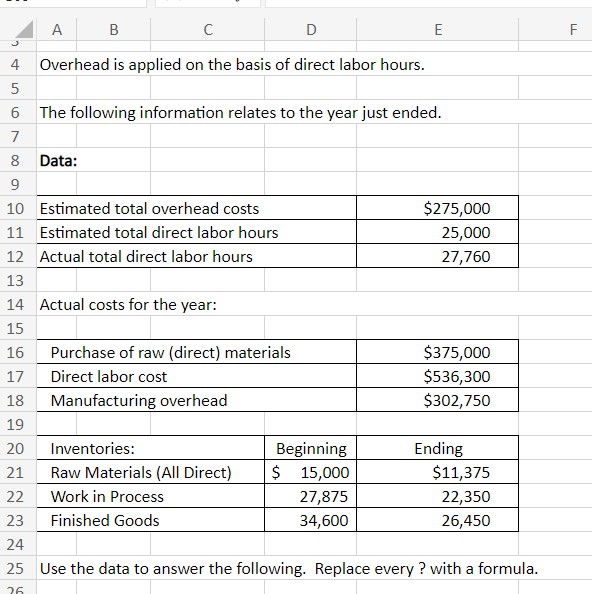

Question: begin{tabular}{|c|c|c|c|c|c|} hline 4 & A & B & C & D & E hline 4 & multicolumn{5}{|c|}{ Overhead is applied on the basis of

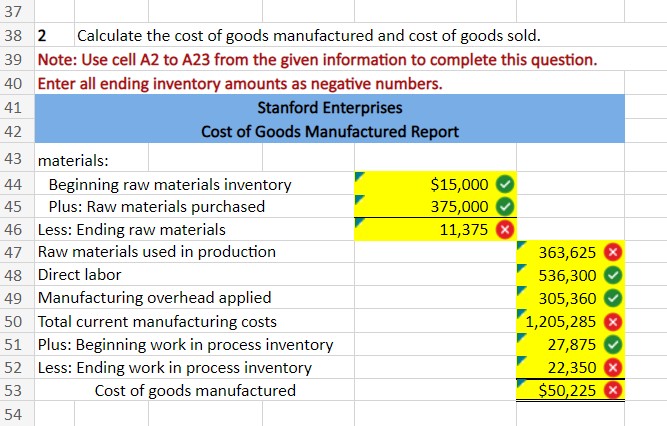

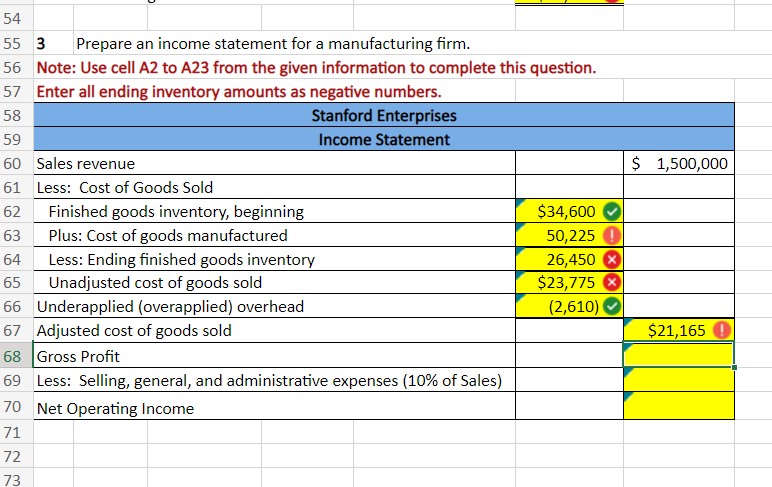

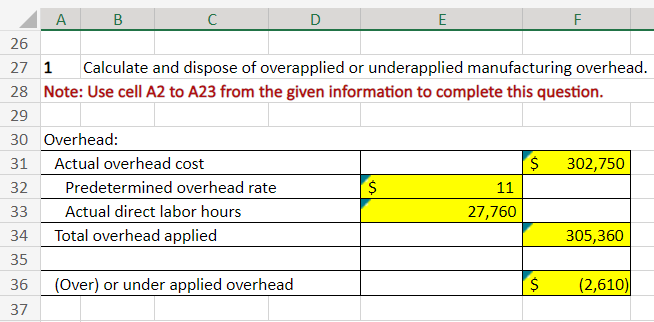

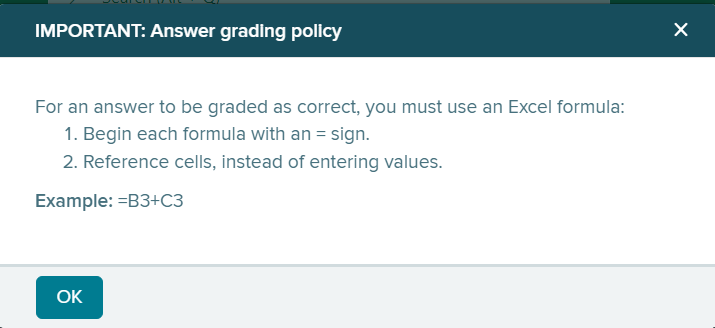

\begin{tabular}{|c|c|c|c|c|c|} \hline 4 & A & B & C & D & E \\ \hline 4 & \multicolumn{5}{|c|}{ Overhead is applied on the basis of direct labor hours. } \\ \hline 5 & & & & & \\ \hline 6 & \multicolumn{5}{|c|}{ The following information relates to the year just ended. } \\ \hline 7 & & & & & \\ \hline 8 & \multicolumn{5}{|c|}{ Data: } \\ \hline 9 & & & & & \\ \hline 10 & \multicolumn{4}{|c|}{ Estimated total overhead costs } & $275,000 \\ \hline 11 & \multicolumn{4}{|c|}{ Estimated total direct labor hours } & 25,000 \\ \hline 12 & \multicolumn{4}{|c|}{ Actual total direct labor hours } & 27,760 \\ \hline 13 & & & & & \\ \hline 14 & \multicolumn{5}{|c|}{ Actual costs for the year: } \\ \hline 15 & & & & & \\ \hline 16 & \multicolumn{4}{|c|}{ Purchase of raw (direct) materials } & $375,000 \\ \hline 17 & \multicolumn{4}{|c|}{ Direct labor cost } & $536,300 \\ \hline 18 & \multicolumn{4}{|c|}{ Manufacturing overhead } & $302,750 \\ \hline 19 & & & & & \\ \hline 20 & \multicolumn{3}{|c|}{ Inventories: } & Beginning & Ending \\ \hline 21 & \multicolumn{3}{|c|}{ Raw Materials (All Direct) } & $15,000 & $11,375 \\ \hline 22 & \multicolumn{3}{|c|}{ Work in Process } & 27,875 & 22,350 \\ \hline 23 & \multicolumn{3}{|c|}{ Finished Goods } & 34,600 & 26,450 \\ \hline 24 & & & & & \\ \hline 25 & \multicolumn{5}{|c|}{ Use the data to answer the following. Replace every ? with a formula. } \\ \hline \end{tabular} 37 382 Calculate the cost of goods manufactured and cost of goods sold. 39 Note: Use cell A2 to A23 from the given information to complete this question. 40 Enter all ending inventory amounts as negative numbers. 54 3 Prepare an income statement for a manufacturing firm. Note: Use cell A2 to A23 from the given information to complete this question. Enter all ending inventory amounts as negative numbers. \begin{tabular}{|c|c|c|c|} \hline 58 & \multicolumn{3}{|l|}{ Stanford Enterprises } \\ \hline 59 & \multicolumn{3}{|l|}{ Income Statement } \\ \hline 60 & Sales revenue & & $1,500,000 \\ \hline 61 & Less: Cost of Goods Sold & & \\ \hline 62 & Finished goods inventory, beginning & $34,600 & \\ \hline 63 & Plus: Cost of goods manufactured & 50,2259 & \\ \hline 64 & Less: Ending finished goods inventory & 26,450 & \\ \hline 65 & Unadjusted cost of goods sold & $23,775 & \\ \hline 66 & Underapplied (overapplied) overhead & (2,610) & \\ \hline 67 & Adjusted cost of goods sold & & $21,165 ! \\ \hline 68 & Gross Profit & & \\ \hline 69 & Less: Selling, general, and administrative expenses ( 10% of Sales) & & \\ \hline 70 & Net Operating Income & & \\ \hline \end{tabular} For an answer to be graded as correct, you must use an Excel formula: 1. Begin each formula with an = sign . 2. Reference cells, instead of entering values. Example: =B3+C3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts