Question: begin{tabular}{llllccll|} hline Sector coupon & type & frequency & years to maturity & current price moody & S&P Manufacturir & 5.95% Fixed & Semi-Annually

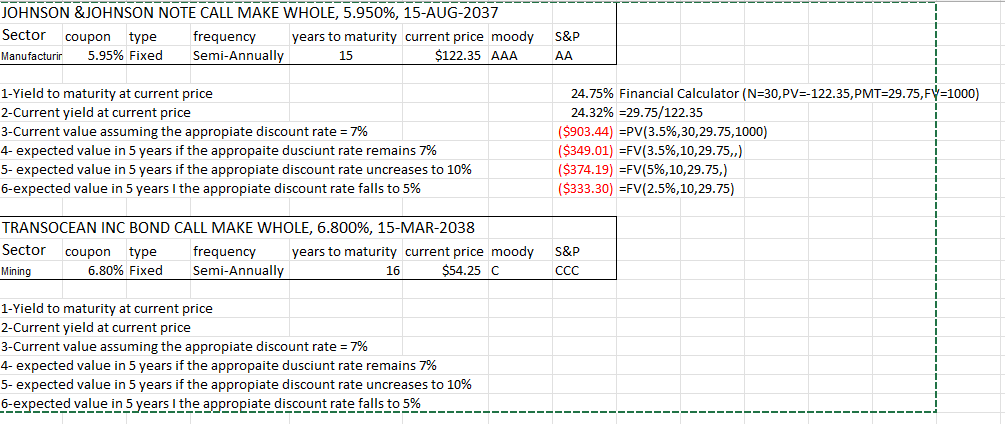

\begin{tabular}{llllccll|} \hline Sector coupon & type & frequency & years to maturity & current price moody & S\&P \\ Manufacturir & 5.95% Fixed & Semi-Annually & 15 & $122.35 & AAA & AA \\ \hline \end{tabular} 1-Yield to maturity at current price 2-Current yield at current price 3 -Current value assuming the appropiate discount rate =7% 4- expected value in 5 years if the appropaite dusciunt rate remains 7% 5 - expected value in 5 years if the appropiate discount rate uncreases to 10% 6 -expected value in 5 years I the appropiate discount rate falls to 5% \begin{tabular}{llllccll|} \hline Sector coupon & type & frequency & years to maturity & current price moody & S\&P \\ Manufacturir & 5.95% Fixed & Semi-Annually & 15 & $122.35 & AAA & AA \\ \hline \end{tabular} 1-Yield to maturity at current price 2-Current yield at current price 3 -Current value assuming the appropiate discount rate =7% 4- expected value in 5 years if the appropaite dusciunt rate remains 7% 5 - expected value in 5 years if the appropiate discount rate uncreases to 10% 6 -expected value in 5 years I the appropiate discount rate falls to 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts