Question: begin { tabular } { | l | r | r | } hline multicolumn { 2 } { | c |

begintabularlrr

hline multicolumncbegintabularc

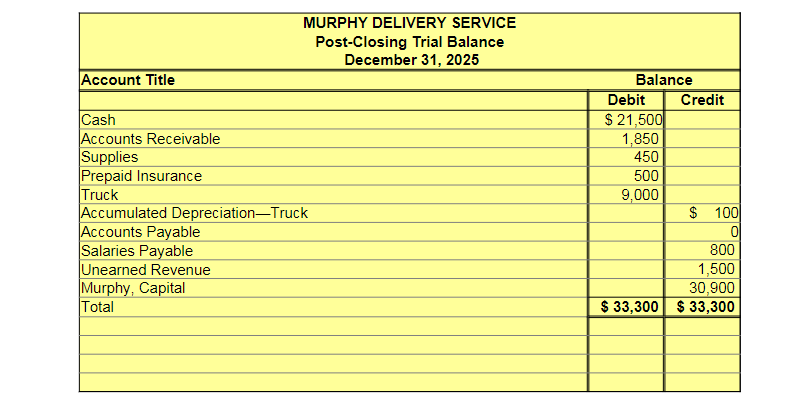

MURPHY DELIVERY SERVICE

PostClosing Trial Balance

December

endtabular

hline Account Title & multicolumnc Balance

hline hline Cash & $ & Credit

hline Accounts Receivable & &

hline Supplies & &

hline Prepaid Insurance & &

hline Truck & & $

hline Accumulated DepreciationTruck & &

hline Accounts Payable & &

hline Salaries Payable & &

hline Unearned Revenue & &

hline Murphy, Capital & $ & $

hline Total & &

hline & &

hline & &

hline & &

hline

endtabular Record each January transaction in the journal. Explanations are not required.

Post the transactions in the Taccounts. Don't forget to use the December ending balances as appropriate.

Prepare an unadjusted trial balance as of January

Prepare a worksheet as of January

Journalize the adjusting entries using the following adjustment data and also by reviewing the journal entries prepared in Requirement Post adjusting entries to the Taccounts.

Adjustment data:

a Supplies on hand, $

b Accrued Service Revenue, $

c Accrued Salaries Expense, $

d Prepaid Insurance for the month has expired.

e Depreciation was recorded on the truck for the month.

Prepare an adjusted trial balance as of January

Prepare Murphy Delivery Service's income statement and statement of owner's equity for the month ended January and the classified balance sheet on that date. On the income statement, list expenses in decreasing order by amount that is the largest expense first, the smallest expense last.

Calculate the following ratios as of January for Murphy Delivery Service: return on assets, debt ratio, and current ratio.

Prepare the closing entries and post to the TAccounts

Prepare the postclosing trial balance

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock