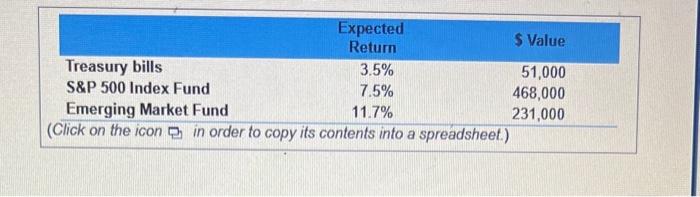

Question: begin{tabular}{|lrr|} hline & Expected Return & $ Value Treasury bills & 3.5% & 51,000 S&P 500 Index Fund & 7.5% & 468,000

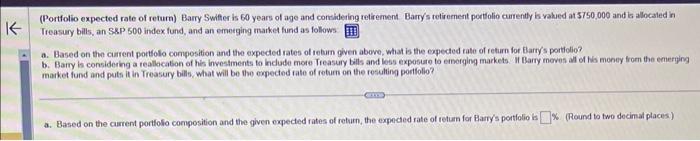

\begin{tabular}{|lrr|} \hline & Expected Return & $ Value \\ Treasury bills & 3.5% & 51,000 \\ S\&P 500 Index Fund & 7.5% & 468,000 \\ Emerging Market Fund & 11.7% & 231,000 \\ \hline (Click on the icon p in order to copy its contents into a spreadsheet.) \\ \hline \end{tabular} (Portfolio expected rate of return) Barry Switter is 60 years of age and consideing retirement Barry's retirement pertiolio currently is valued at 5750,000 and is allocaled in Treasury bills, an S\&P 500 index fund, and an emeeging market fund as follows a. Based on the cuarent pontifolo composition and the expected rates of retiin given above, what is the expected rate of return for flarty's porticlio? b. Barry is considering a reallecabon of his investments to indude mote Treasury bills and loss exposute to ennorging markets. If Barry meves all of his meney from the enerpin market fund and puts it in Treasury bills, what will be the eppected rate of rotuen on the resulting portfollo? a. Based on the carrent portfolio composition and the given expected rates of return, the expecied rate of return for Barry's portiolio is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts