Question: Bel Computers purchases integrated chips at $350 per chip. The holding cost is $35 per unit per year, the ordering cost is $122 per order,

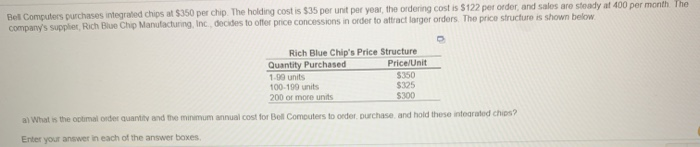

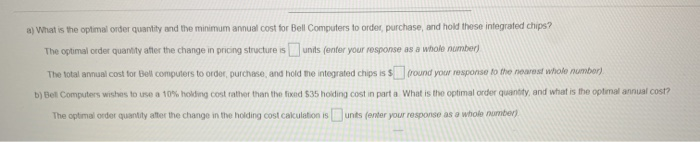

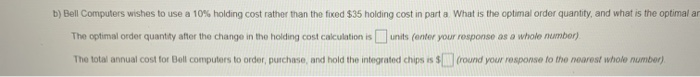

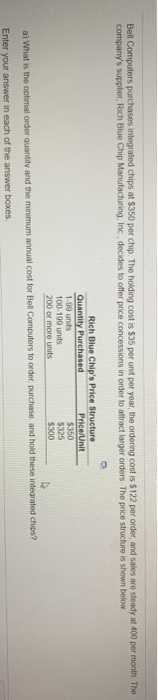

Bel Computers purchases integrated chips at $350 per chip. The holding cost is $35 per unit per year, the ordering cost is $122 per order, and sales are steady at 400 per month The company's supplier, Rich Blue Chip Manufacturing, Inc. decides to offer price concessions in order to attract larger orders. The price structure is shown below. Rich Blue Chip's Price Structure Quantity Purchased Price/Unit 1.99 units $350 100-199 units 200 or more units $300 $325 al What is the optimal order quantity and the minimum annual cost for Boll Computers to order Durchase and hold these integrated chips? Enter your answer in each of the answer boxes a) What is the optimal order quantity and the minimum annual cost for Bell Computers to order purchase, and hold those integrated chips? The optimal order quantity after the change in pricing structure is units (enter your response as a whole number) The total annual cost for Bell computers to order, purchase, and hold the integrated chips is 5 fround your response to the nearest whole number) b) Bel Computers wishes to use a 10% holding cost rather than the fixed 535 holding cost in part a What is the optimal order quantity, and what is the optimal annual cost? The optimal order quantity after the change in the holding cost calculation is unts (enter your response as a whole number) b) Bell Computers wishes to use a 10% holding cost rather than the fixed $35 holding cost in part a What is the optimal order quantity, and what is the optimal ar The optimal order quantity after the change in the holding cost calculation is units (enter your response as a whole newbor) The total annual cost for Ball computers to order, purchase, and hold the integrated chips is $ (round your response to the nearest whose number). Bell Computers purchases integrated chips at $350 per chip. The holding cost is $35 per unit per year, the ordering cost is $122 per order, and sales are steady at 400 per month The company's supplier, Rich Blue Chip Manufacturing, Inc. decides to offer price concessions in order to attract larger orders. The price structure is shown below Rich Blue Chip's Price Structure Quantity Purchased Price Unit 1-99 units $350 100-199 units $325 200 or more units $300 a) What is the optimal order quantity and the minimum annual cost for Bell Computers to order Durchase, and hold these integrated chips? Enter your answer in each of the answer boxes a) What is the optimal order quantity and the minimum annual cost for Bell Computers to order, purchase, and hold these integrated chips? The optimal order quantity after the change in pricing structure is unts (enter your response as a whole number) The total annual cost for Bell computers to order, purchase, and hold the integrated chips is $round your response to the nearest whole number) b) Bell Computers wishes to use a 10% holding cost rather than the fixed $35 holding cost in part a What is the optimal order quantity, and what is the optimal annual cost? The optimal order quantity after the change in the holding cost calculation is units (enter your response as a whole number). Un part What is the optimal order quantity, and what is the optimal annual cos The optimal order quantity after the change in the holding cost calculation is units (enter your response as a whole number) The total annual cost for Bell computers to order, purchase, and hold the integrated chips is $fround your response to the nearest whole number)