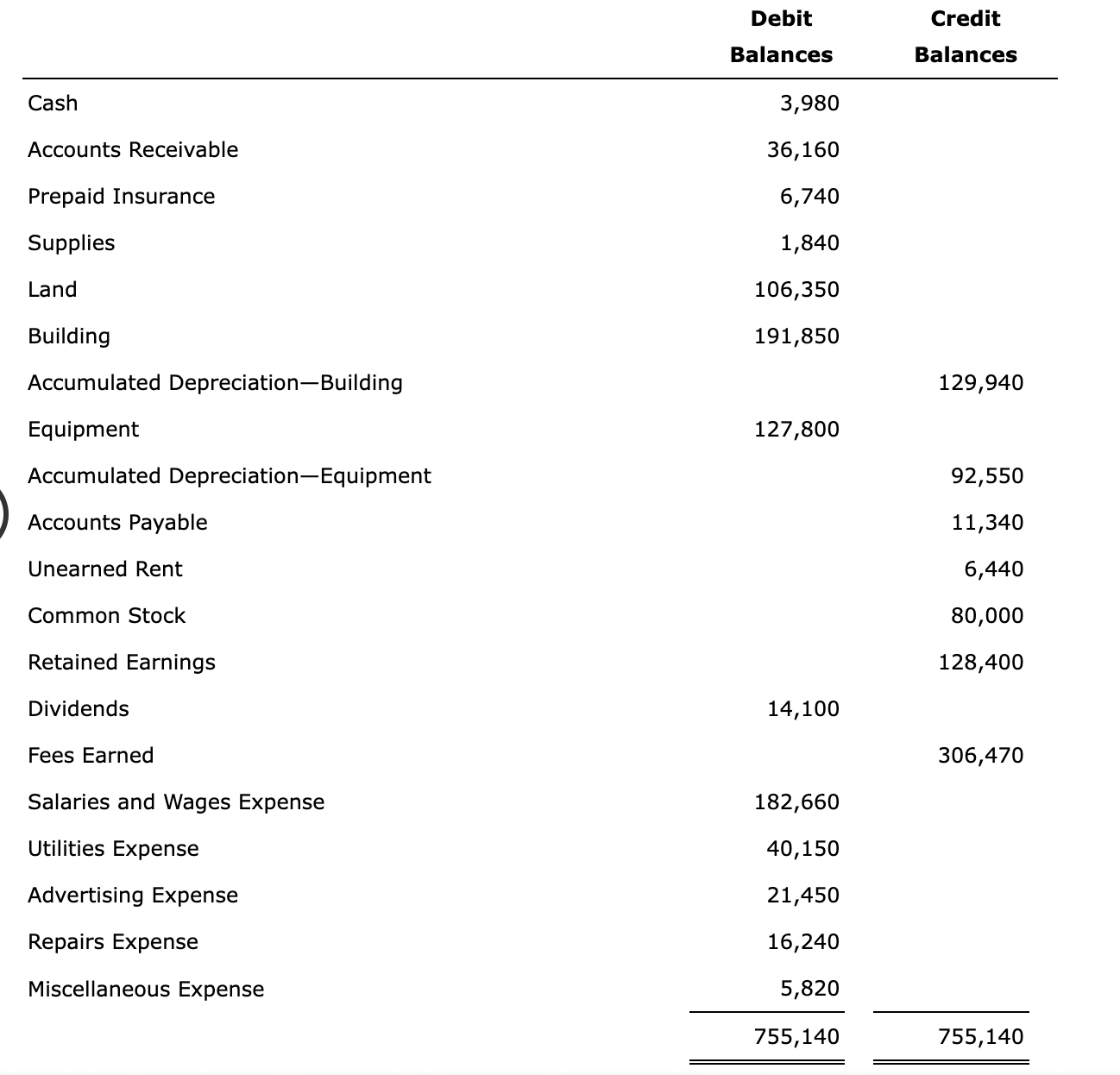

Question: begin{tabular}{|c|c|c|} hline & begin{tabular}{c} Debit Balances end{tabular} & begin{tabular}{c} Credit Balances end{tabular} hline Cash & 3,980 & hline Accounts Receivable &

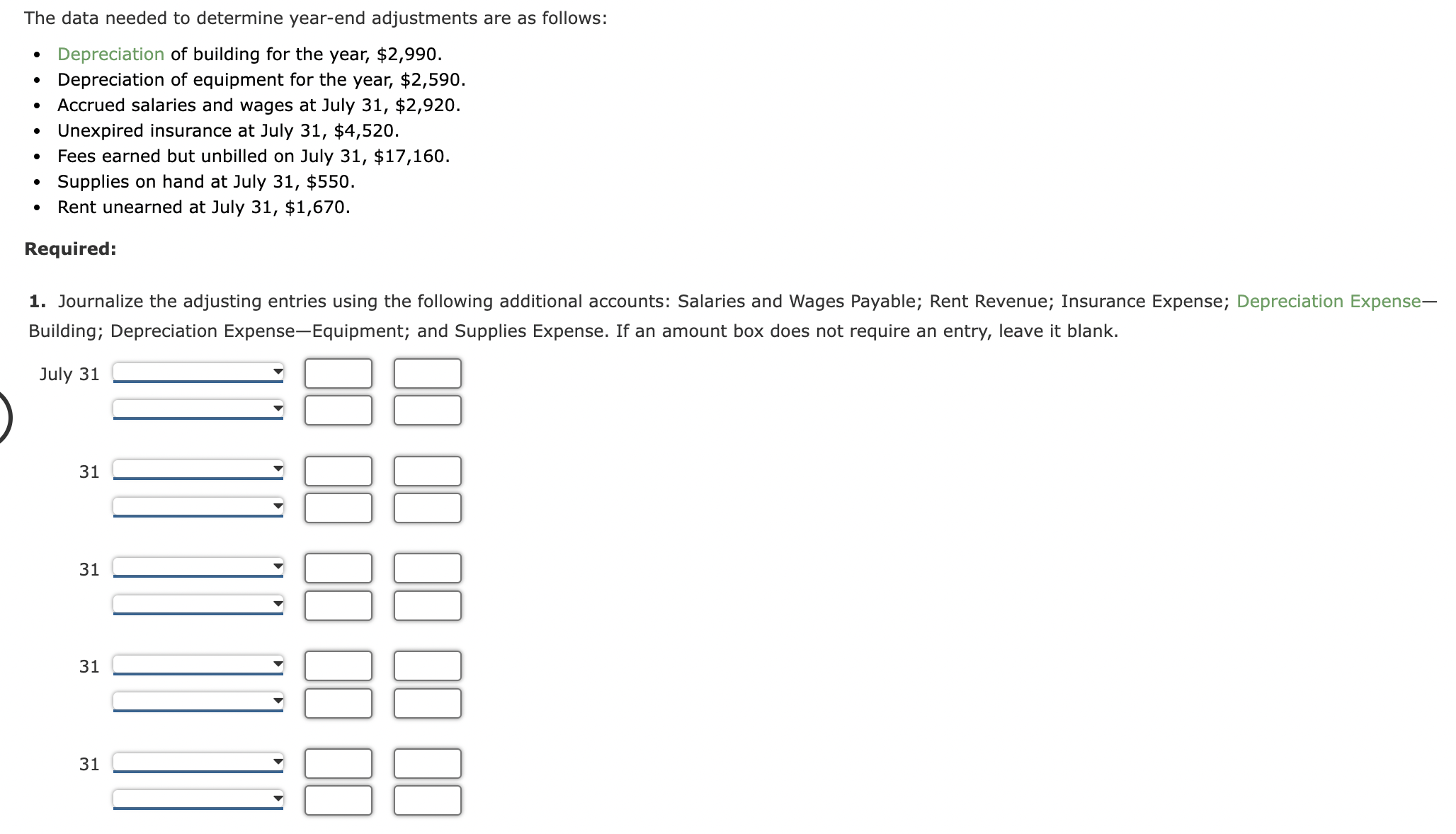

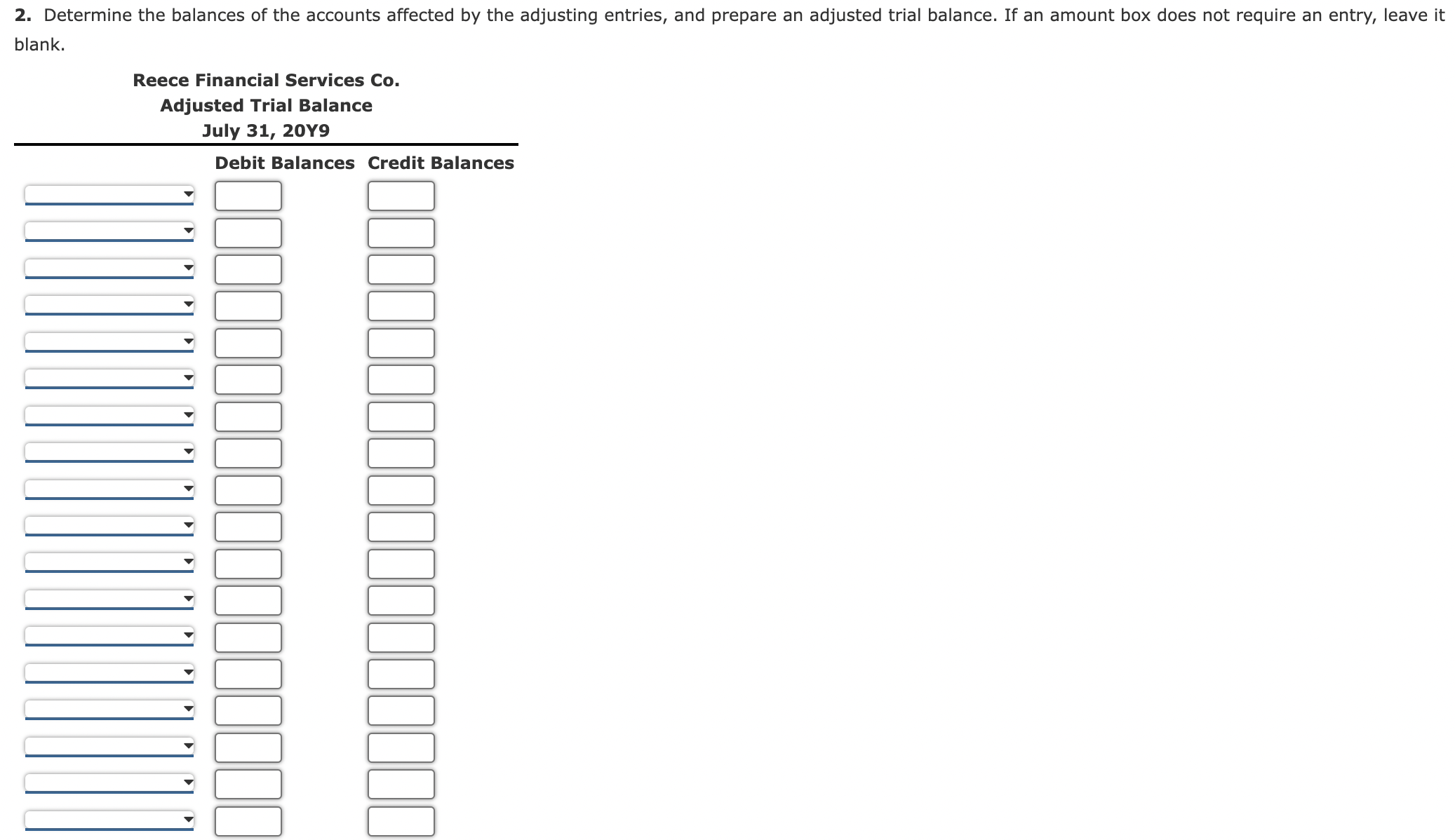

\begin{tabular}{|c|c|c|} \hline & \begin{tabular}{c} Debit \\ Balances \end{tabular} & \begin{tabular}{c} Credit \\ Balances \end{tabular} \\ \hline Cash & 3,980 & \\ \hline Accounts Receivable & 36,160 & \\ \hline Prepaid Insurance & 6,740 & \\ \hline Supplies & 1,840 & \\ \hline Land & 106,350 & \\ \hline Building & 191,850 & \\ \hline Accumulated Depreciation-Building & & 129,940 \\ \hline Equipment & 127,800 & \\ \hline Accumulated Depreciation-Equipment & & 92,550 \\ \hline Accounts Payable & & 11,340 \\ \hline Unearned Rent & & 6,440 \\ \hline Common Stock & & 80,000 \\ \hline Retained Earnings & & 128,400 \\ \hline Dividends & 14,100 & \\ \hline Fees Earned & & 306,470 \\ \hline Salaries and Wages Expense & 182,660 & \\ \hline Utilities Expense & 40,150 & \\ \hline Advertising Expense & 21,450 & \\ \hline Repairs Expense & 16,240 & \\ \hline \multirow[t]{2}{*}{ Miscellaneous Expense } & 5,820 & \\ \hline & 755,140 & 755,140 \\ \hline \end{tabular} The data needed to determine year-end adjustments are as follows: - Depreciation of building for the year, $2,990. - Depreciation of equipment for the year, $2,590. - Accrued salaries and wages at July 31,$2,920. - Unexpired insurance at July 31,$4,520. - Fees earned but unbilled on July 31,$17,160. - Supplies on hand at July 31,$550. - Rent unearned at July 31,$1,670. Required: 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation ExpenseBuildina: Depreciation Expense-Eauipment: and Supblies Expense. If an amount box does not require an entry, leave it blank. 2. Determine the balances of the accounts affected by the adjusting entries, and prepare an adjusted trial balance. If an amount box does not require an entry, leave it blank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts