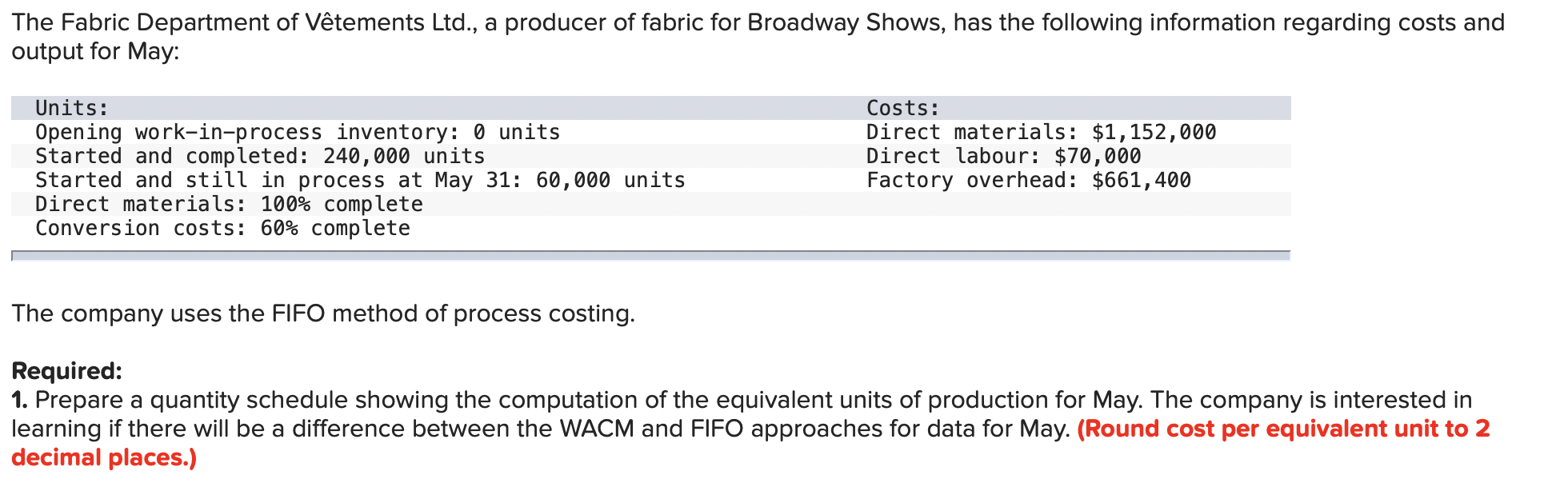

Question: begin{tabular}{|c|c|c|c|c|c|c|c|c|} hline & multicolumn{2}{|c|}{ Physical Units } & multicolumn{6}{|c|}{ Equivalent Units Processed } hline & multirow{3}{*}{ To account for } & multirow{3}{*}{ Accounted for

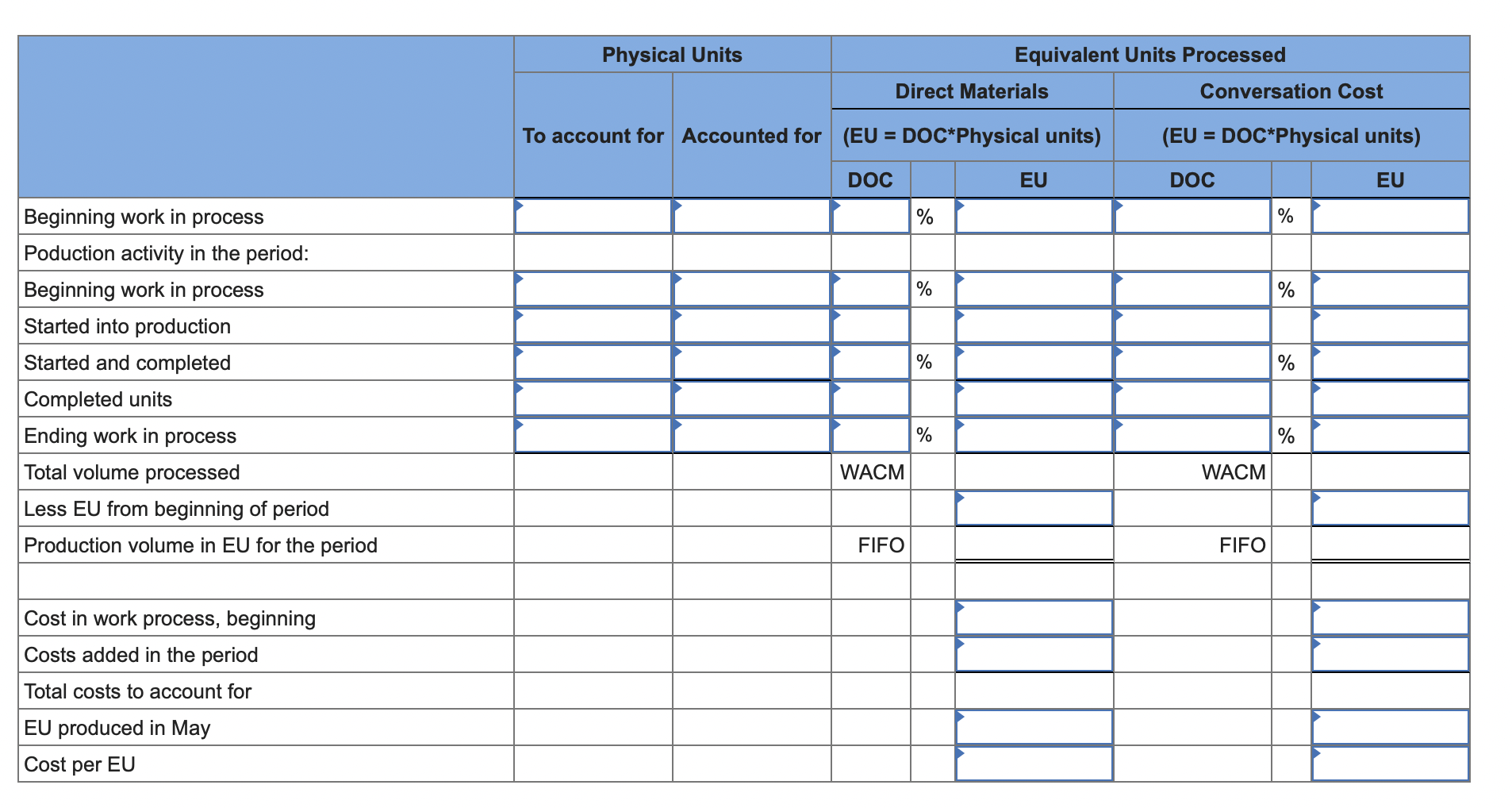

\begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & \multicolumn{2}{|c|}{ Physical Units } & \multicolumn{6}{|c|}{ Equivalent Units Processed } \\ \hline & \multirow{3}{*}{ To account for } & \multirow{3}{*}{ Accounted for } & \multirow{2}{*}{\multicolumn{3}{|c|}{(EU=DOC*Physicalunits)DirectMaterials}} & \multirow{2}{*}{\multicolumn{3}{|c|}{\begin{tabular}{c} Conversation Cost \\ (EU = DOC*Physical units) \end{tabular}}} \\ \hline & & & & & & & & \\ \hline & & & DOC & & EU & DOC & & EU \\ \hline Beginning work in process & & & & % & & & % & \\ \hline \multicolumn{9}{|l|}{ Poduction activity in the period: } \\ \hline \multicolumn{9}{|l|}{ Started into production } \\ \hline Started and completed & & & & % & & & % & 7 \\ \hline \multicolumn{9}{|l|}{ Completed units } \\ \hline Ending work in process & & & & % & & & % & \\ \hline Total volume processed & & & WACM & & & WACM & & \\ \hline \multicolumn{9}{|l|}{ Less EU from beginning of period } \\ \hline \multicolumn{9}{|l|}{ Cost in work process, beginning } \\ \hline \multicolumn{9}{|l|}{ Costs added in the period } \\ \hline \multicolumn{9}{|l|}{ Total costs to account for } \\ \hline \multicolumn{9}{|l|}{ EU produced in May } \\ \hline Cost per EU & & & & & & & & \\ \hline \end{tabular} The Fabric Department of Vtements Ltd., a producer of fabric for Broadway Shows, has the following information regarding costs and output for May: The company uses the FIFO method of process costing. Required: 1. Prepare a quantity schedule showing the computation of the equivalent units of production for May. The company is interested in learning if there will be a difference between the WACM and FIFO approaches for data for May. (Round cost per equivalent unit to 2 decimal places.) 2. Calculate the cost of 240,000 units transferred out in May. 3. Calculate the cost of ending inventory in May. (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts