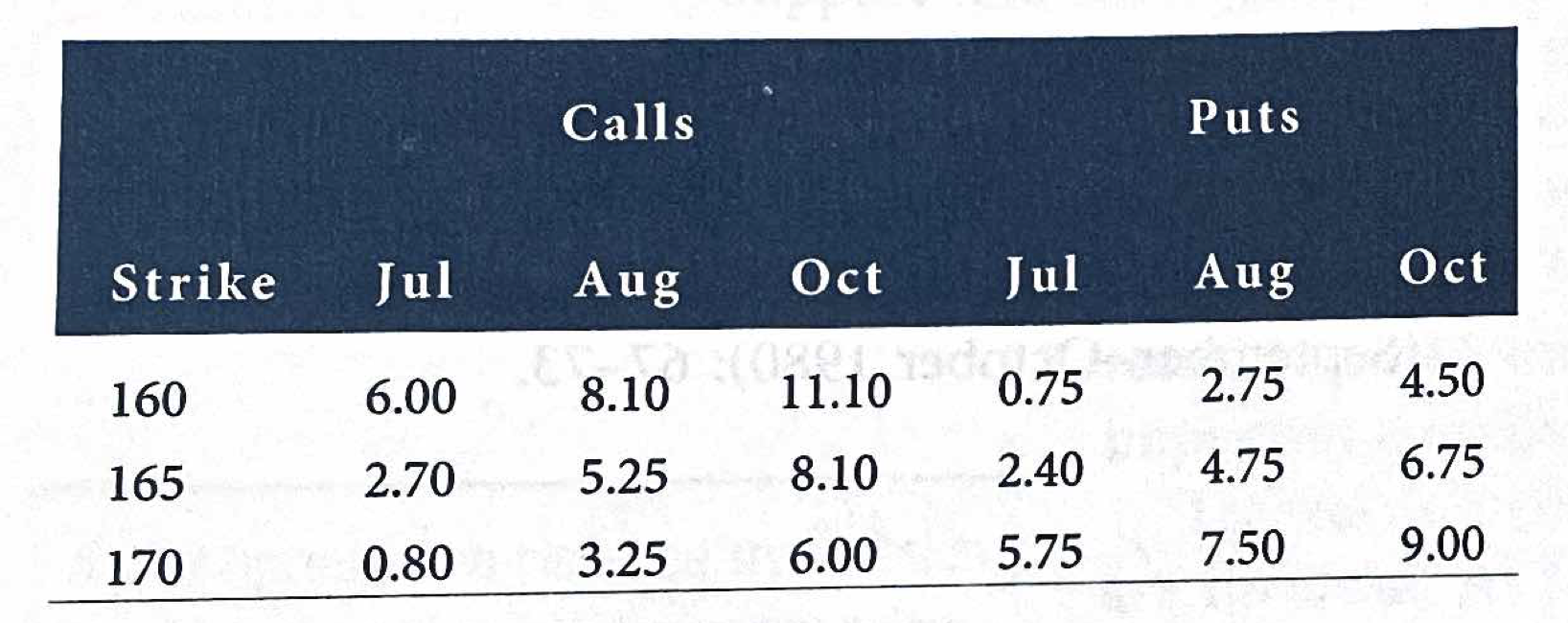

Question: begin{tabular}{llllllll} hline & & Calls & & & Puts & Strike & Jul & Aug & Oct & Jul & Aug & Oct

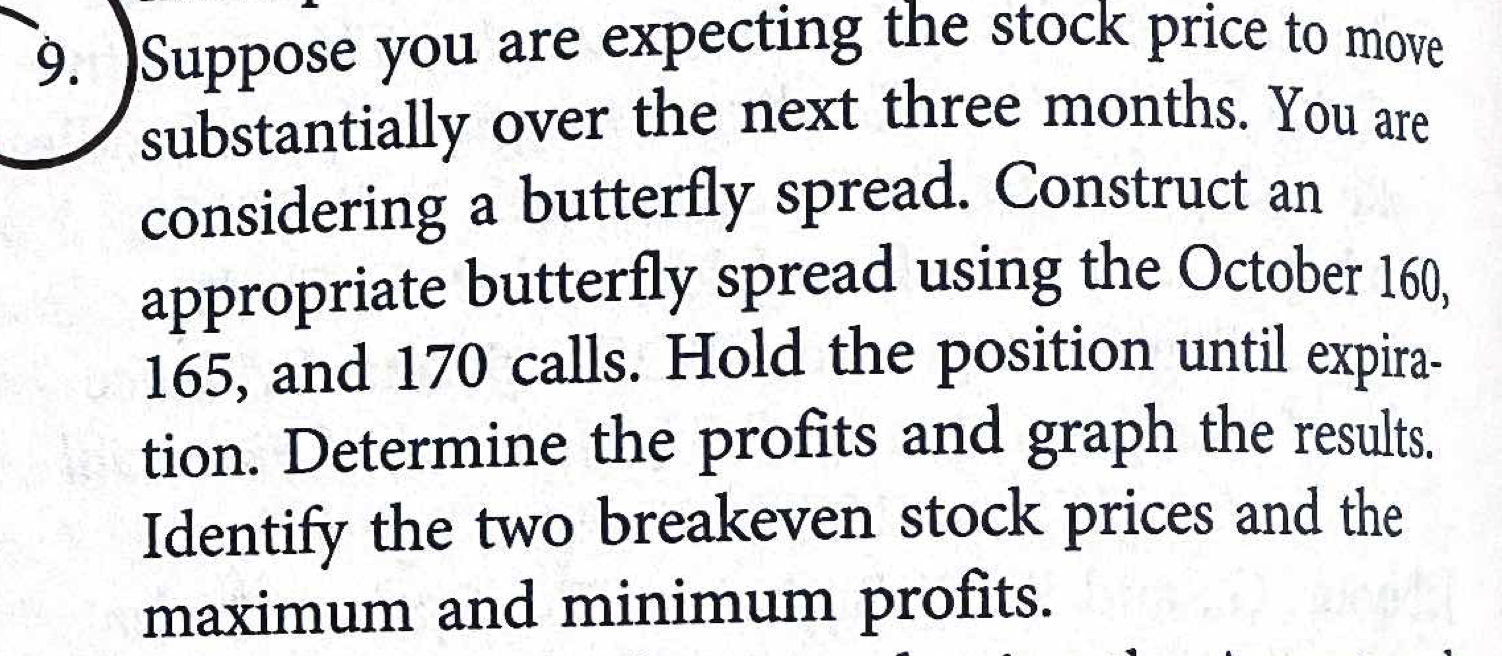

\begin{tabular}{llllllll} \hline & & Calls & & & Puts & \\ Strike & Jul & Aug & Oct & Jul & Aug & Oct \\ \hline 160 & 6.00 & 8.10 & 11.10 & 0.75 & 2.75 & 4.50 \\ 165 & 2.70 & 5.25 & 8.10 & 2.40 & 4.75 & 6.75 \\ 170 & 0.80 & 3.25 & 6.00 & 5.75 & 7.50 & 9.00 \\ \hline \end{tabular} Suppose you are expecting the stock price to move substantially over the next three months. You are considering a butterfly spread. Construct an appropriate butterfly spread using the October 160 , 165 , and 170 calls. Hold the position until expiration. Determine the profits and graph the results. Identify the two breakeven stock prices and the maximum and minimum profits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts