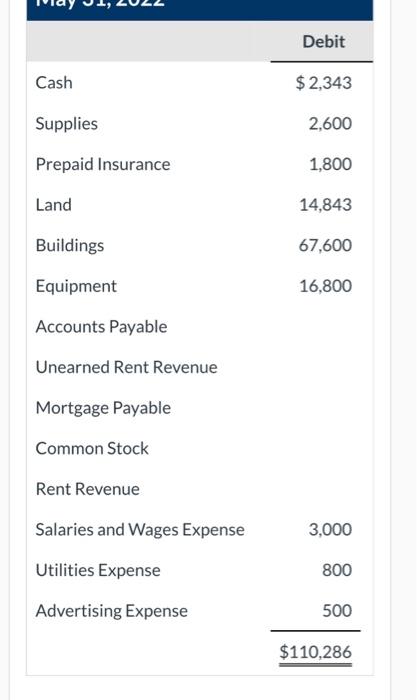

Question: begin{tabular}{lr} & multicolumn{1}{c}{ Debit } cline { 2 - 2 } Cash & $2,343 Supplies & 2,600 Prepaid Insurance & 1,800

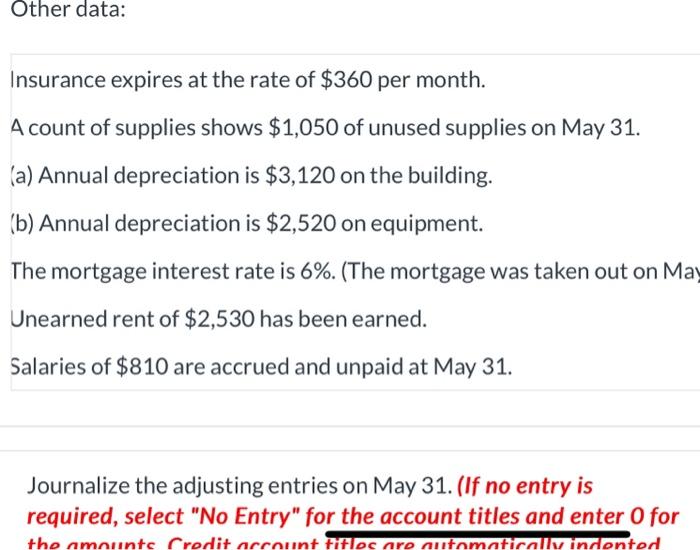

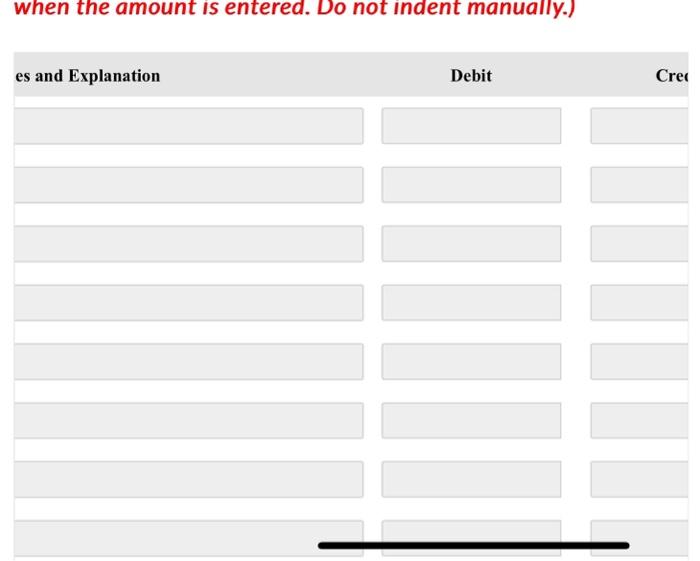

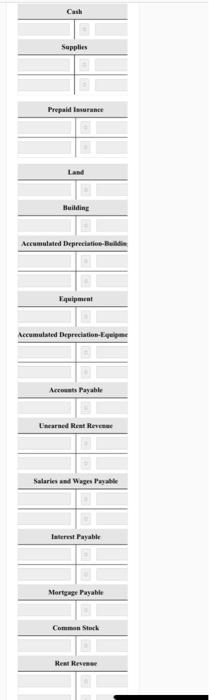

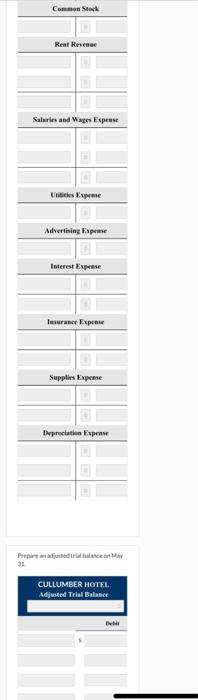

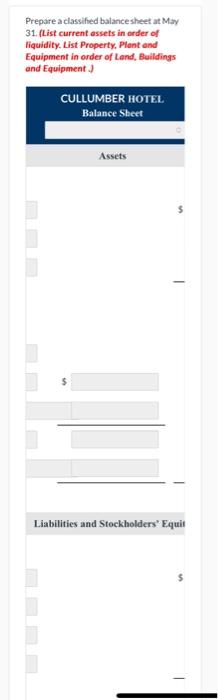

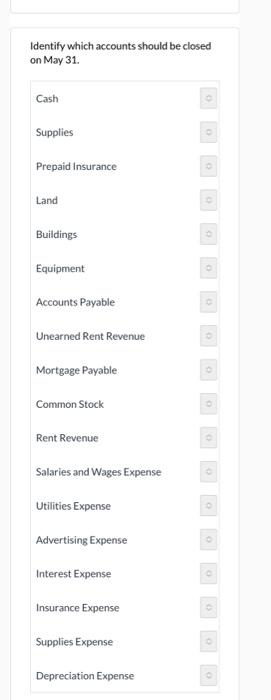

\begin{tabular}{lr} & \multicolumn{1}{c}{ Debit } \\ \cline { 2 - 2 } Cash & $2,343 \\ Supplies & 2,600 \\ Prepaid Insurance & 1,800 \\ Land & 14,843 \\ Buildings & 67,600 \\ Equipment & 16,800 \\ Accounts Payable & \\ Unearned Rent Revenue & \\ Mortgage Payable & \\ Common Stock & \\ Rent Revenue & \\ Salaries and Wages Expense & \\ Utilities Expense & \\ Advertising Expense & \\ \hline \end{tabular} Insurance expires at the rate of $360 per month. A count of supplies shows $1,050 of unused supplies on May 31. (a) Annual depreciation is $3,120 on the building. (b) Annual depreciation is $2,520 on equipment. The mortgage interest rate is 6%. (The mortgage was taken out on Ma' Unearned rent of $2,530 has been earned. Salaries of $810 are accrued and unpaid at May 31. Journalize the adjusting entries on May 31. (If no entry is required, select "No Entry" for the account titles and enter O for when the amount is entered. Do not indent manually.) Necumulated Drpreciatiob-Beadie Equipneat Accumulated Depreciation-Eqelpene 31 Prepare an income statement for the month of May. Prepare a retained earnings statement for the month of May. Prepare aclassified balance sheet at May Identify which accounts should be closed on May 31. Cash Supplies Prepaid Insurance Land Buildings Equipment Accounts Payable Unearned Rent Revenue Mortgage Payable Common Stock Rent Revenue Salaries and Wages Expense Utilities Expense Advertising Expense Interest Expense Insurance Expense Supplies Expense Depreciation Expense \begin{tabular}{lr} & \multicolumn{1}{c}{ Debit } \\ \cline { 2 - 2 } Cash & $2,343 \\ Supplies & 2,600 \\ Prepaid Insurance & 1,800 \\ Land & 14,843 \\ Buildings & 67,600 \\ Equipment & 16,800 \\ Accounts Payable & \\ Unearned Rent Revenue & \\ Mortgage Payable & \\ Common Stock & \\ Rent Revenue & \\ Salaries and Wages Expense & \\ Utilities Expense & \\ Advertising Expense & \\ \hline \end{tabular} Insurance expires at the rate of $360 per month. A count of supplies shows $1,050 of unused supplies on May 31. (a) Annual depreciation is $3,120 on the building. (b) Annual depreciation is $2,520 on equipment. The mortgage interest rate is 6%. (The mortgage was taken out on Ma' Unearned rent of $2,530 has been earned. Salaries of $810 are accrued and unpaid at May 31. Journalize the adjusting entries on May 31. (If no entry is required, select "No Entry" for the account titles and enter O for when the amount is entered. Do not indent manually.) Necumulated Drpreciatiob-Beadie Equipneat Accumulated Depreciation-Eqelpene 31 Prepare an income statement for the month of May. Prepare a retained earnings statement for the month of May. Prepare aclassified balance sheet at May Identify which accounts should be closed on May 31. Cash Supplies Prepaid Insurance Land Buildings Equipment Accounts Payable Unearned Rent Revenue Mortgage Payable Common Stock Rent Revenue Salaries and Wages Expense Utilities Expense Advertising Expense Interest Expense Insurance Expense Supplies Expense Depreciation Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts