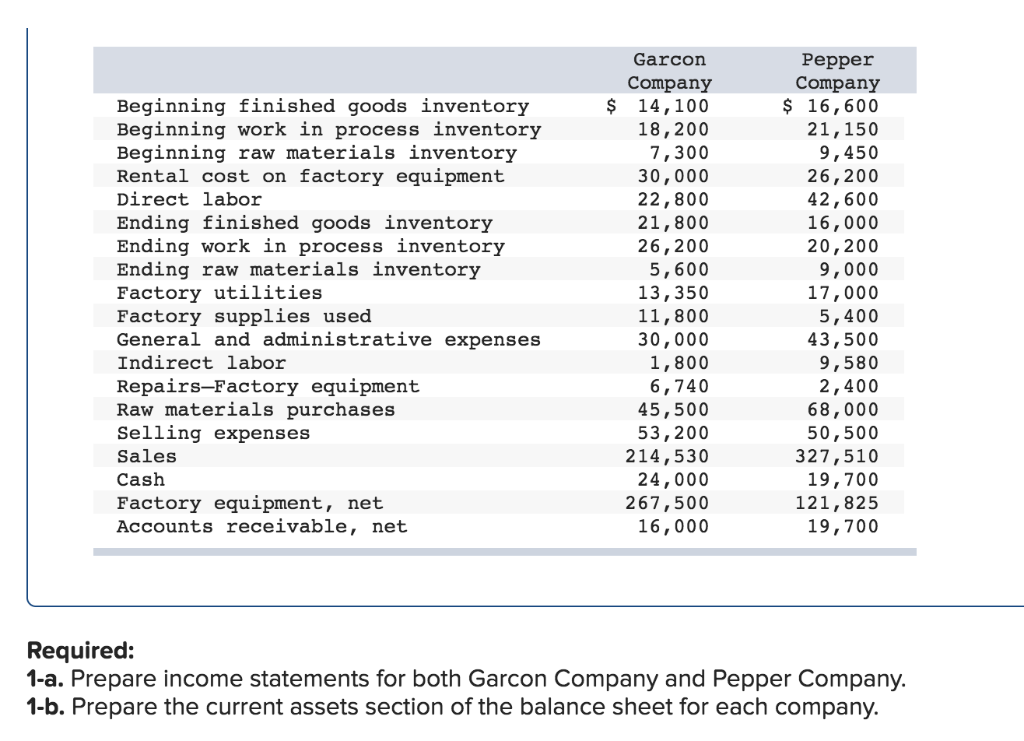

Question: Beginning finished goods inventory Beginning work in process inventory Beginning raw materials inventory Rental cost on factory equipment Direct labor Ending finished goods inventory Ending

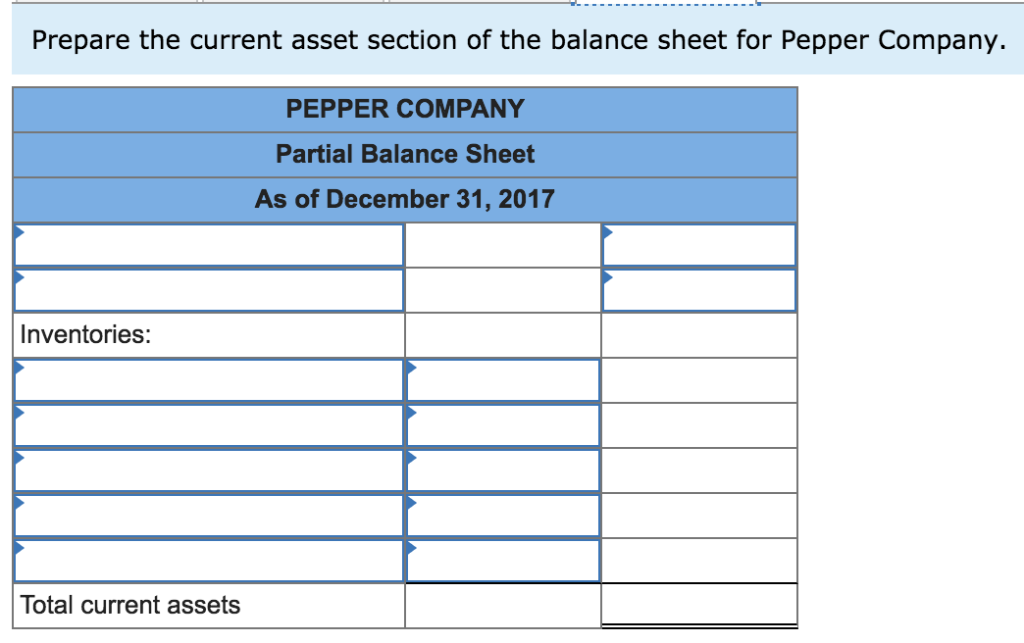

Beginning finished goods inventory Beginning work in process inventory Beginning raw materials inventory Rental cost on factory equipment Direct labor Ending finished goods inventory Ending work in process inventory Ending raw materials inventory Factory utilities Factory supplies used General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Factory equipment, net Accounts receivable, net Garcon Company $ 14,100 18,200 7,300 30,000 22,800 21,800 26,200 5,600 13,350 11,800 30,000 1,800 6,740 45,500 53,200 214,530 24,000 267,500 16,000 Pepper Company $ 16,600 21,150 9,450 26,200 42,600 16,000 20,200 9,000 17,000 5,400 43,500 9,580 2,400 68,000 50,500 327,510 19,700 121,825 19,700 Required: 1-a. Prepare income statements for both Garcon Company and Pepper Company. 1-b. Prepare the current assets section of the balance sheet for each company Prepare the income statement for Garcon Company. GARCON COMPANY Income Statement For Year Ended December 31, 2017 Operating expenses Income (loss) before tax Prepare the income statement for Pepper Company. PEPPER COMPANY Income Statement For Year Ended December 31, 2017 Operating expenses Income (loss) before tax Prepare the current asset section of the balance sheet for Garcon Company. GARCON COMPANY Partial Balance Sheet As of December 31, 2017 Inventories: Total current assets Prepare the current asset section of the balance sheet for Pepper Company. PEPPER COMPANY Partial Balance Sheet As of December 31, 2017 Inventories Total current assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts