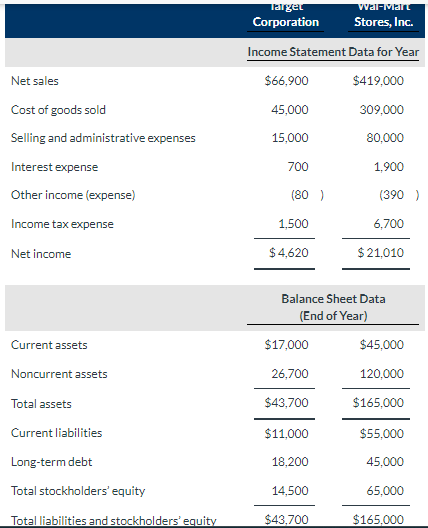

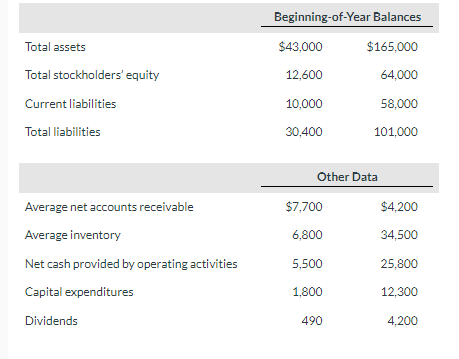

Question: begin{tabular}{lcc} & multicolumn{2}{c}{ Beginning-of-Year Balances } cline { 2 - 3 } Total assets & $43,000 & $165,000 Total stockholders' equity & 12,600

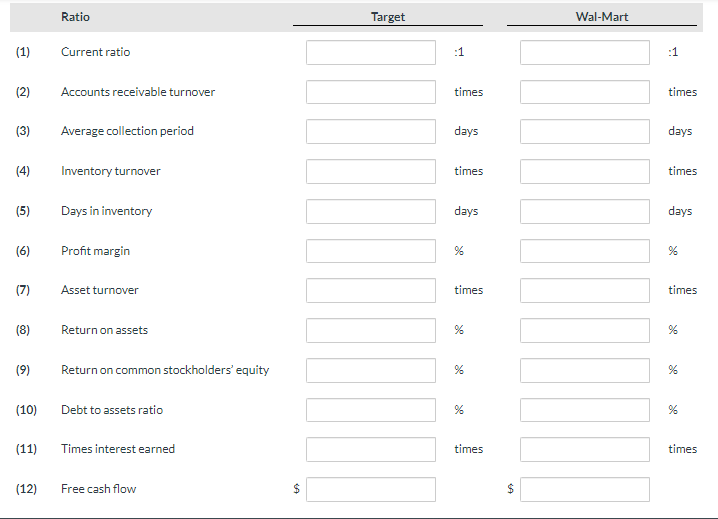

\begin{tabular}{lcc} & \multicolumn{2}{c}{ Beginning-of-Year Balances } \\ \cline { 2 - 3 } Total assets & $43,000 & $165,000 \\ Total stockholders' equity & 12,600 & 64,000 \\ Current liabilities & 10,000 & 58,000 \\ Total liabilities & 30,400 & 101,000 \\ & \multicolumn{2}{c}{ Other Data } \\ \hline Average net accounts receivable & $7,700 & $4,200 \\ Average inventory & 6,800 & 34,500 \\ Net cash provided by operating activities & 5,500 & 25,800 \\ Capital expenditures & 1,800 & 12,300 \\ Dividends & 490 & 4,200 \end{tabular} Ratio (1) Current ratio (2) Accounts receivable turnover (3) Average collection period (4) Inventory turnover (5) Days in inventory (6) Profit margin (7) Asset turnover (8) Return on assets (9) Return on common stockholders' equity (10) Debt to assets ratio (11) Times interest earned (12) Free cash flow Target Wal-Mart 1 times times days times days days % % times times % % % % % times $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts