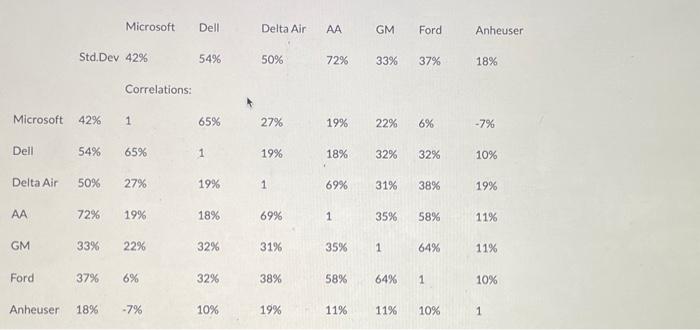

Question: begin{tabular}{rcccccc} Microsoft & Dell & Delta Air & AA & GM & Ford & Anheuser Std.Dev 42% & 54% & 50% & 72% &

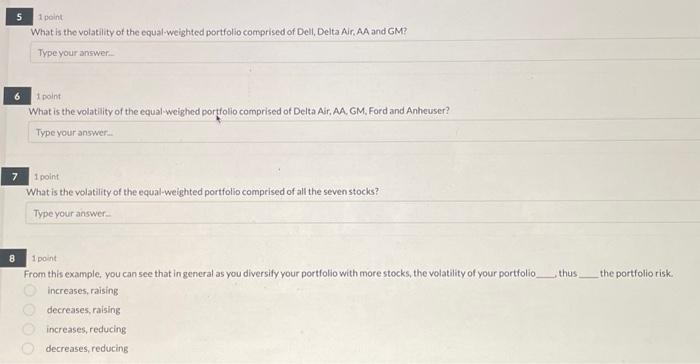

\begin{tabular}{rcccccc} Microsoft & Dell & Delta Air & AA & GM & Ford & Anheuser \\ Std.Dev 42% & 54% & 50% & 72% & 33% & 37% & 18% \end{tabular} Correlations: \begin{tabular}{lllllllll} Microsoft & 42% & 1 & 65% & 27% & 19% & 22% & 6% & 7% \\ Dell & 54% & 65% & 1 & 19% & 18% & 32% & 32% & 10% \\ Delta Air & 50% & 27% & 19% & 1 & 69% & 31% & 38% & 19% \\ AA & 72% & 19% & 18% & 69% & 1 & 35% & 58% & 11% \\ GM & 33% & 22% & 32% & 31% & 35% & 1 & 64% & 11% \\ Ford & 37% & 6% & 32% & 38% & 58% & 64% & 1 & 10% \\ Anheuser & 18% & 7% & 10% & 19% & 11% & 11% & 10% & 1 \end{tabular} 1 point What is the volatility of the equal-weighted portfolio comprised of Dell, Delta Air. AA and GM? I point What is the volatility of the equal-weighed portfolio comprised of Delta Air, AA, GM, Ford and Anheuser? Type your answer. 1 point What is the volatility of the equal-weighted portfollo comprised of all the seven stocks? Type your answer- Ipoint From this example, you can see that in general as you diversify your portfolio with more stocks, the volatility of your portfolio thus the portfolio risk. increases, raising decreases, raising increases, reducing decreases, reducing \begin{tabular}{rcccccc} Microsoft & Dell & Delta Air & AA & GM & Ford & Anheuser \\ Std.Dev 42% & 54% & 50% & 72% & 33% & 37% & 18% \end{tabular} Correlations: \begin{tabular}{lllllllll} Microsoft & 42% & 1 & 65% & 27% & 19% & 22% & 6% & 7% \\ Dell & 54% & 65% & 1 & 19% & 18% & 32% & 32% & 10% \\ Delta Air & 50% & 27% & 19% & 1 & 69% & 31% & 38% & 19% \\ AA & 72% & 19% & 18% & 69% & 1 & 35% & 58% & 11% \\ GM & 33% & 22% & 32% & 31% & 35% & 1 & 64% & 11% \\ Ford & 37% & 6% & 32% & 38% & 58% & 64% & 1 & 10% \\ Anheuser & 18% & 7% & 10% & 19% & 11% & 11% & 10% & 1 \end{tabular} 1 point What is the volatility of the equal-weighted portfolio comprised of Dell, Delta Air. AA and GM? I point What is the volatility of the equal-weighed portfolio comprised of Delta Air, AA, GM, Ford and Anheuser? Type your answer. 1 point What is the volatility of the equal-weighted portfollo comprised of all the seven stocks? Type your answer- Ipoint From this example, you can see that in general as you diversify your portfolio with more stocks, the volatility of your portfolio thus the portfolio risk. increases, raising decreases, raising increases, reducing decreases, reducing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts