Question: begin{tabular}{|c|c|c|c|c|} hline & A & B & C & D hline 26 & multicolumn{2}{|c|}{ Step 2: Compute the Equivalent Units of Production } &

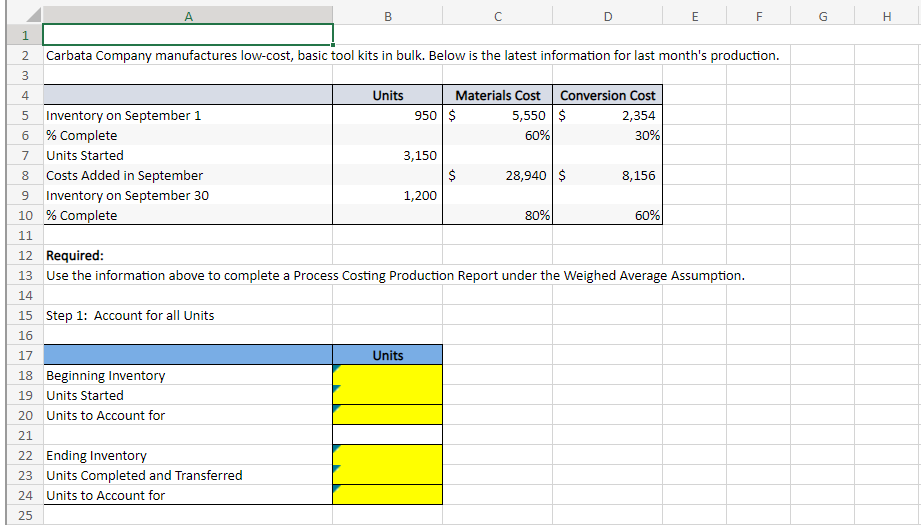

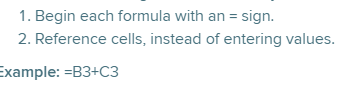

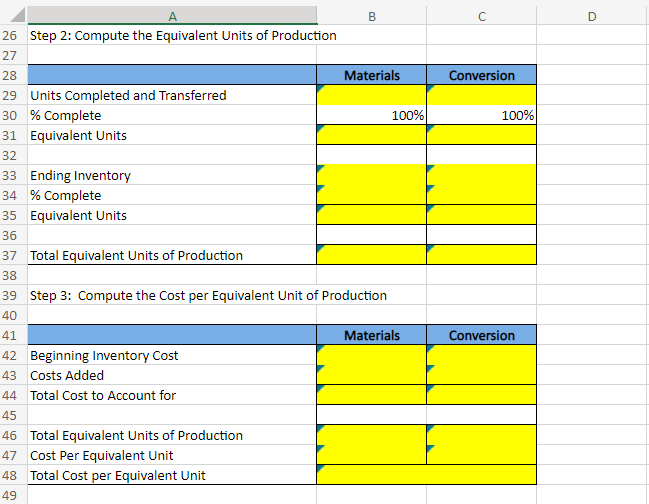

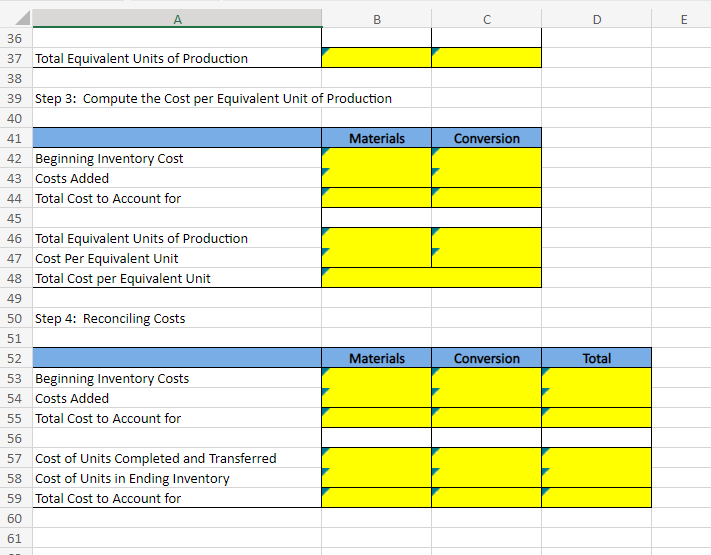

\begin{tabular}{|c|c|c|c|c|} \hline & A & B & C & D \\ \hline 26 & \multicolumn{2}{|c|}{ Step 2: Compute the Equivalent Units of Production } & & \\ \hline \multicolumn{5}{|l|}{27} \\ \hline 28 & & Materials & Conversion & \\ \hline 29 & Units Completed and Transferred & & & \\ \hline 30 & % Complete & 100% & 100% & \\ \hline 31 & Equivalent Units & & & \\ \hline \multicolumn{5}{|l|}{32} \\ \hline 33 & Ending Inventory & & & \\ \hline 34 & % Complete & & & \\ \hline 35 & Equivalent Units & & & \\ \hline \multicolumn{5}{|l|}{36} \\ \hline 37 & Total Equivalent Units of Production & & & \\ \hline \multicolumn{5}{|l|}{38} \\ \hline 39 & \multicolumn{2}{|c|}{ Step 3: Compute the Cost per Equivalent Unit of Production } & & \\ \hline \multicolumn{5}{|l|}{40} \\ \hline 41 & & Materials & Conversion & \\ \hline 42 & Beginning Inventory Cost & & & \\ \hline 43 & Costs Added & & & \\ \hline 44 & Total Cost to Account for & & & \\ \hline \multicolumn{5}{|l|}{45} \\ \hline 46 & Total Equivalent Units of Production & & & \\ \hline 47 & Cost Per Equivalent Unit & & & \\ \hline 48 & Total Cost per Equivalent Unit & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline 4 & A & B & C & D & E \\ \hline \multicolumn{6}{|l|}{36} \\ \hline 37 & Total Equivalent Units of Production & & & & \\ \hline \multicolumn{6}{|l|}{38} \\ \hline 39 & \multicolumn{2}{|c|}{ Step 3: Compute the Cost per Equivalent Unit of Production } & & & \\ \hline \multicolumn{6}{|l|}{40} \\ \hline 41 & & Materials & Conversion & & \\ \hline 42 & Beginning Inventory Cost & & & & \\ \hline 43 & Costs Added & & & & \\ \hline 44 & Total Cost to Account for & & & & \\ \hline \multicolumn{6}{|l|}{45} \\ \hline 46 & Total Equivalent Units of Production & & & & \\ \hline 47 & Cost Per Equivalent Unit & & & & \\ \hline 48 & Total Cost per Equivalent Unit & & & & \\ \hline \multicolumn{6}{|l|}{49} \\ \hline 50 & Step 4: Reconciling Costs & & & & \\ \hline \multicolumn{6}{|l|}{51} \\ \hline 52 & & Materials & Conversion & Total & \\ \hline 53 & Beginning Inventory Costs & & & & \\ \hline 54 & Costs Added & & & & \\ \hline 55 & Total Cost to Account for & & & & \\ \hline \multicolumn{6}{|l|}{56} \\ \hline 57 & Cost of Units Completed and Transferred & & & & \\ \hline 58 & Cost of Units in Ending Inventory & & & & \\ \hline 59 & Total Cost to Account for & & & & \\ \hline \multicolumn{6}{|l|}{60} \\ \hline 61 & & & & & \\ \hline \end{tabular} 1. Begin each formula with an = sign. 2. Reference cells, instead of entering values. xample: =B3+C3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts