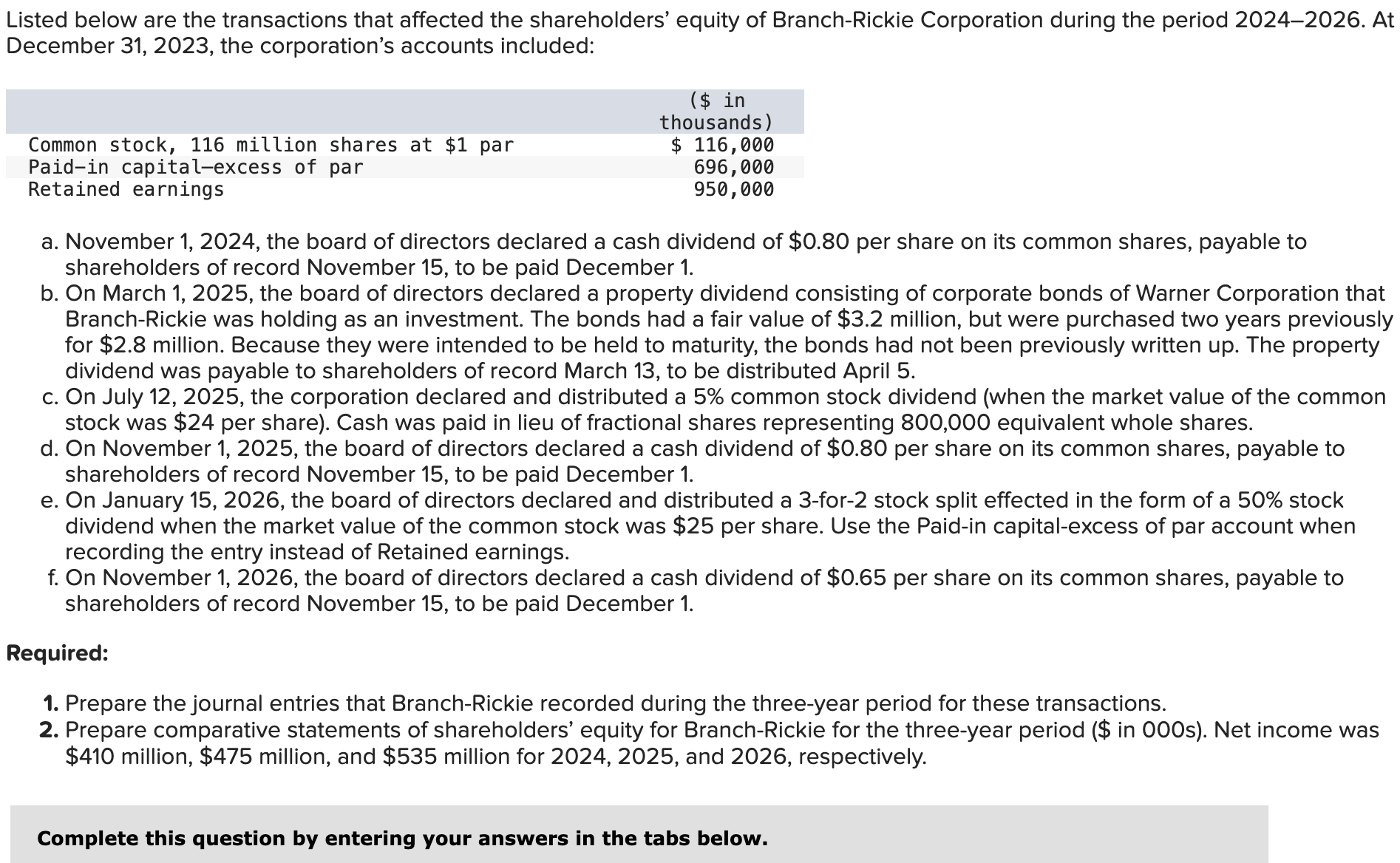

Question: begin { tabular } { | l | l | l | l | l | l | } hline multicolumn {

begintabularllllll

hline multicolumncmultirow & multicolumncmultirow & & LUU,UUU

hline & & & & &

hline & July & Retained earnings & downarrow & &

hline & & Common stock & & &

hline & & Paidin capital excess of par & & &

hline & & Cash & & &

hline & & & & &

hline & November & Retained earnings & & &

hline & & Cash dividends payable & & &

hline & & & & &

hline & November & No journal entry required & & &

hline & & & & &

hline & December & Cash dividends payable & & &

hline & & Cash & & &

hline & & & & &

hline & January & Paidin capital excess of par & & &

hline & & Common stock & diamond & &

hline & & & & &

hline & November & Retained earnings & & &

hline & & Cash dividends payable & & &

hline & & & & &

hline & November & No journal entry required & & &

hline & & & & &

hline & December & Cash dividends payable & & &

hline & & Cash & & &

hline

endtabular Note: Negative amounts should be indicated by a minus sign. Enter your answers in thousands s

begintabularlllll

hline multicolumncBRANCHRICKIE CORPORATION

hline multicolumncStatement of Shareholders' Equity

hline multicolumncFor the Years Ended December and $ in thousands

hline & Common Stock & Additional Paidin Capital & Retained Earnings & Total Shareholders' Equity

hline January & $ & $ & $ & $

hline Net income & & & &

hline Cash dividends & & & ~ &

hline December & & & &

hline Property dividends & & & ~ &

hline Common stock dividend & times & X & &

hline Net income & & & &

hline Cash dividends & & & & times

hline December & & & &

hline for split effected in the form of a stock dividend & & times & &

hline Net income & & & &

hline Cash dividends & & & times & times

hline December & $ & $ & $ & $

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock