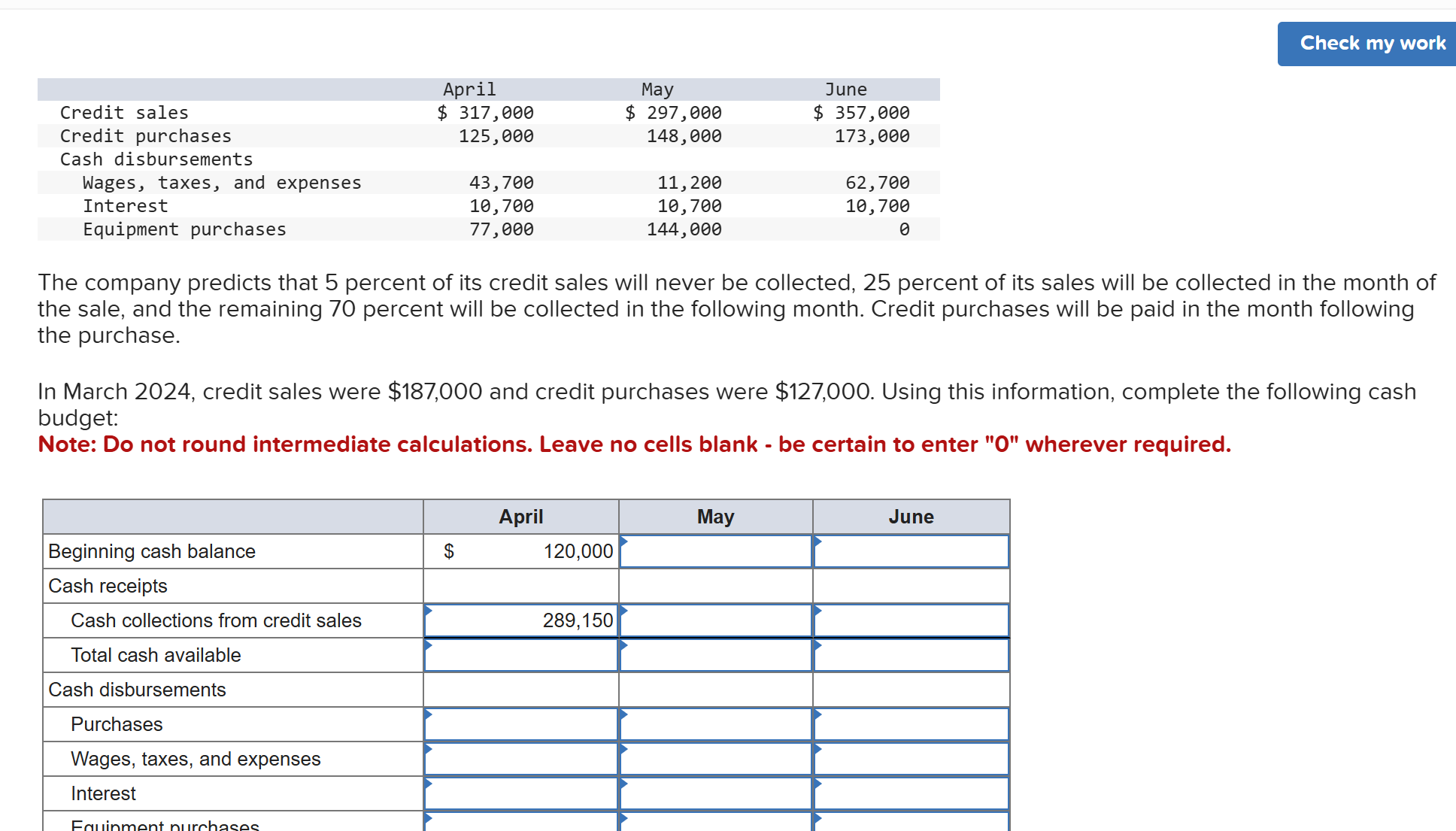

Question: begin { tabular } { lccr } & April & May & June Credit sales & ( $ 3 1

begintabularlccr

& April & May & June

Credit sales & $ & $ & $

Credit purchases & & &

Cash disbursements & & &

Wages, taxes, and expenses & & &

Interest & & &

Equipment purchases & & &

endtabular

The company predicts that percent of its credit sales will never be collected, percent of its sales will be collected in the month of the sale, and the remaining percent will be collected in the following month. Credit purchases will be paid in the month following the purchase.

In March credit sales were $ and credit purchases were $ Using this information, complete the following cash budget:

Note: Do not round intermediate calculations. Leave no cells blank be certain to enter wherever required.

begintabularllll

hline & multicolumnc April & multicolumnc May & June

hline Beginning cash balance & $ quad & &

hline Cash receipts & & &

hline Cash collections from credit sales & & &

hline Total cash available & & &

hline Cash disbursements & & &

hline Purchases & & &

hline Wages, taxes, and expenses & & &

hline Interest & & &

hline Fauinment nurchaces & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock