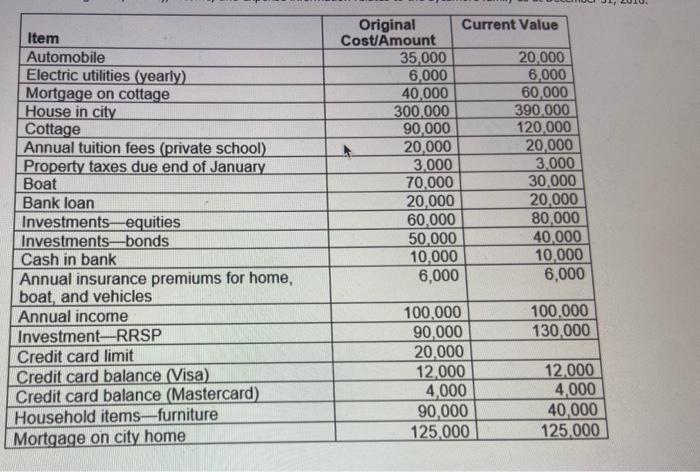

Question: begin{tabular}{|l|r|r|} hline Item & Original CostfAmount & Current Value hline Automobile & 35,000 & 20,000 hline Electric utilities (yearly) & 6,000 & 6,000

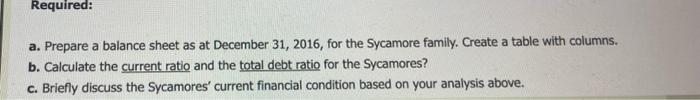

\begin{tabular}{|l|r|r|} \hline Item & Original CostfAmount & Current Value \\ \hline Automobile & 35,000 & 20,000 \\ \hline Electric utilities (yearly) & 6,000 & 6,000 \\ \hline Mortgage on cottage & 40,000 & 60,000 \\ \hline House in city & 300,000 & 390,000 \\ \hline Cottage & 90,000 & 120,000 \\ \hline Annual tuition fees (private school) & 20,000 & 20,000 \\ \hline Property taxes due end of January & 3,000 & 3,000 \\ \hline Boat & 70,000 & 30,000 \\ \hline Bank loan & 20,000 & 20,000 \\ \hline Investments - equities & 60,000 & 80,000 \\ \hline Investments-bonds & 50,000 & 40,000 \\ \hline Cash in bank & 10,000 & 10,000 \\ \hline Annual insurance premiums for home, boat, and vehicles & 6,000 & 6,000 \\ \hline Annual income & & \\ \hline Investment-RRSP & 100,000 & 100,000 \\ \hline Credit card limit & 90,000 & 130,000 \\ \hline Credit card balance (Visa) & 20,000 & \\ \hline Credit card balance (Mastercard) & 12,000 & 12,000 \\ \hline Household items-furniture & 4,000 & 4,000 \\ \hline Mortgage on city home & 90,000 & 40,000 \\ \hline \end{tabular} a. Prepare a balance sheet as at December 31, 2016, for the Sycamore family. Create a table with columns. b. Calculate the current ratio and the total debt ratio for the Sycamores? c. Briefly discuss the Sycamores' current financial condition based on your analysis above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts