Question: begin{tabular}{l|l|l} MMDC & DYDO & Sensitivity Analysis end{tabular} begin{tabular}{|c|c|c|c|c|c|c|} hline New Heritage & Capit & Budgeting & & & & hline NPV Sensiti &

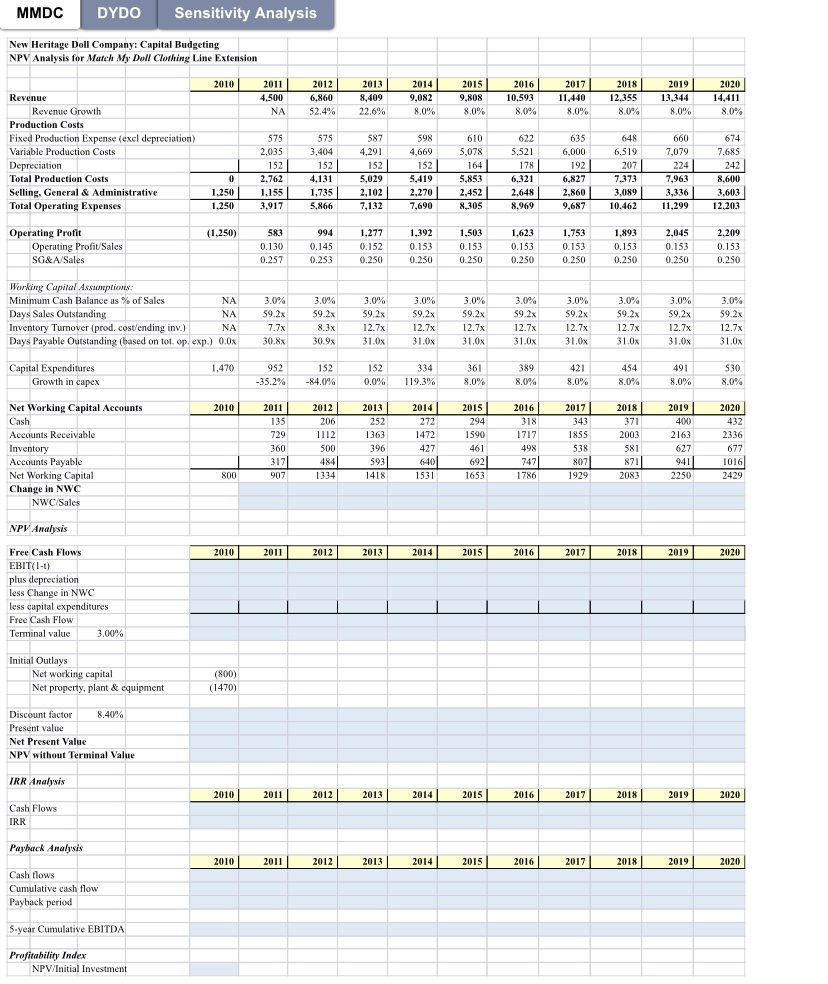

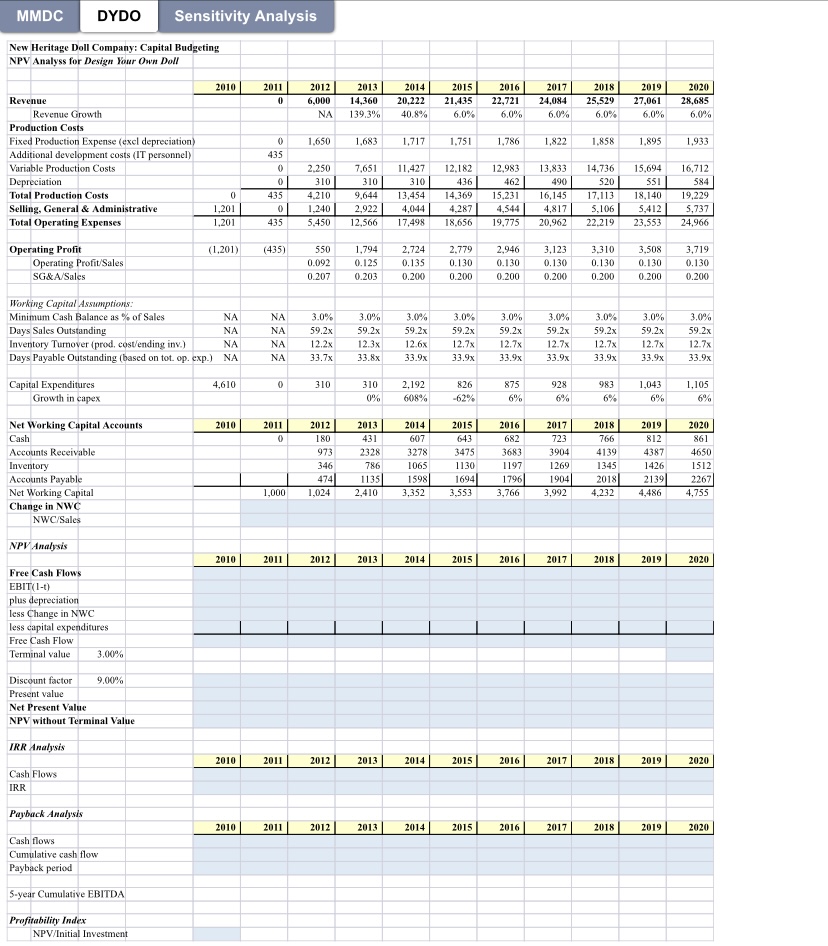

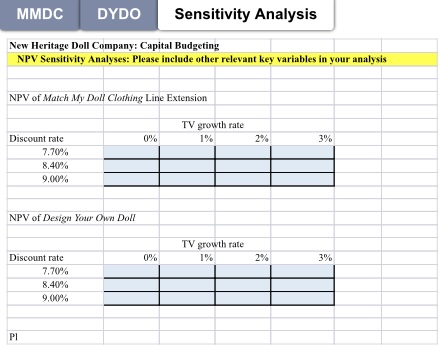

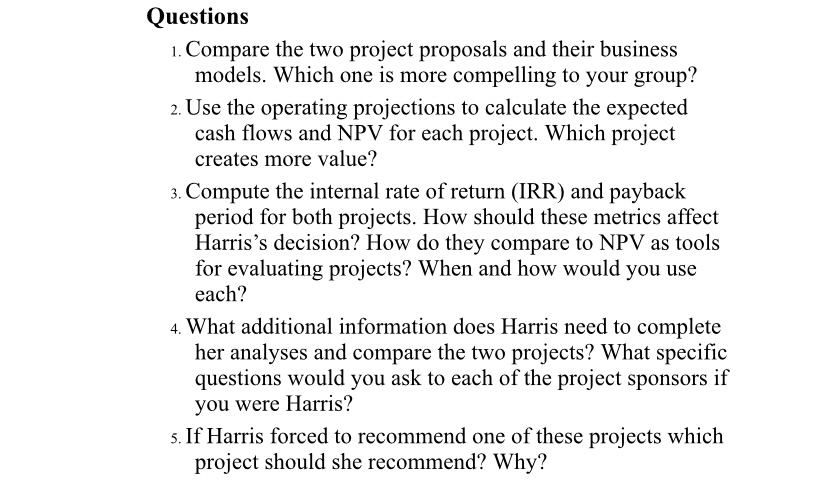

\begin{tabular}{l|l|l} MMDC & DYDO & Sensitivity Analysis \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline New Heritage & Capit & Budgeting & & & & \\ \hline NPV Sensiti & lease & lude other & nt key & y variables in y & rour analysis & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline NPV of Match & g Line & tension & & & & \\ \hline & & & & & & \\ \hline & & TV growt & & & & \\ \hline Discount rate & 0% & 1% & 2% & 3% & & \\ \hline 7.70% & & & & & & \\ \hline 8.40% & & & & & & \\ \hline 9.00% & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline NPV of Design & & & & & & \\ \hline & & & & & & \\ \hline & & TV grow & & & & \\ \hline Discount rate & 0% & 1% & 2% & 3% & & \\ \hline 7.70% & & & & & & \\ \hline 8.40% & & & & & & \\ \hline 9.00% & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline Pl & & & & & & \\ \hline \end{tabular} \begin{tabular}{l|l|l} MMDC & DYDO & Sensitivity Analysis \end{tabular} MMDC \begin{tabular}{l|l} DYDO & Sensitivity Analysis \end{tabular} Questions 1. Compare the two project proposals and their business models. Which one is more compelling to your group? 2. Use the operating projections to calculate the expected cash flows and NPV for each project. Which project creates more value? 3. Compute the internal rate of return (IRR) and payback period for both projects. How should these metrics affect Harris's decision? How do they compare to NPV as tools for evaluating projects? When and how would you use each? 4. What additional information does Harris need to complete her analyses and compare the two projects? What specific questions would you ask to each of the project sponsors if you were Harris? 5. If Harris forced to recommend one of these projects which project should she recommend? Why? \begin{tabular}{l|l|l} MMDC & DYDO & Sensitivity Analysis \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline New Heritage & Capit & Budgeting & & & & \\ \hline NPV Sensiti & lease & lude other & nt key & y variables in y & rour analysis & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline NPV of Match & g Line & tension & & & & \\ \hline & & & & & & \\ \hline & & TV growt & & & & \\ \hline Discount rate & 0% & 1% & 2% & 3% & & \\ \hline 7.70% & & & & & & \\ \hline 8.40% & & & & & & \\ \hline 9.00% & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline NPV of Design & & & & & & \\ \hline & & & & & & \\ \hline & & TV grow & & & & \\ \hline Discount rate & 0% & 1% & 2% & 3% & & \\ \hline 7.70% & & & & & & \\ \hline 8.40% & & & & & & \\ \hline 9.00% & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline Pl & & & & & & \\ \hline \end{tabular} \begin{tabular}{l|l|l} MMDC & DYDO & Sensitivity Analysis \end{tabular} MMDC \begin{tabular}{l|l} DYDO & Sensitivity Analysis \end{tabular} Questions 1. Compare the two project proposals and their business models. Which one is more compelling to your group? 2. Use the operating projections to calculate the expected cash flows and NPV for each project. Which project creates more value? 3. Compute the internal rate of return (IRR) and payback period for both projects. How should these metrics affect Harris's decision? How do they compare to NPV as tools for evaluating projects? When and how would you use each? 4. What additional information does Harris need to complete her analyses and compare the two projects? What specific questions would you ask to each of the project sponsors if you were Harris? 5. If Harris forced to recommend one of these projects which project should she recommend? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts