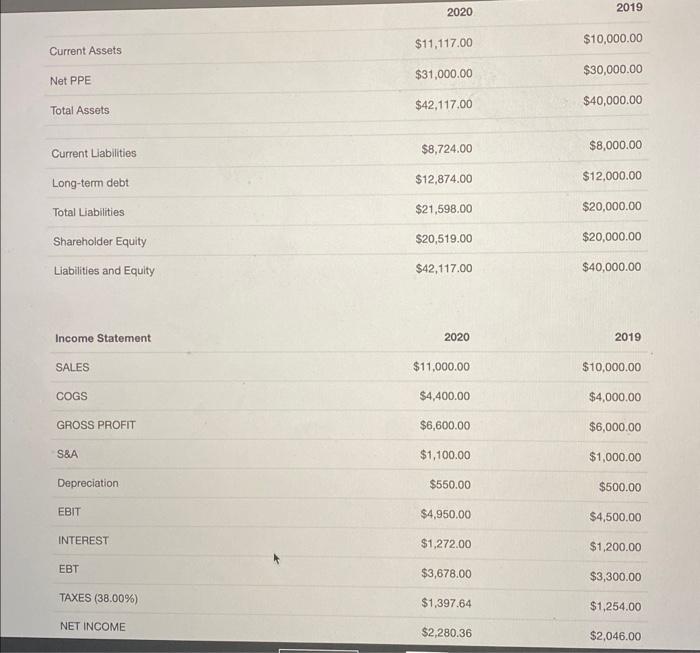

Question: begin{tabular}{|c|c|c|} hline & 2020 & 2019 hline Current Assets & $11,117.00 & $10,000.00 hline Net PPE & $31,000.00 & $30,000.00 hline Total

\begin{tabular}{|c|c|c|} \hline & 2020 & 2019 \\ \hline Current Assets & $11,117.00 & $10,000.00 \\ \hline Net PPE & $31,000.00 & $30,000.00 \\ \hline Total Assets & $42,117,00 & $40,000.00 \\ \hline Current Liabilities & $8,724.00 & $8,000.00 \\ \hline Long-term debt & $12,874.00 & $12,000.00 \\ \hline Total Liabilities & $21,598.00 & $20,000.00 \\ \hline Shareholder Equity & $20,519.00 & $20,000.00 \\ \hline Liabilities and Equity & $42,117.00 & $40,000.00 \\ \hline Income Statement & 2020 & 2019 \\ \hline SALES & $11,000.00 & $10,000.00 \\ \hline COGS & $4,400.00 & $4,000.00 \\ \hline GROSS PROFIT & $6,600.00 & $6,000.00 \\ \hline S\&A & $1,100.00 & $1,000.00 \\ \hline Depreciation & $550.00 & $500.00 \\ \hline EBIT & $4,950.00 & $4,500.00 \\ \hline INTEREST & $1,272.00 & $1,200.00 \\ \hline EBT & $3,678.00 & $3,300.00 \\ \hline TAXES (38.00%) & $1,397.64 & $1,254.00 \\ \hline NET INCOME & $2,280.36 & $2,046.00 \\ \hline \end{tabular} Going forward, analysts have forecasted the following free cash flows: $2,400.00 in 2021 , and $2,600.00 in 2022 . After that point, analysts expect free cash flows to grow at 5.00%. The firm has no short-term debt or preferred stock, and there are 1,000 shares outstanding. The firm's cost of capital is 10.00%. Estimate the firm's price per share using the discounted cash flow model. Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts