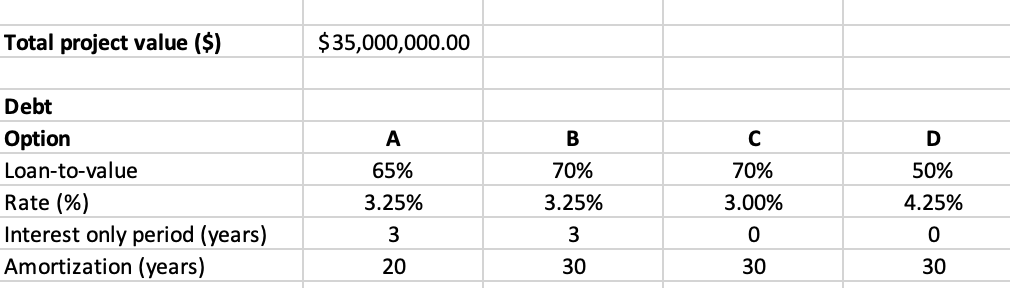

Question: begin{tabular}{l|c|c|c|c|} hline Total project value ($) & $35,000,000.00 & & & hline & & & & hline Debt & & & &

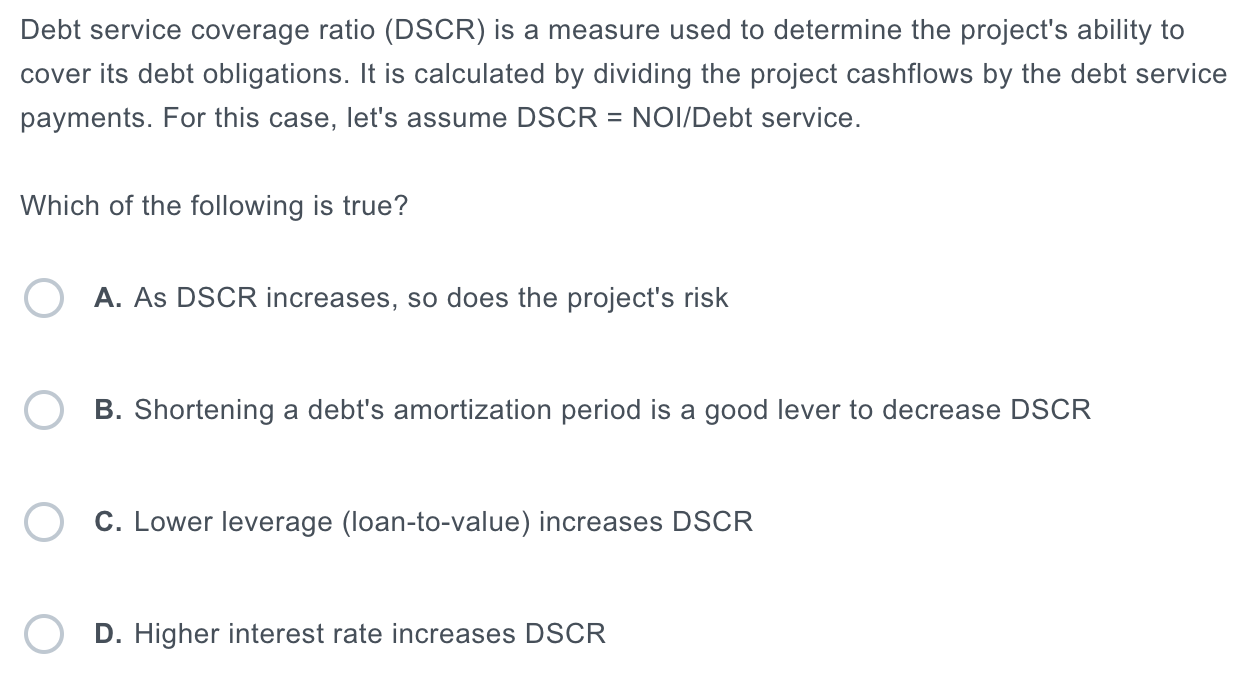

\begin{tabular}{l|c|c|c|c|} \hline Total project value (\$) & $35,000,000.00 & & & \\ \hline & & & & \\ \hline Debt & & & & \\ \hline Option & A & B & D & \\ \hline Loan-to-value & 65% & 70% & 70% & 50% \\ \hline Rate (\%) & 3.25% & 3.25% & 3.00% & 4.25% \\ \hline Interest only period (years) & 3 & 3 & 0 & 0 \\ \hline Amortization (years) & 20 & 30 & 30 & 30 \\ \hline \end{tabular} Debt service coverage ratio (DSCR) is a measure used to determine the project's ability to cover its debt obligations. It is calculated by dividing the project cashflows by the debt service payments. For this case, let's assume DSCR = NOI/Debt service. Which of the following is true? A. As DSCR increases, so does the project's risk B. Shortening a debt's amortization period is a good lever to decrease DSCR C. Lower leverage (loan-to-value) increases DSCR D. Higher interest rate increases DSCR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts