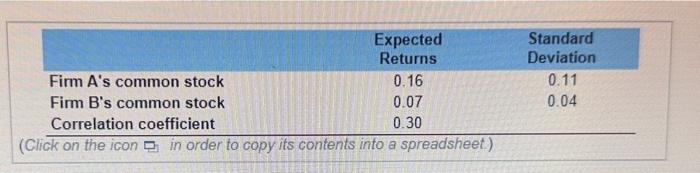

Question: begin{tabular}{lcc} & ExpectedReturns & StandardDeviation hline Firm A's common stock & 0.16 & 0.11 Firm B's common stock & 0.07 & 0.04

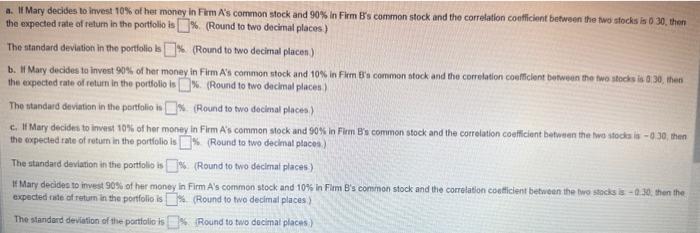

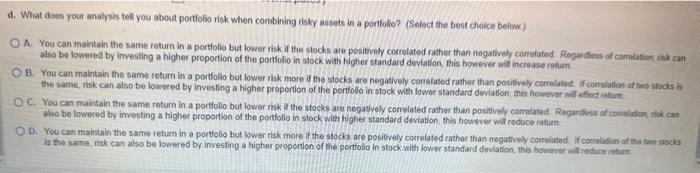

\begin{tabular}{lcc} & ExpectedReturns & StandardDeviation \\ \hline Firm A's common stock & 0.16 & 0.11 \\ Firm B's common stock & 0.07 & 0.04 \\ Correlation coefficient & 0.30 & \\ \hline ick on the icon in order to copy its contents into a spreadsheet) & \end{tabular} (Computing the standard deviation for a portfolio of two risky investments) Mary Gulott recently graduated from college and is evaluating an inveatmert in fiwo canparins common stock. She has colocted the following information about the common stock of Firm A and Firm B. a. If Mary decides to invest 10 percent of her money in Firm A's common stock and 90 percent in Firm B's cemmon stock, what is the erpectad nate of ratarm and the standard deviation of the portolio return? b. If Mary decides to invest 90 percent of her money in Firm A's common stock and 10 percent in Firm B's convmon sfock, what is the expecied rate af iatum and the ifandaid deviation of the portiolio return? c. Recocapute your responses to both questions a and b. where the correlation between the two firms' stock returns is -0.30 d. Summarize what your analysis tells you about portfolio risk when combining risky assets in a portfolio a. If Mary decides to imvest 10% of her money in Fim A's common stock and 90% in Firm B's common stock and the correlation contlicient between the fwo stocks is 0 30 , then the expected rate of return in the portiolio is 6. (Round to two decinal places) The standard deviation in the portiolio is % (Round to two decimal placen) b. II Mary decides ta invest 90% of har monev in Firm A's common stock and 10% in Firm B's common stock and the correlation coefficlent between the fwo stocks is 030 , then the expected rate of return in the portiolio is N. (Round to two decimal places) The standard deviatian in the portiolio is \%. (Round to two docimal places.) c. If Mary decides to inwest 10% of her money in Firm A's common slock and 90% in Firm B's common stock and the correlation coefficient between the Awo stocka is - O. 30, then the expected rate of retum in the portiolio is (Round to two decimal places.) The standard deviation in the portiolio is 16. (Round to two decimal places) expected rate of retum in the portfolio is is. (Round to two decimal places) The standard deviation of the portiolio is 4. Round to two docimal places ) 1. What does your analysis tell you about portiolio risk when combining risky assets in a portfolio? (Selact the best choice below) A. You can maintain the same return in a portfolio but lower itsk if the stocks are positively corrolated rather than negatively comefated. Regarthoss of complabion ink can also be lowered by investing a higher proportion of the portiflio in stock with higher standard deviation, this however will increase retum. C. You can maintain the same return in a porfollo but lower risk if the stocks are nogatvelly correlated rather than positively correlafed. Regarntlers of contelabion risk can also be lowered by investing a higher proportion of the portolio in stock with higher standard deviation this however will roduce return. as the same, risk can also be lowered by investing a higher proportion of the portiolio in stock with lower standard deviation this bowevar will reduce intarm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts