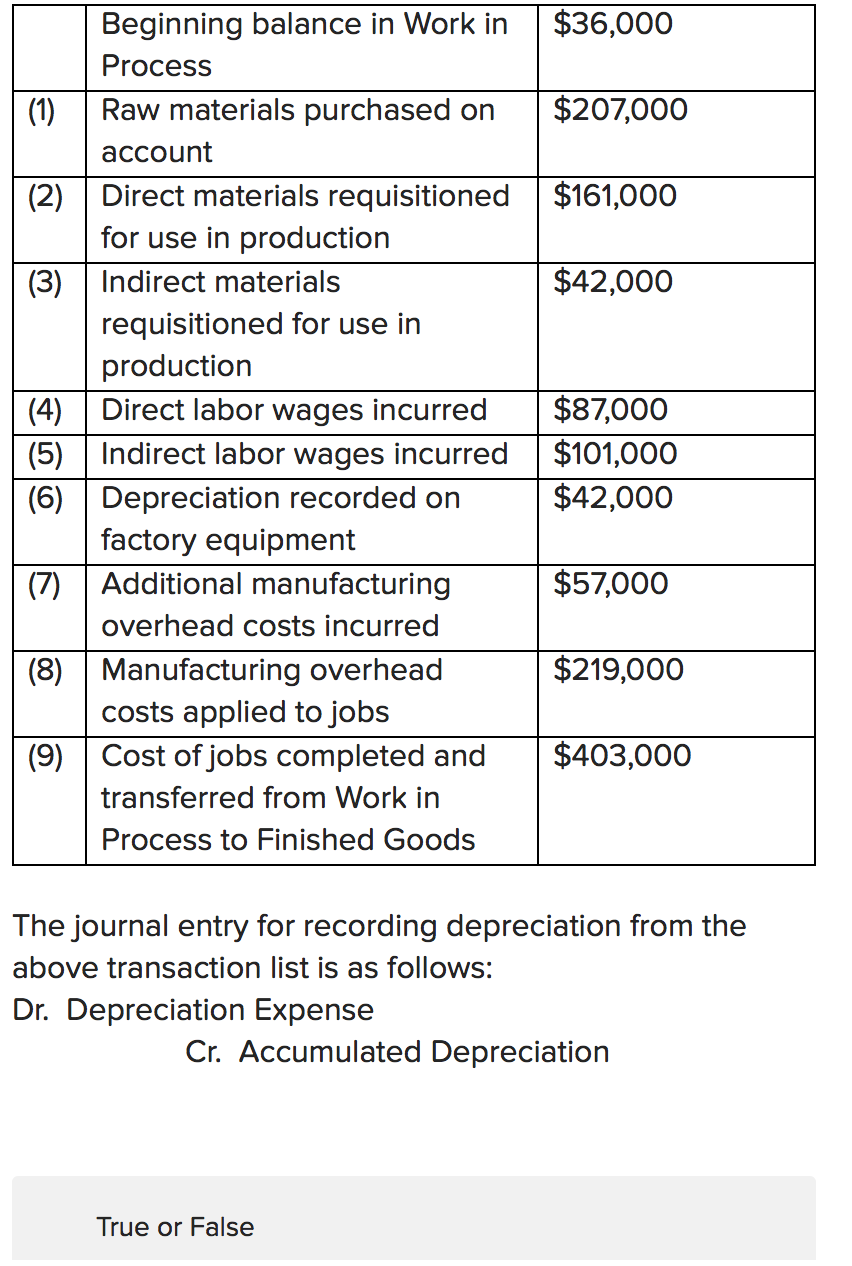

Question: Beginning balance in Work in $36,000 Process (1) Raw materials purchased on $207,000 account (2) Direct materials requisitioned $161,000 for use in production (3) Indirect

Beginning balance in Work in $36,000 Process (1) Raw materials purchased on $207,000 account (2) Direct materials requisitioned $161,000 for use in production (3) Indirect materials $42,000 requisitioned for use in production (4) Direct labor wages incurred $87,000 (5) Indirect labor wages incurred $101,000 (6) Depreciation recorded on $42,000 factory equipment (7) Additional manufacturing $57,000 overhead costs incurred (8) Manufacturing overhead $219,000 costs applied to jobs (9) Cost of jobs completed and $403,000 transferred from Work in Process to Finished Goods The journal entry for recording depreciation from the above transaction list is as follows: Dr. Depreciation Expense Cr. Accumulated Depreciation True or False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts