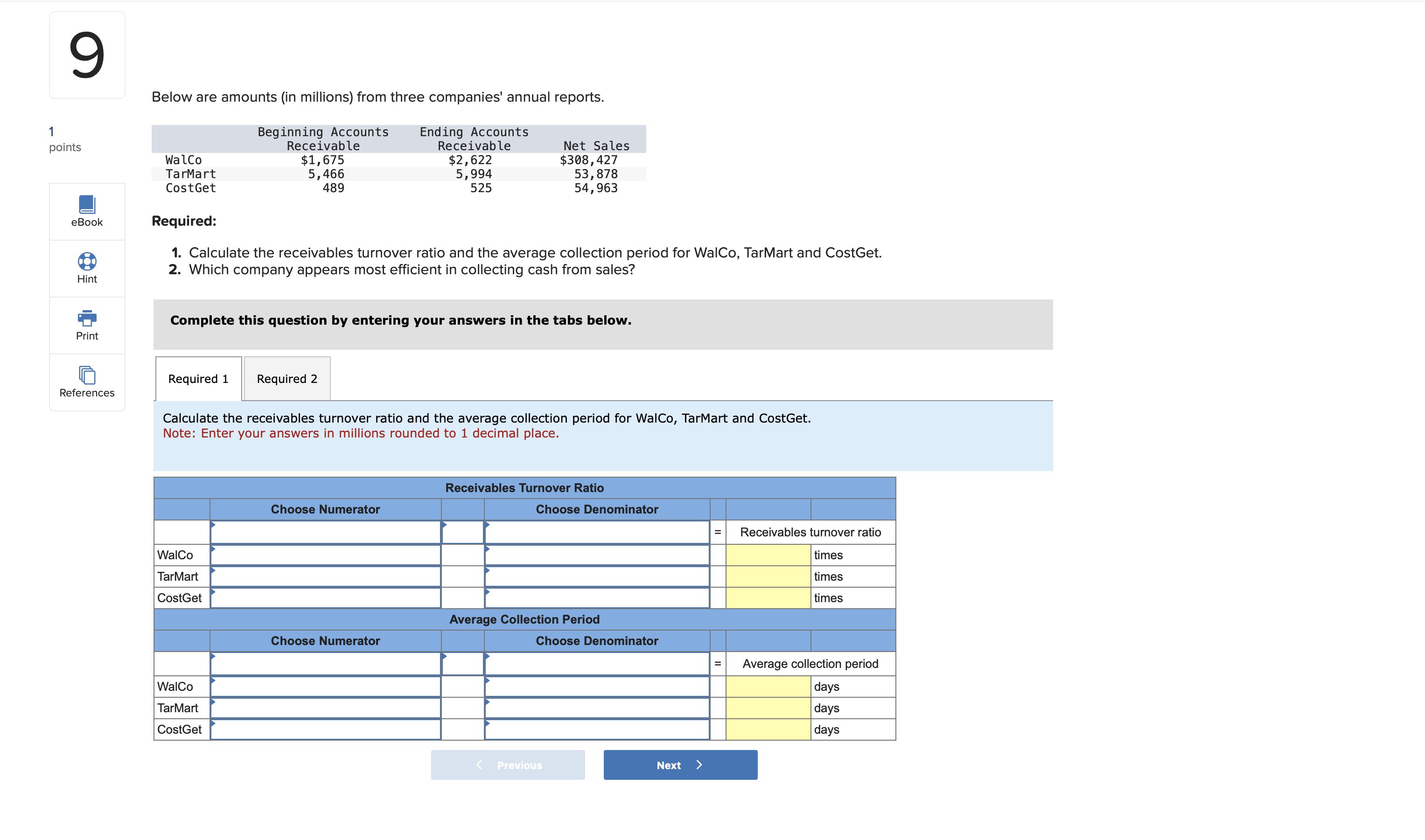

Question: Below are amounts ( in millions ) from three companies' annual reports. 1 points eBook Hint Print References begin { tabular } { lccc

Below are amounts in millions from three companies' annual reports.

points

eBook

Hint

Print

References

begintabularlccc

& begintabularc

Beginning Accounts

Receivable

endtabular & begintabularc

Ending Accounts

Receivable

endtabular & Net Sales

WalCo & $ & $ & $

TarMart & & &

CostGet & & &

endtabular

Required:

Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet.

Which company appears most efficient in collecting cash from sales?

Complete this question by entering your answers in the tabs below.

Required

Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet.

Note: Enter your answers in millions rounded to decimal place.

begintabularlllll

hline multicolumncReceivables Turnover Ratio

hline & Choose Numerator & Choose Denominator & &

hline & & & & Receivables turnover ratio

hline WalCo & & & & times

hline TarMart & & & & times

hline CostGet & & & & times

hline multicolumncAverage Collection Period

hline & Choose Numerator & Choose Denominator & &

hline & & & & Average collection period

hline WalCo & & & & days

hline TarMart & & & & days

hline CostGet & & & & days

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock