Question: begin { tabular } { | l | l | l | l | l | l | l | } hline &

begintabularlllllll

hline & & & & & &

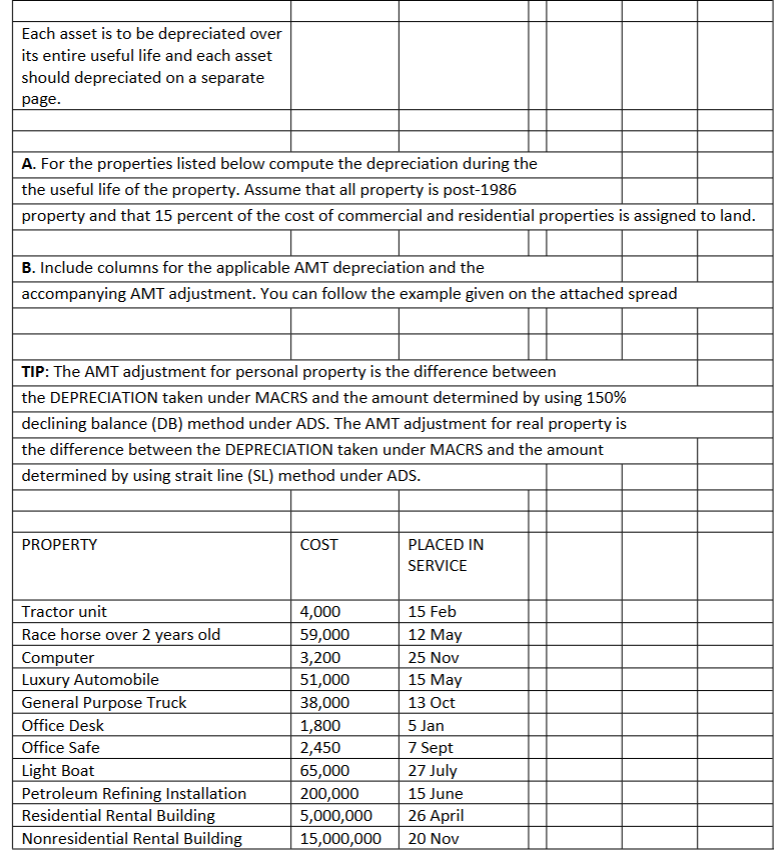

hline Each asset is to be depreciated over its entire useful life and each asset should depreciated on a separate page. & & & & & &

hline & & & & & &

hline & & & & & &

hline multicolumnlA For the properties listed below compute the depreciation during the & &

hline multicolumnlthe useful life of the property. Assume that all property is post & &

hline multicolumnlproperty and that percent of the cost of commercial and residential properties is assigned to land.

hline & & & & & &

hline multicolumnlB Include columns for the applicable AMT depreciation and the

hline multicolumnlaccompanying AMT adjustment. You can follow the example given on the attached spread

hline & & & & & &

hline & & & & & &

hline multicolumnlTIP: The AMT adjustment for personal property is the difference between

hline multicolumnlthe DEPRECIATION taken under MACRS and the amount determined by using

hline multicolumnldeclining balance DB method under ADS. The AMT adjustment for real property is

hline multicolumnlthe difference between the DEPRECIATION taken under MACRS and the amount &

hline multicolumnldetermined by using strait line SL method under ADS. & & &

hline & & & & & &

hline & & & & & &

hline PROPERTY & COST & PLACED IN SERVICE & & & &

hline Tractor unit & & Feb & & & &

hline Race horse over years old & & May & & & &

hline Computer & & Nov & & & &

hline Luxury Automobile & & May & & & &

hline General Purpose Truck & & Oct & & & &

hline Office Desk & & Jan & & & &

hline Office Safe & & Sept & & & &

hline Light Boat & & July & & & &

hline Petroleum Refining Installation & & June & & & &

hline Residential Rental Building & & April & & & &

hline Nonresidential Rental Building & & Nov & & & &

hline

endtabular Note: These are the suggested columns. Make sure that all the columns fit on one page

Asset Description

Cost Basis

Recovery Rate

MACRS Accumulated Depreciation

Adjusted Basis

AMT Rate

AMT Recovery Amount

AMT Accumulated Depreciation

AMT Adjustment

AMT Adjusted Basis

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock