Question: begin{tabular}{|c|c|c|c|c|} hline MAS & begin{tabular}{l} Student Name > Section Number > end{tabular} & & & hline A & B & C & D

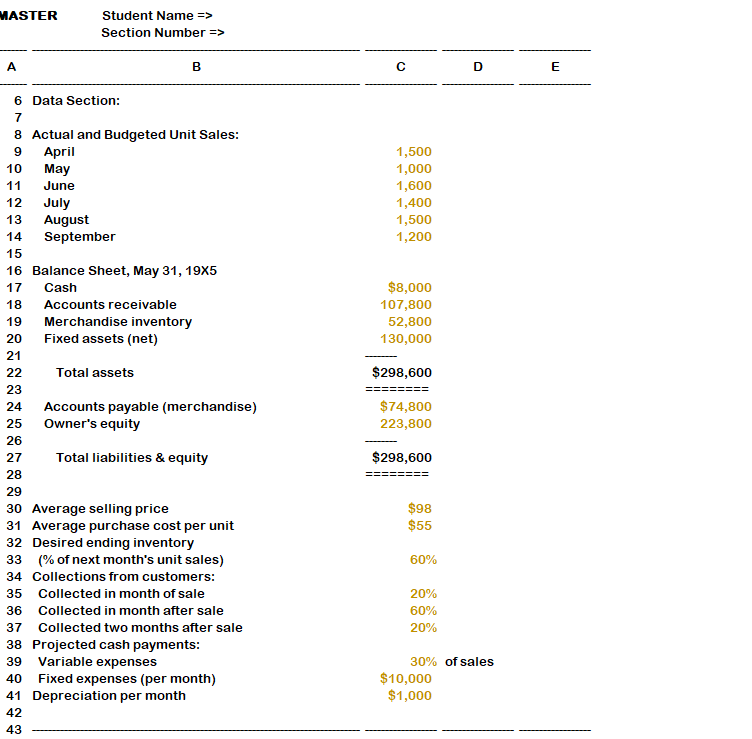

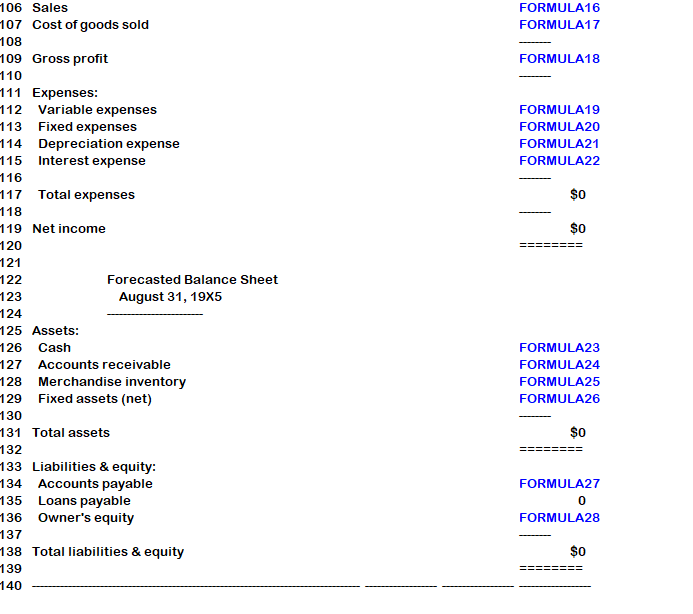

\begin{tabular}{|c|c|c|c|c|} \hline MAS & \begin{tabular}{l} Student Name > \\ Section Number > \end{tabular} & & & \\ \hline A & B & C & D & E \\ \hline \begin{tabular}{l} 6 \\ 7 \end{tabular} & \multicolumn{4}{|l|}{ Data Section: } \\ \hline 8 & \multicolumn{4}{|l|}{ Actual and Budgeted Unit Sales: } \\ \hline 9 & April & 1,500 & & \\ \hline 10 & May & 1,000 & & \\ \hline 11 & June & 1,600 & & \\ \hline 12 & July & 1,400 & & \\ \hline 13 & August & 1,500 & & \\ \hline 14 & September & 1,200 & & \\ \hline 15 & & & & \\ \hline 16 & \multicolumn{4}{|l|}{ Balance Sheet, May 31, 19x5 } \\ \hline 17 & Cash & $8,000 & & \\ \hline 18 & Accounts receivable & 107,800 & & \\ \hline 19 & Merchandise inventory & 52,800 & & \\ \hline 20 & Fixed assets (net) & 130,000 & & \\ \hline 21 & & - & & \\ \hline 22 & Total assets & $298,600 & & \\ \hline 23 & & ======== & & \\ \hline 24 & Accounts payable (merchandise) & $74,800 & & \\ \hline 25 & Owner's equity & 223,800 & & \\ \hline 26 & & - & & \\ \hline 27 & Total liabilities \& equity & $298,600 & & \\ \hline 28 & & ======== & & \\ \hline \multicolumn{5}{|l|}{29} \\ \hline 30 & Average selling price & $98 & & \\ \hline 31 & Average purchase cost per unit & $55 & & \\ \hline 32 & Desired ending inventory & & & \\ \hline 33 & (\% of next month's unit sales) & 60% & & \\ \hline 34 & Collections from customers: & & & \\ \hline 35 & Collected in month of sale & 20% & & \\ \hline 36 & Collected in month after sale & 60% & & \\ \hline 37 & Collected two months after sale & 20% & & \\ \hline 38 & Projected cash payments: & & & \\ \hline 39 & Variable expenses & 30% & of sales & \\ \hline 40 & Fixed expenses (per month) & $10,000 & & \\ \hline 41 & Depreciation per month & $1,000 & & \\ \hline 42 & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline Sales & FORMULA16 \\ \hline Cost of goods sold & FORMULA17 \\ \hline Gross profit & FORMULA18 \\ \hline \multicolumn{2}{|l|}{ Expenses: } \\ \hline Variable expenses & FORMULA19 \\ \hline Fixed expenses & FORMULA20 \\ \hline Depreciation expense & FORMULA21 \\ \hline Interest expense & FORMULA22 \\ \hline Total expenses & $0 \\ \hline Net income & ======= \\ \hline \multicolumn{2}{|c|}{ Forecasted Balance Sheet } \\ \hline \multicolumn{2}{|l|}{ Assets: } \\ \hline Cash & FORMULA23 \\ \hline Accounts receivable & FORMULA24 \\ \hline Merchandise inventory & FORMULA25 \\ \hline Fixed assets (net) & FORMULA26 \\ \hline \multirow[t]{2}{*}{ Total assets } & $0 \\ \hline & ======== \\ \hline \multicolumn{2}{|l|}{ Liabilities \& equity: } \\ \hline Accounts payable & FORMULA27 \\ \hline Loans payable & 0 \\ \hline Owner's equity & FORMULA28 \\ \hline \multirow{2}{*}{ Total liabilities \& equity } & so \\ \hline & ======= \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline MAS & \begin{tabular}{l} Student Name > \\ Section Number > \end{tabular} & & & \\ \hline A & B & C & D & E \\ \hline \begin{tabular}{l} 6 \\ 7 \end{tabular} & \multicolumn{4}{|l|}{ Data Section: } \\ \hline 8 & \multicolumn{4}{|l|}{ Actual and Budgeted Unit Sales: } \\ \hline 9 & April & 1,500 & & \\ \hline 10 & May & 1,000 & & \\ \hline 11 & June & 1,600 & & \\ \hline 12 & July & 1,400 & & \\ \hline 13 & August & 1,500 & & \\ \hline 14 & September & 1,200 & & \\ \hline 15 & & & & \\ \hline 16 & \multicolumn{4}{|l|}{ Balance Sheet, May 31, 19x5 } \\ \hline 17 & Cash & $8,000 & & \\ \hline 18 & Accounts receivable & 107,800 & & \\ \hline 19 & Merchandise inventory & 52,800 & & \\ \hline 20 & Fixed assets (net) & 130,000 & & \\ \hline 21 & & - & & \\ \hline 22 & Total assets & $298,600 & & \\ \hline 23 & & ======== & & \\ \hline 24 & Accounts payable (merchandise) & $74,800 & & \\ \hline 25 & Owner's equity & 223,800 & & \\ \hline 26 & & - & & \\ \hline 27 & Total liabilities \& equity & $298,600 & & \\ \hline 28 & & ======== & & \\ \hline \multicolumn{5}{|l|}{29} \\ \hline 30 & Average selling price & $98 & & \\ \hline 31 & Average purchase cost per unit & $55 & & \\ \hline 32 & Desired ending inventory & & & \\ \hline 33 & (\% of next month's unit sales) & 60% & & \\ \hline 34 & Collections from customers: & & & \\ \hline 35 & Collected in month of sale & 20% & & \\ \hline 36 & Collected in month after sale & 60% & & \\ \hline 37 & Collected two months after sale & 20% & & \\ \hline 38 & Projected cash payments: & & & \\ \hline 39 & Variable expenses & 30% & of sales & \\ \hline 40 & Fixed expenses (per month) & $10,000 & & \\ \hline 41 & Depreciation per month & $1,000 & & \\ \hline 42 & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline Sales & FORMULA16 \\ \hline Cost of goods sold & FORMULA17 \\ \hline Gross profit & FORMULA18 \\ \hline \multicolumn{2}{|l|}{ Expenses: } \\ \hline Variable expenses & FORMULA19 \\ \hline Fixed expenses & FORMULA20 \\ \hline Depreciation expense & FORMULA21 \\ \hline Interest expense & FORMULA22 \\ \hline Total expenses & $0 \\ \hline Net income & ======= \\ \hline \multicolumn{2}{|c|}{ Forecasted Balance Sheet } \\ \hline \multicolumn{2}{|l|}{ Assets: } \\ \hline Cash & FORMULA23 \\ \hline Accounts receivable & FORMULA24 \\ \hline Merchandise inventory & FORMULA25 \\ \hline Fixed assets (net) & FORMULA26 \\ \hline \multirow[t]{2}{*}{ Total assets } & $0 \\ \hline & ======== \\ \hline \multicolumn{2}{|l|}{ Liabilities \& equity: } \\ \hline Accounts payable & FORMULA27 \\ \hline Loans payable & 0 \\ \hline Owner's equity & FORMULA28 \\ \hline \multirow{2}{*}{ Total liabilities \& equity } & so \\ \hline & ======= \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts