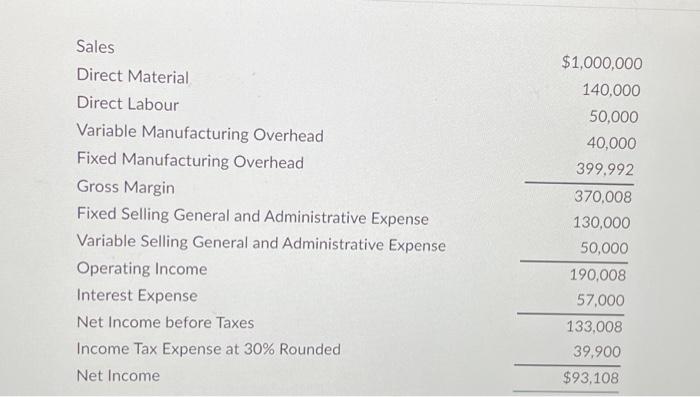

Question: begin{tabular}{lr} Sales & $1,000,000 Direct Material & 140,000 Direct Labour & 50,000 Variable Manufacturing Overhead & 40,000 Fixed Manufacturing Overhead &

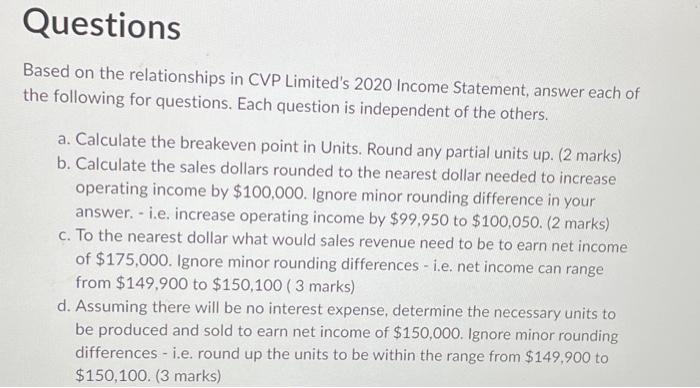

\begin{tabular}{lr} Sales & $1,000,000 \\ Direct Material & 140,000 \\ Direct Labour & 50,000 \\ Variable Manufacturing Overhead & 40,000 \\ Fixed Manufacturing Overhead & 399,992 \\ Gross Margin & 370,008 \\ Fixed Selling General and Administrative Expense & 130,000 \\ Variable Selling General and Administrative Expense & 50,000 \\ Operating Income & 190,008 \\ Interest Expense & 57,000 \\ Net Income before Taxes & 133,008 \\ Income Tax Expense at 30\% Rounded & 39,900 \\ Net Income & $93,108 \end{tabular} Based on the relationships in CVP Limited's 2020 Income Statement, answer each of the following for questions. Each question is independent of the others. a. Calculate the breakeven point in Units. Round any partial units up. (2 marks) b. Calculate the sales dollars rounded to the nearest dollar needed to increase operating income by $100,000. Ignore minor rounding difference in your answer. - i.e. increase operating income by $99,950 to $100,050. (2 marks) c. To the nearest dollar what would sales revenue need to be to earn net income of $175,000. Ignore minor rounding differences - i.e. net income can range from $149,900 to $150,100 ( 3 marks) d. Assuming there will be no interest expense, determine the necessary units to be produced and sold to earn net income of $150,000. Ignore minor rounding differences - i.e. round up the units to be within the range from $149,900 to $150,100. (3 marks) \begin{tabular}{lr} Sales & $1,000,000 \\ Direct Material & 140,000 \\ Direct Labour & 50,000 \\ Variable Manufacturing Overhead & 40,000 \\ Fixed Manufacturing Overhead & 399,992 \\ Gross Margin & 370,008 \\ Fixed Selling General and Administrative Expense & 130,000 \\ Variable Selling General and Administrative Expense & 50,000 \\ Operating Income & 190,008 \\ Interest Expense & 57,000 \\ Net Income before Taxes & 133,008 \\ Income Tax Expense at 30\% Rounded & 39,900 \\ Net Income & $93,108 \end{tabular} Based on the relationships in CVP Limited's 2020 Income Statement, answer each of the following for questions. Each question is independent of the others. a. Calculate the breakeven point in Units. Round any partial units up. (2 marks) b. Calculate the sales dollars rounded to the nearest dollar needed to increase operating income by $100,000. Ignore minor rounding difference in your answer. - i.e. increase operating income by $99,950 to $100,050. (2 marks) c. To the nearest dollar what would sales revenue need to be to earn net income of $175,000. Ignore minor rounding differences - i.e. net income can range from $149,900 to $150,100 ( 3 marks) d. Assuming there will be no interest expense, determine the necessary units to be produced and sold to earn net income of $150,000. Ignore minor rounding differences - i.e. round up the units to be within the range from $149,900 to $150,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts