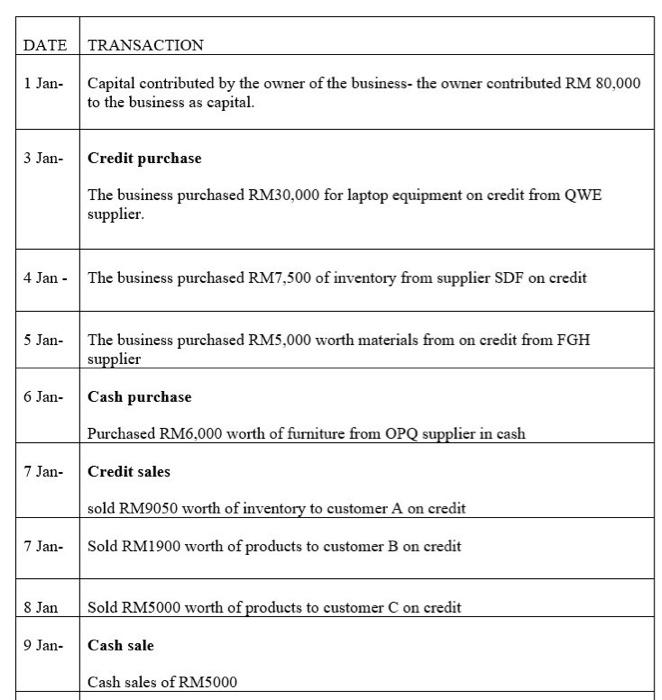

Question: begin{tabular}{|c|c|} hline DATE & TRANSACTION hline 1 Jan- & begin{tabular}{l} Capital contributed by the owner of the business- the owner contributed RM 80,000

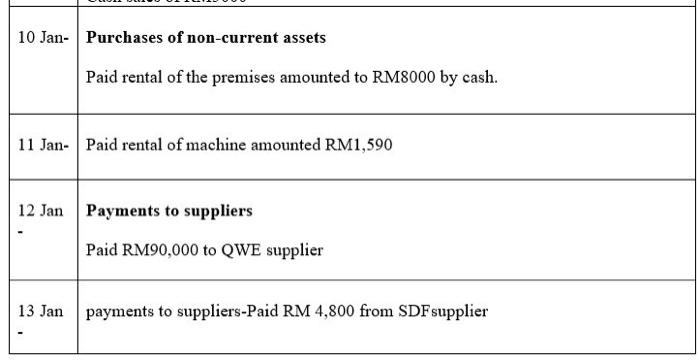

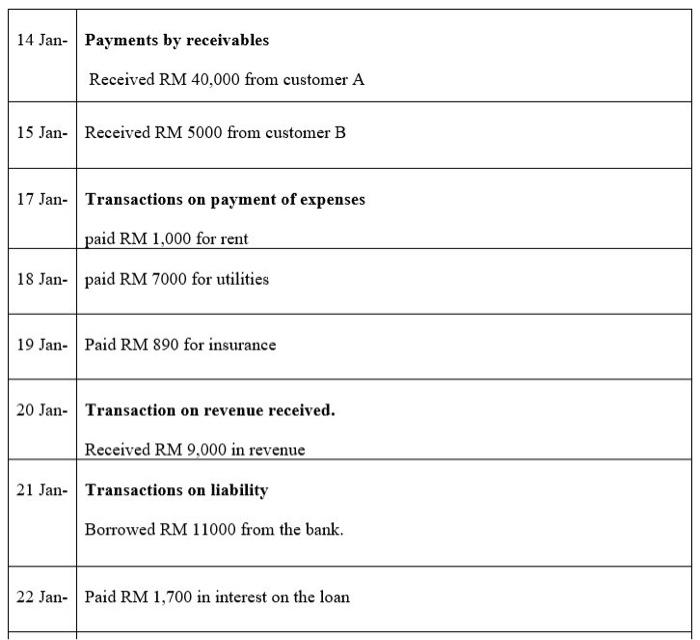

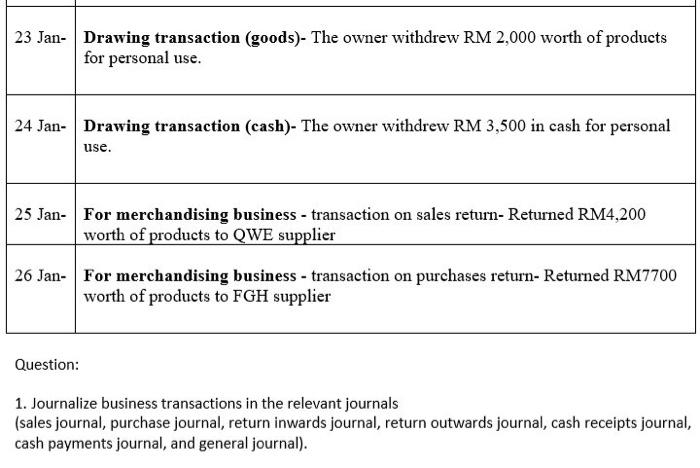

\begin{tabular}{|c|c|} \hline DATE & TRANSACTION \\ \hline 1 Jan- & \begin{tabular}{l} Capital contributed by the owner of the business- the owner contributed RM 80,000 \\ to the business as capital. \end{tabular} \\ \hline 3 Jan- & \begin{tabular}{l} Credit purchase \\ The business purchased RM30,000 for laptop equipment on credit from QWE \\ supplier. \end{tabular} \\ \hline 4 Jan - & The business purchased RM7,500 of inventory from supplier SDF on credit \\ \hline 5 Jan- & \begin{tabular}{l} The business purchased RM5,000 worth materials from on credit from FGH \\ supplier \end{tabular} \\ \hline 6 Jan- & \begin{tabular}{l} Cash purchase \\ Purchased RM6,000 worth of furniture from OPQ supplier in cash \end{tabular} \\ \hline 7 Jan- & \begin{tabular}{l} Credit sales \\ sold RM9050 worth of inventory to customer A on credit \end{tabular} \\ \hline 7 Jan- & Sold RM1900 worth of products to customer B on credit \\ \hline 8Jan & Sold RM5000 worth of products to customer C on credit \\ \hline 9 Jan- & \begin{tabular}{l} Cash sale \\ Cash sales of RM5000 \end{tabular} \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline 10 Jan- & \begin{tabular}{l} Purchases of non-current assets \\ Paid rental of the premises amounted to RM8000 by cash. \end{tabular} \\ \hline 11 Jan- & Paid rental of machine amounted RM1,590 \\ \hline 12 Jan & \begin{tabular}{l} Payments to suppliers \\ Paid RM90,000 to QWE supplier \end{tabular} \\ \hline \begin{tabular}{l} 13 Jan \\ - \end{tabular} & \begin{tabular}{l} payments to suppliers-Paid RM 4,800 from SDF supplier \\ \hline \end{tabular} \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline 14 Jan- & \begin{tabular}{l} Payments by receivables \\ Received RM 40,000 from customer A \end{tabular} \\ \hline 15 Jan- & Received RM 5000 from customer B \\ \hline 17 Jan- & \begin{tabular}{l} Transactions on payment of expenses \\ paid RM 1,000 for rent \end{tabular} \\ \hline 18 Jan- & paid RM 7000 for utilities \\ \hline 19 Jan- & Paid RM 890 for insurance \\ \hline 20 Jan- & \begin{tabular}{l} Transaction on revenue received. \\ Received RM 9,000 in revenue \end{tabular} \\ \hline 21 Jan- & \begin{tabular}{l} Transactions on liability \\ Borrowed RM 11000 from the bank. \end{tabular} \\ \hline 22 Jan- & Paid RM 1,700 in interest on the loan \\ \hline \end{tabular} 1. Journalize business transactions in the relevant journals (sales journal, purchase journal, return inwards journal, return outwards journal, cash receipts journal, cash payments journal, and general journal)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts