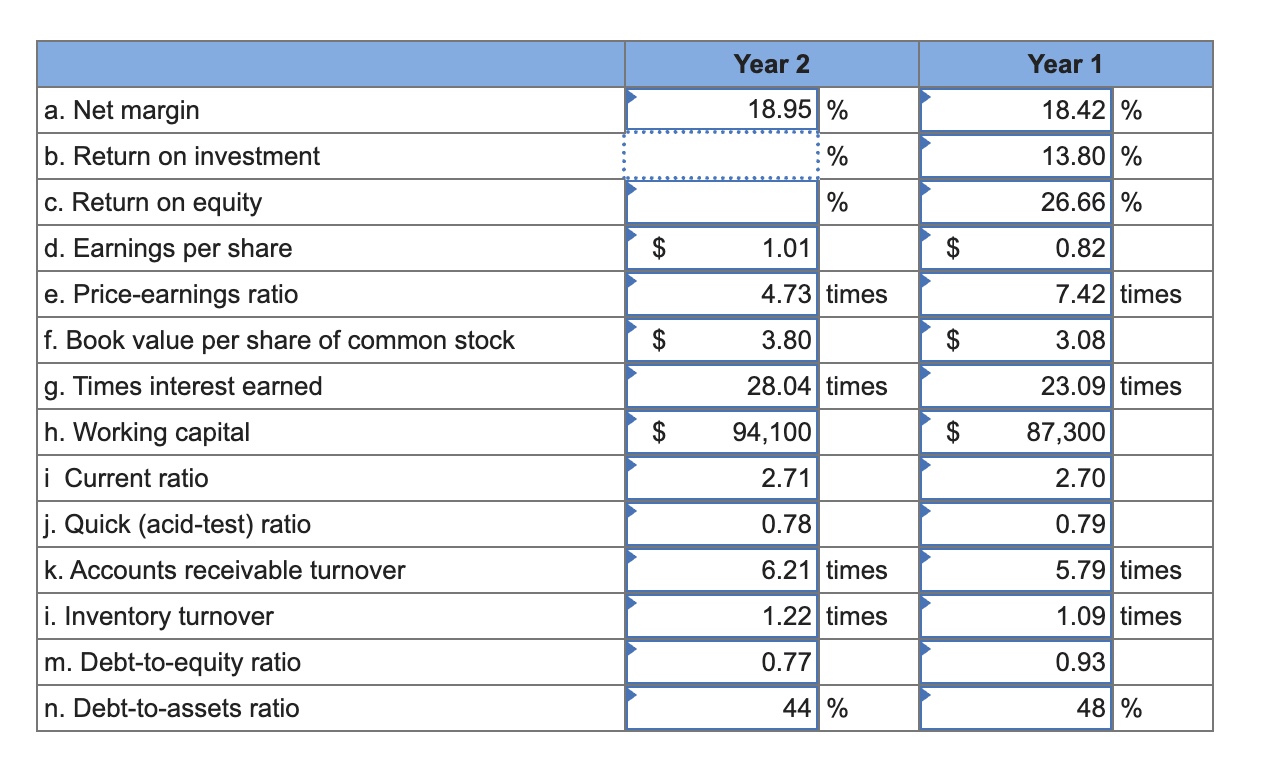

begintabularlllllhline & multicolumncYear & multicolumncYear hline a Net margin & & & & hline b Return on investment & & & & hline c Return on equity & & & & hline d Earnings per share & $ & & $ & hline e Priceearnings ratio & & times & & times hline f Book value per share of common stock & $ & & $ & hline g Times interest earned & & times & & times hline h Working capital & $ & & $ & hline i Current ratio & & & & hline j Quick acidtest ratio & & & & hline k Accounts receivable turnover & & times & & times hline i Inventory turnover & & times & & times hline m Debttoequity ratio & & & & hline n Debttoassets ratio & & & & hline endtabular The following financial statements apply to Rooney Company:

begintabularlll

hline multicolumncIncome Statements for the Years Ending December Year Year

hline Revenues & $ & $

hline multicolumnlExpenses

hline Cost of goods sold & &

hline Selling expenses & &

hline General and administrative expenses & &

hline Interest expense & &

hline Income tax expense & &

hline Total expenses & &

hline Net income & $ & $

hline

endtabularbegintabularlll

hline multicolumncROONEY COMPANY Balance Sheets As of December

hline & Year & Year

hline multicolumnlAssets

hline multicolumnlCurrent assets

hline Cash & $ & $

hline Marketable securities & &

hline Accounts receivable & &

hline Inventories & &

hline Prepaid expenses & &

hline Total current assets & &

hline Plant and equipment net & &

hline Intangibles & &

hline Total assets & $ & $

hline multicolumnlLiabilities and Stockholders' Equity

hline multicolumnlLiabilities

hline multicolumncCurrent liabilities

hline Accounts payable & $ & $

hline Other & &

hline Total current liabilities & &

hline Bonds payable & &

hline Total liabilities & &

hline multicolumnlStockholders equity

hline Common stock shares & &

hline Retained earnings & &

hline Total stockholders' equity & &

hline Total liabilities and stockholders' equity & $ & $

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock