Question: below 300000 this is a one question and read c and D option in 2nd picture .plz solve it fast . I need answer in

below 300000 this is a one question and read c and D option in 2nd picture .plz solve it fast . I need answer in 20 minutes.

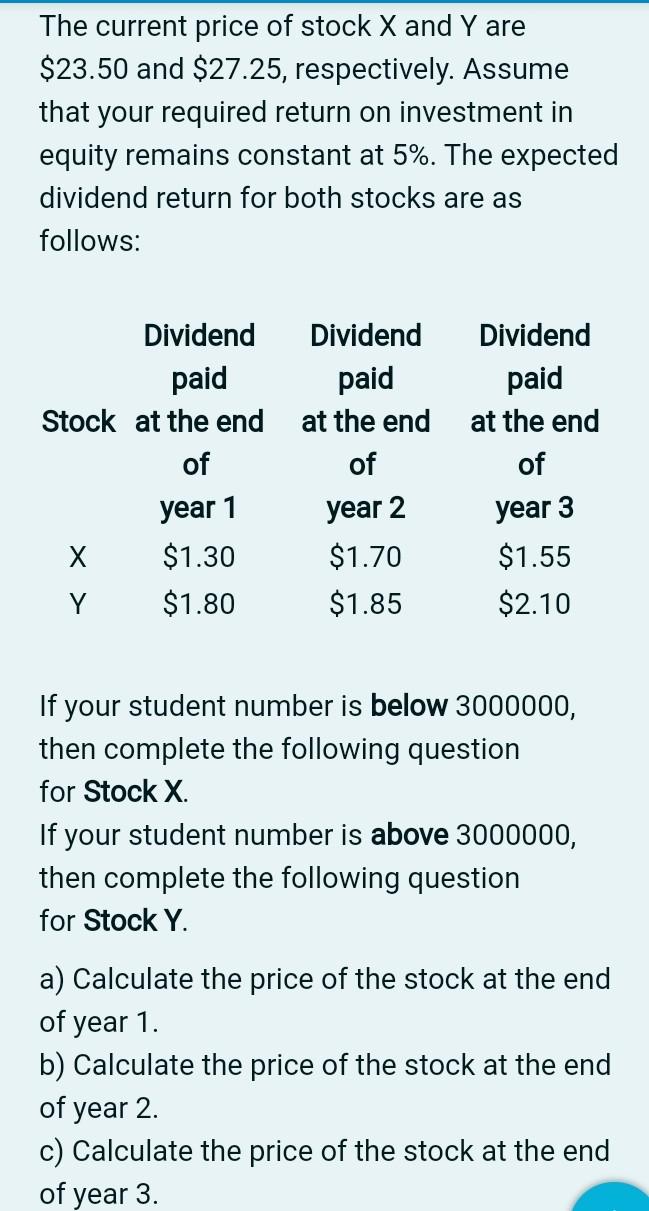

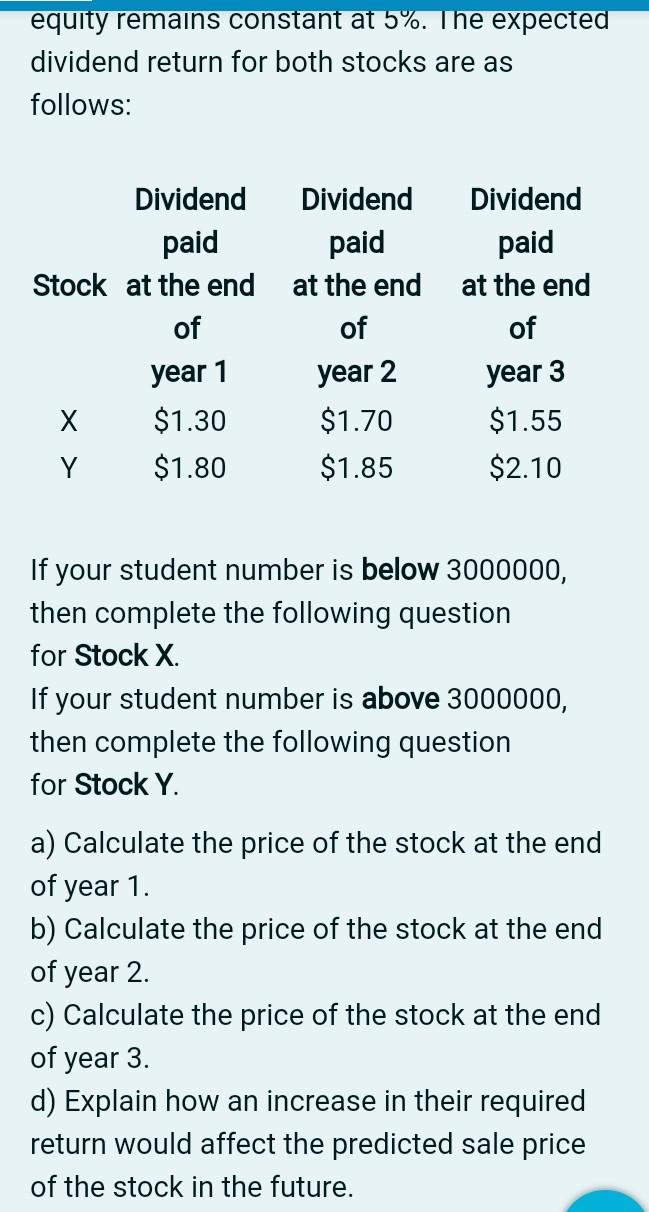

The current price of stock X and Y are $23.50 and $27.25, respectively. Assume that your required return on investment in equity remains constant at 5%. The expected dividend return for both stocks are as follows: Dividend paid Stock at the end of year 1 x $1.30 Y $1.80 Dividend paid at the end of year 2 $1.70 $1.85 Dividend paid at the end of year 3 $1.55 $2.10 If your student number is below 3000000, then complete the following question for Stock X. If your student number is above 3000000, then complete the following question for Stock Y. a) Calculate the price of the stock at the end of year 1. b) Calculate the price of the stock at the end of year 2. c) Calculate the price of the stock at the end of year 3. equity remains constant at 5%. The expected dividend return for both stocks are as follows: Dividend paid Stock at the end of year 1 $1.30 Y $1.80 Dividend paid at the end of Dividend paid at the end of year 2 year 3 $1.70 $1.85 $1.55 $2.10 If your student number is below 3000000, then complete the following question for Stock X. If your student number is above 3000000, then complete the following question for Stock Y. a) Calculate the price of the stock at the end of year 1. b) Calculate the price of the stock at the end of year 2. c) Calculate the price of the stock at the end of year 3. d) Explain how an increase in their required return would affect the predicted sale price of the stock in the future

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts