Question: Beginner Python nothing advanced coding. Please make it short and simple Depreciation. For tax purposes an item may be depreciated over a period of several

Beginner Python nothing advanced coding. Please make it short and simple

Depreciation. For tax purposes an item may be depreciated over a period of several years, n

With the straightline method of depreciation, each year the item depreciates by n the of its original value.

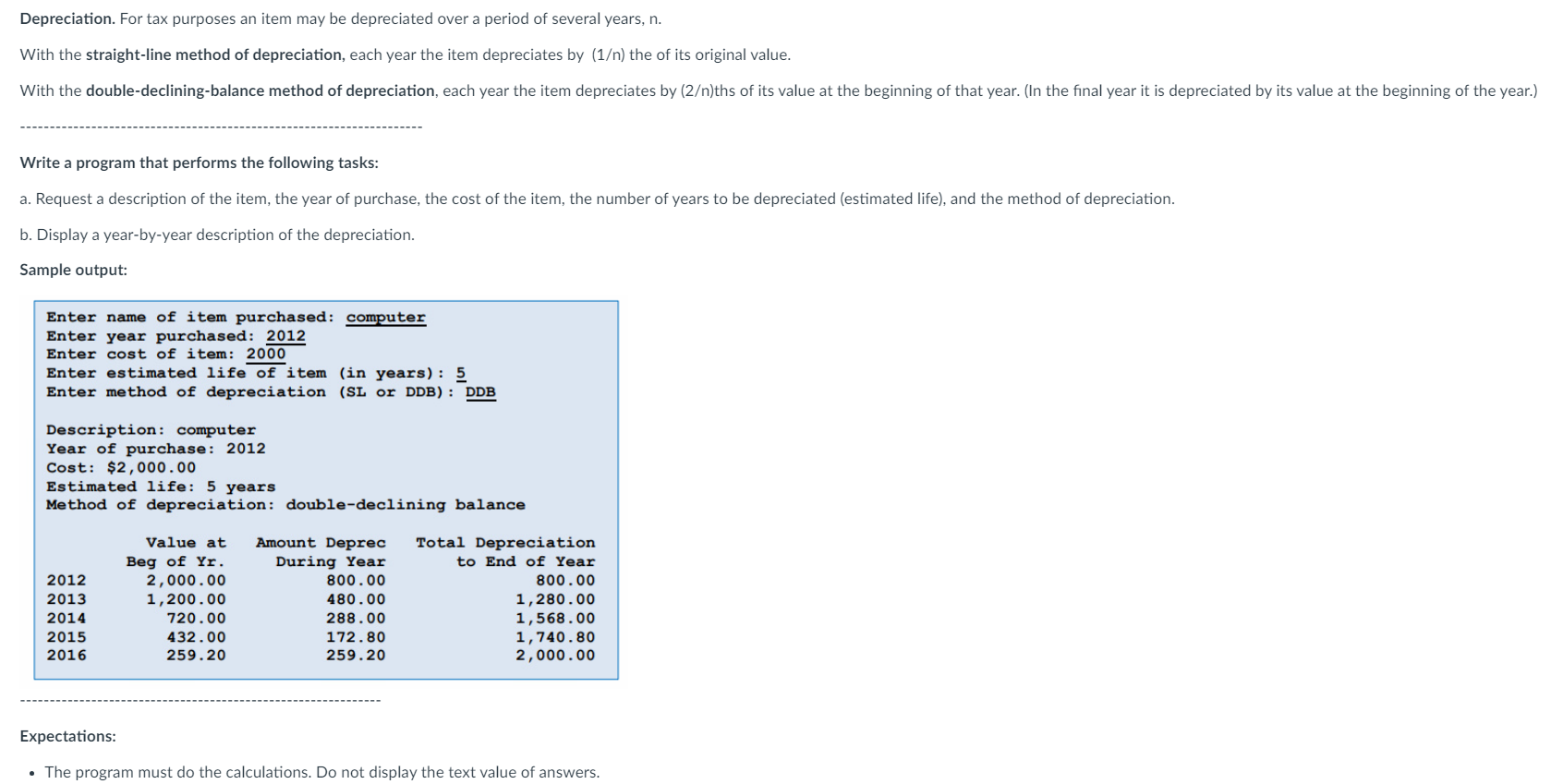

Write a program that performs the following tasks:

a Request a description of the item, the year of purchase, the cost of the item, the number of years to be depreciated estimated life and the method of depreciation.

b Display a yearbyyear description of the depreciation.

Sample output:

Enter name of item purchased: computer

Enter year purchased:

Enter cost of item:

Enter estimated life of item in years:

Enter method of depreciation SL or DDB : DDB

Description: computer

Year of purchase:

Cost: $

Estimated life: mathrm years

Method of depreciation: doubledeclining balance

Expectations:

The program must do the calculations. Do not display the text value of answers.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock