Question: begin{tabular}{|l|l|l|l|} hline 45 & & & hline 46 & 2018 & 2019 hline 47 & & hline end{tabular} 48 49 Net Sales

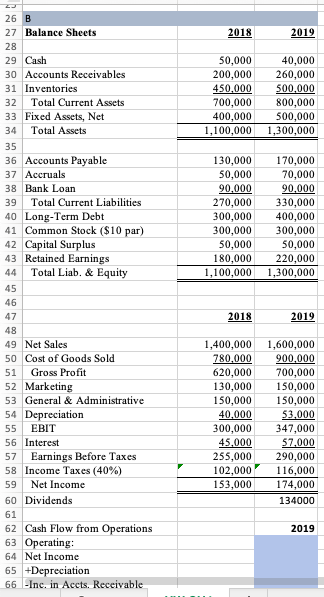

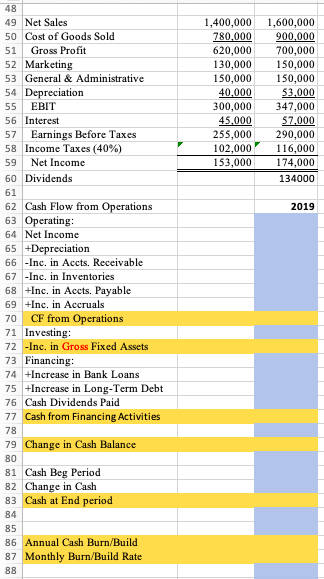

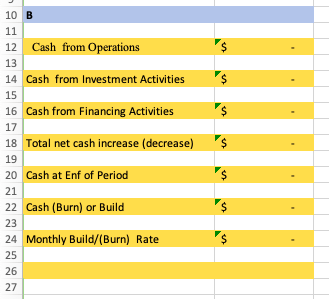

\begin{tabular}{|l|l|l|l|} \hline 45 & & & \\ \hline 46 & 2018 & 2019 \\ \hline 47 & & \\ \hline \end{tabular} 48 49 Net Sales 50 Cost of Goods Sold 51 Gross Profit 52 Marketing 53 General \& Administrative 54 Depreciation 55 EBIT 56 Interest 57 Earnings Before Taxes 58 Income Taxes (40\%) 59 Net Income 60 Dividends \begin{tabular}{|r|r|} \hline 1,400,000 & 1,600,000 \\ \hline620,000780,000 & 700,000900,000 \\ \hline 130,000 & 150,000 \\ \hline 150,000 & 150,000 \\ \hline 40,000 & 43,000 \\ \hline 300,000 & 347,000 \\ \hline45,000 & 57,000 \\ \hline 255,000 & 290,000 \\ \hline 102,000 & 116,000 \\ \hline 153,000 & 174,000 \\ \hline \hline & 134000 \\ \hline \end{tabular} Cash Flow from Operations 2019 Operating: 4 Net Income 65+ Depreciation 66 -Inc. in Accts. Receivable B Cash from Operations Cash from Investment Activities Cash from Financing Activities Total net cash increase (decrease) Cash at Enf of Period Cash (Burn) or Build Monthly Build/(Burn) Rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts