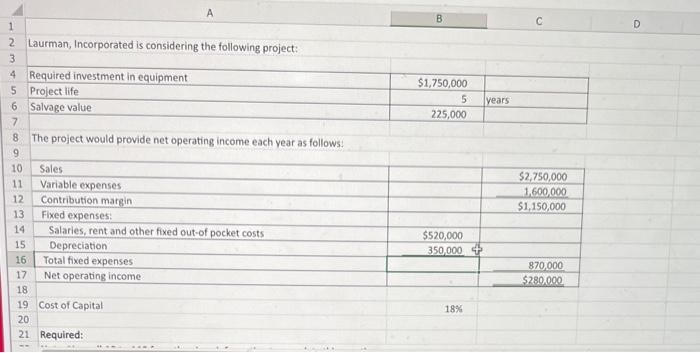

Question: begin{tabular}{|l|l|c|c|} hline 1 & multicolumn{1}{|c|}{ A } & B hline 2 & Laurman, Incorporated is considering the following project: & C hline 3

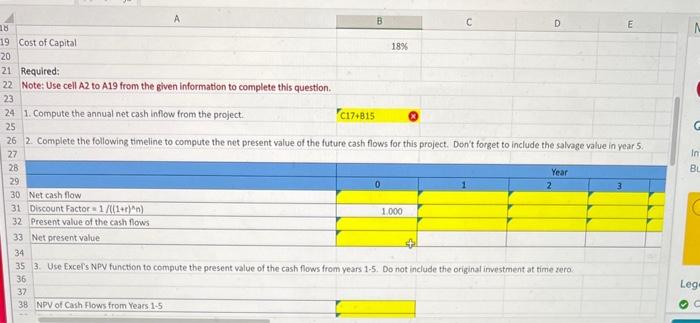

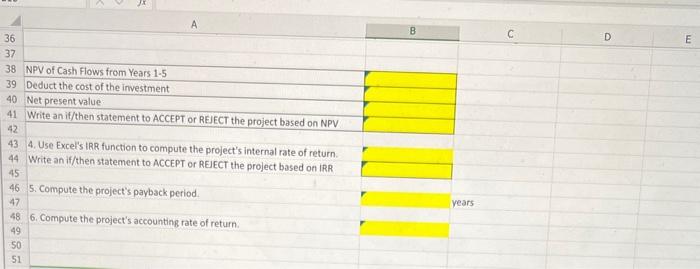

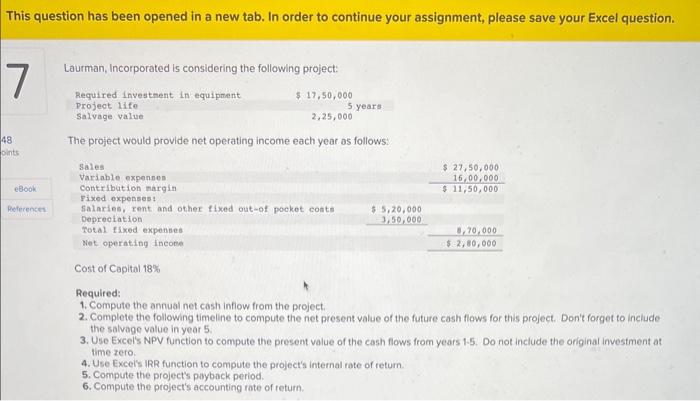

\begin{tabular}{|l|l|c|c|} \hline 1 & \multicolumn{1}{|c|}{ A } & B \\ \hline 2 & Laurman, Incorporated is considering the following project: & C \\ \hline 3 & & & \\ \hline 4 & Required investment in equipment & $1,750,000 & \\ \hline 5 & Project life & 5 & years \\ \hline 6 & Salvage value & 225,000 & \\ \hline 7 & & \end{tabular} 8 The project would provide net operating income each year as follows: Cost of Capital 18% Required: Cost of Capital 18% Required: Note: Use cell A2 to A19 from the given information to complete this question. 1. Compute the annual net cash inflow from the project. 2. Complete the following timeline to compute the net present value of the future cash flows for this project. Don't forget to include the salvage value in year 5 . 3. Use Excefs NPV function to compute the present value of the cash flows from years 1-5. Do not include the original investment at time zero. NPV of Cash Flows from Years 1-5 NPV of Cash Flows from Years 1-5 Deduct the cost of the investment Net present value Write an if/then statement to ACCEPT or REEECT the project based on NPV 4. Use Excel's IRR function to compute the project's internal rate of return. Write an if/then statement to ACCEPT or REECT the project based on IRR 5. Compute the project's payback period. vears 6. Compute the project's accounting rate of return. 5 question has been opened in a new tab. In order to continue your assignment, please save your Excel question. Laurman, Incorporated is considering the following project: The project would provide net operating income each year as follows: Cost of Capital 18% Required: 1. Compute the annual net cash inflow from the project. 2. Complete the following timeline to compute the net present value of the future cash flows for this project. Don't forget to include the salvage value in year 5. 3. Use Excel's NPV function to compute the present value of the cash flows from years 1.5. Do not include the original investment at time zero. 4. Use Excels IRR function to compute the project's internal rote of retum. 5. Compute the project's payback period. 6. Compute the project's accounting rote of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts