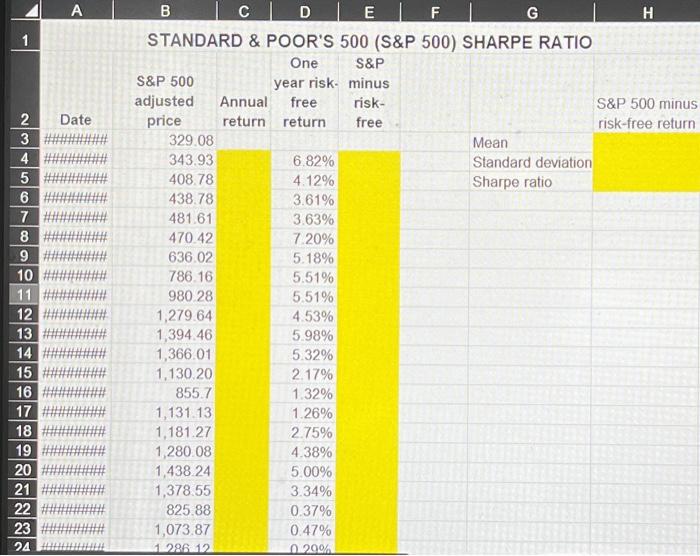

Question: begin{tabular}{|c|c|c|c|c|c|c|c|c|} hline & A & B & C & D & E & F & G & H hline 1 & multicolumn{8}{|c|}{ STANDARD &

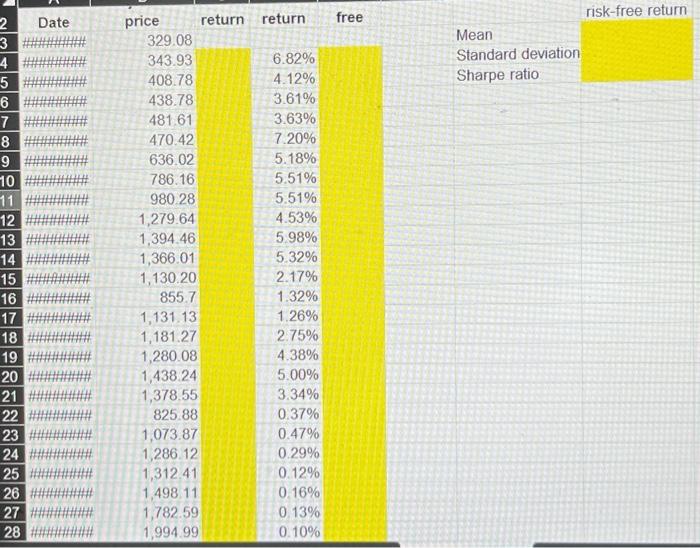

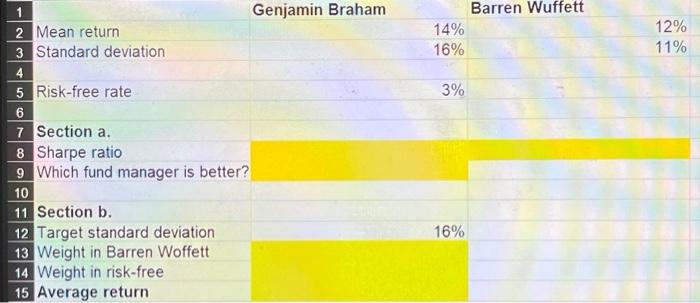

\begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & A & B & C & D & E & F & G & H \\ \hline 1 & \multicolumn{8}{|c|}{ STANDARD \& POOR'S 500 (S\&P 500) SHARPE RATIO } \\ \hline 2 & Date & \begin{tabular}{c} S\&P 500 \\ adjusted \\ price \end{tabular} & \begin{tabular}{l} Annual \\ return \end{tabular} & \begin{tabular}{l} One \\ year risk- \\ free \\ return \end{tabular} & \begin{tabular}{l} S\&P \\ minus \\ risk- \\ free \end{tabular} & & & \begin{tabular}{l} S\&P 500 minus \\ risk-free return \end{tabular} \\ \hline 3 & \#\#\#\#\#\#\#\# & 329.08 & & & & & Mean & \\ \hline 4 & \#\#\#\#\#\#\# & 343.93 & & 6.82% & & & Standard deviation & \\ \hline 5 & \#\#\#\#\#\#\#\# & 408.78 & & 4.12% & & & Sharpe ratio & \\ \hline 6 & H\#\#\#\#\#\#\# & 438.78 & & 3.61% & & & & \\ \hline 7 & \#\#\#\#\#\#\#\# & 481.61 & & 3.63% & & & & \\ \hline 8 & \#\#\#\#\#\#\#\# & 470.42 & & 7.20% & & & & \\ \hline 9 & \#\#\#\#\#\#\#\# & 636.02 & & 5.18% & & & & \\ \hline 10 & \#\#\#\#\#\#\#\# & 786.16 & & 5.51% & & & & \\ \hline 11 & \#\#\#\#\#\#\#\# & 980.28 & & 5.51% & & & & \\ \hline 12 & \#\#\#\#\#\#\#\# & 1,279.64 & & 4.53% & & & & \\ \hline 13 & \#\#\#\#\#\#\#\# & 1,394.46 & & 5.98% & & & & \\ \hline 14 & \#\#\#\#\#\#\#\# & 1,366.01 & & 5.32% & & & & \\ \hline 15 & \#\#\#\#\#\#\#\# & 1,130.20 & & 2.17% & & & & \\ \hline 16 & H\#\#\#\#\#\#\#\# & 855.7 & & 1.32% & & & & \\ \hline 17 & \#\#\#\#\#\#\#\# & 1,131.13 & & 1.26% & & & & \\ \hline 18 & H\#\#\#\#\#\#\# & 1,181.27 & & 2.75% & & & & \\ \hline 19 & \#\#\#\#\#\#\#\# & 1,280.08 & & 4.38% & & & & \\ \hline 20 & \#\#\#\#\#\#\#\# & 1,438.24 & & 5.00% & & & & \\ \hline 21 & \#\#\#\#\#\#\#\# & 1,378.55 & & 3.34% & & & & \\ \hline 22 & & 825.88 & & 0.37% & & & & \\ \hline 23 & \#\#\#\#\#\#\#\# & 1,073.87 & & 0.47% & & & & \\ \hline 2 & & 1286.12 & & 0.20% & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Date & price & return & return & free & & risk-free return \\ \hline \#\#\#\#\#\#\# & 329.08 & & & & Mean & \\ \hline \#\#\#\#\#\#\#\# & 343.93 & & 6.82% & & Standard deviation & \\ \hline \#\#\#\#\#\#\# & 408.78 & & 4.12% & & Sharpe ratio & \\ \hline \#\#\#\#\#\#\#\# & 438.78 & & 3.61% & & & \\ \hline \#\#\#\#\#\#\#\# & 481.61 & & 3.63% & & & \\ \hline \#\#\#\#\#\#\#\# & 470.42 & & 7.20% & & & \\ \hline \#\#\#\#\#\#\# & 636.02 & & 5.18% & & & \\ \hline & 786.16 & & 5.51% & & & \\ \hline \#\#\#\#\#\#\#\# & 980.28 & & 5.51% & & & \\ \hline \#\#\#\#\#\#\#\# & 1,279.64 & & 4.53% & & & \\ \hline & 1,394.46 & & 598% & & & \\ \hline |\#\#\#\#\#\#\# & 1,366.01 & & 5.32% & & & \\ \hline \#\#\#\#\#\#\# & 1,130.20 & & 2.17% & & & \\ \hline \#\#\#\#\#\#\# & 855.7 & & 1.32% & & & \\ \hline & 1,131.13 & & 1.26% & & & \\ \hline \#\#\#\#\#\#\#\# & 1,181.27 & & 2.75% & & & \\ \hline & 1,280.08 & & 4.38% & & & \\ \hline & 1,438.24 & & 5.00% & & & \\ \hline & 1,378.55 & & 3.34% & & & \\ \hline | H\#\#\#\#\#\#\# & 825.88 & & 0.37% & & & \\ \hline & 1,073.87 & & 0.47% & & & \\ \hline H\#\#\#\#\#\#\# & 1,286.12 & & 0.29% & & & \\ \hline H\#\#\#\#\#\#\# & 1,312.41 & & 0.12% & & & \\ \hline & 1,498.11 & & 0.16% & & & \\ \hline & 1,782.59 & & 0.13% & & & \\ \hline & 1,994.99 & & 0.10% & & & \\ \hline \end{tabular} \begin{tabular}{l|l|l|l} \hline 1 & & Genjamin Braham & Barren Wuffett \\ \hline 2 & Mean return & 14% & 12% \\ \hline 3 & Standard deviation & 16% & 11% \\ \hline 4 & & & \\ \hline 5 & Risk-free rate & 3% & \\ \hline 6 & & & \\ \hline 7 & Section a. & & \\ \hline 8 & Sharpe ratio & & \\ \hline 9 & Which fund manager is better? & & \\ \hline 10 & & & \\ \hline 11 & Section b. & & \\ \hline 12 & Target standard deviation & & \\ \hline 13 & Weight in Barren Woffett & & \\ \hline 14 & Weight in risk-free & & \\ \hline 15 & Average return & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & A & B & C & D & E & F & G & H \\ \hline 1 & \multicolumn{8}{|c|}{ STANDARD \& POOR'S 500 (S\&P 500) SHARPE RATIO } \\ \hline 2 & Date & \begin{tabular}{c} S\&P 500 \\ adjusted \\ price \end{tabular} & \begin{tabular}{l} Annual \\ return \end{tabular} & \begin{tabular}{l} One \\ year risk- \\ free \\ return \end{tabular} & \begin{tabular}{l} S\&P \\ minus \\ risk- \\ free \end{tabular} & & & \begin{tabular}{l} S\&P 500 minus \\ risk-free return \end{tabular} \\ \hline 3 & \#\#\#\#\#\#\#\# & 329.08 & & & & & Mean & \\ \hline 4 & \#\#\#\#\#\#\# & 343.93 & & 6.82% & & & Standard deviation & \\ \hline 5 & \#\#\#\#\#\#\#\# & 408.78 & & 4.12% & & & Sharpe ratio & \\ \hline 6 & H\#\#\#\#\#\#\# & 438.78 & & 3.61% & & & & \\ \hline 7 & \#\#\#\#\#\#\#\# & 481.61 & & 3.63% & & & & \\ \hline 8 & \#\#\#\#\#\#\#\# & 470.42 & & 7.20% & & & & \\ \hline 9 & \#\#\#\#\#\#\#\# & 636.02 & & 5.18% & & & & \\ \hline 10 & \#\#\#\#\#\#\#\# & 786.16 & & 5.51% & & & & \\ \hline 11 & \#\#\#\#\#\#\#\# & 980.28 & & 5.51% & & & & \\ \hline 12 & \#\#\#\#\#\#\#\# & 1,279.64 & & 4.53% & & & & \\ \hline 13 & \#\#\#\#\#\#\#\# & 1,394.46 & & 5.98% & & & & \\ \hline 14 & \#\#\#\#\#\#\#\# & 1,366.01 & & 5.32% & & & & \\ \hline 15 & \#\#\#\#\#\#\#\# & 1,130.20 & & 2.17% & & & & \\ \hline 16 & H\#\#\#\#\#\#\#\# & 855.7 & & 1.32% & & & & \\ \hline 17 & \#\#\#\#\#\#\#\# & 1,131.13 & & 1.26% & & & & \\ \hline 18 & H\#\#\#\#\#\#\# & 1,181.27 & & 2.75% & & & & \\ \hline 19 & \#\#\#\#\#\#\#\# & 1,280.08 & & 4.38% & & & & \\ \hline 20 & \#\#\#\#\#\#\#\# & 1,438.24 & & 5.00% & & & & \\ \hline 21 & \#\#\#\#\#\#\#\# & 1,378.55 & & 3.34% & & & & \\ \hline 22 & & 825.88 & & 0.37% & & & & \\ \hline 23 & \#\#\#\#\#\#\#\# & 1,073.87 & & 0.47% & & & & \\ \hline 2 & & 1286.12 & & 0.20% & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Date & price & return & return & free & & risk-free return \\ \hline \#\#\#\#\#\#\# & 329.08 & & & & Mean & \\ \hline \#\#\#\#\#\#\#\# & 343.93 & & 6.82% & & Standard deviation & \\ \hline \#\#\#\#\#\#\# & 408.78 & & 4.12% & & Sharpe ratio & \\ \hline \#\#\#\#\#\#\#\# & 438.78 & & 3.61% & & & \\ \hline \#\#\#\#\#\#\#\# & 481.61 & & 3.63% & & & \\ \hline \#\#\#\#\#\#\#\# & 470.42 & & 7.20% & & & \\ \hline \#\#\#\#\#\#\# & 636.02 & & 5.18% & & & \\ \hline & 786.16 & & 5.51% & & & \\ \hline \#\#\#\#\#\#\#\# & 980.28 & & 5.51% & & & \\ \hline \#\#\#\#\#\#\#\# & 1,279.64 & & 4.53% & & & \\ \hline & 1,394.46 & & 598% & & & \\ \hline |\#\#\#\#\#\#\# & 1,366.01 & & 5.32% & & & \\ \hline \#\#\#\#\#\#\# & 1,130.20 & & 2.17% & & & \\ \hline \#\#\#\#\#\#\# & 855.7 & & 1.32% & & & \\ \hline & 1,131.13 & & 1.26% & & & \\ \hline \#\#\#\#\#\#\#\# & 1,181.27 & & 2.75% & & & \\ \hline & 1,280.08 & & 4.38% & & & \\ \hline & 1,438.24 & & 5.00% & & & \\ \hline & 1,378.55 & & 3.34% & & & \\ \hline | H\#\#\#\#\#\#\# & 825.88 & & 0.37% & & & \\ \hline & 1,073.87 & & 0.47% & & & \\ \hline H\#\#\#\#\#\#\# & 1,286.12 & & 0.29% & & & \\ \hline H\#\#\#\#\#\#\# & 1,312.41 & & 0.12% & & & \\ \hline & 1,498.11 & & 0.16% & & & \\ \hline & 1,782.59 & & 0.13% & & & \\ \hline & 1,994.99 & & 0.10% & & & \\ \hline \end{tabular} \begin{tabular}{l|l|l|l} \hline 1 & & Genjamin Braham & Barren Wuffett \\ \hline 2 & Mean return & 14% & 12% \\ \hline 3 & Standard deviation & 16% & 11% \\ \hline 4 & & & \\ \hline 5 & Risk-free rate & 3% & \\ \hline 6 & & & \\ \hline 7 & Section a. & & \\ \hline 8 & Sharpe ratio & & \\ \hline 9 & Which fund manager is better? & & \\ \hline 10 & & & \\ \hline 11 & Section b. & & \\ \hline 12 & Target standard deviation & & \\ \hline 13 & Weight in Barren Woffett & & \\ \hline 14 & Weight in risk-free & & \\ \hline 15 & Average return & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts