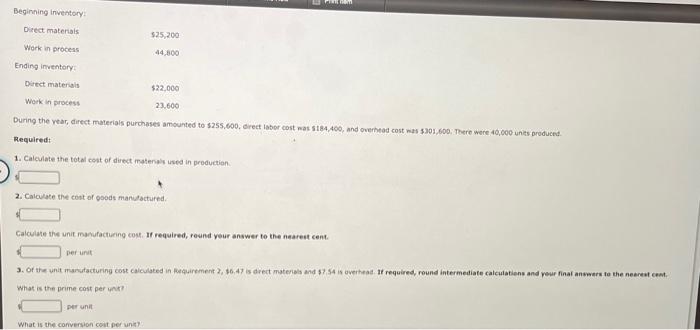

Question: Beginning Inventory: Direct materials Work in process Ending inventory: $25,200 44,800 Direct materials $22,000 Work in process 23,600 During the year, direct materials purchases

Beginning Inventory: Direct materials Work in process Ending inventory: $25,200 44,800 Direct materials $22,000 Work in process 23,600 During the year, direct materials purchases amounted to $255,600, direct labor cost was $184,400, and overhead cost was $301,600. There were 40,000 units produced. Required: 1. Calculate the total cost of direct materials used in production 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. If required, round your answer to the nearest cent per unit 3. Of the unit manufacturing cost calculated in Requirement 2, $6.47 is direct materials and $7.54 is overhead. If required, round intermediate calculations and your final answers to the nearest cent. What is the prime cost per unit? per unit What is the conversion cost per unit?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts