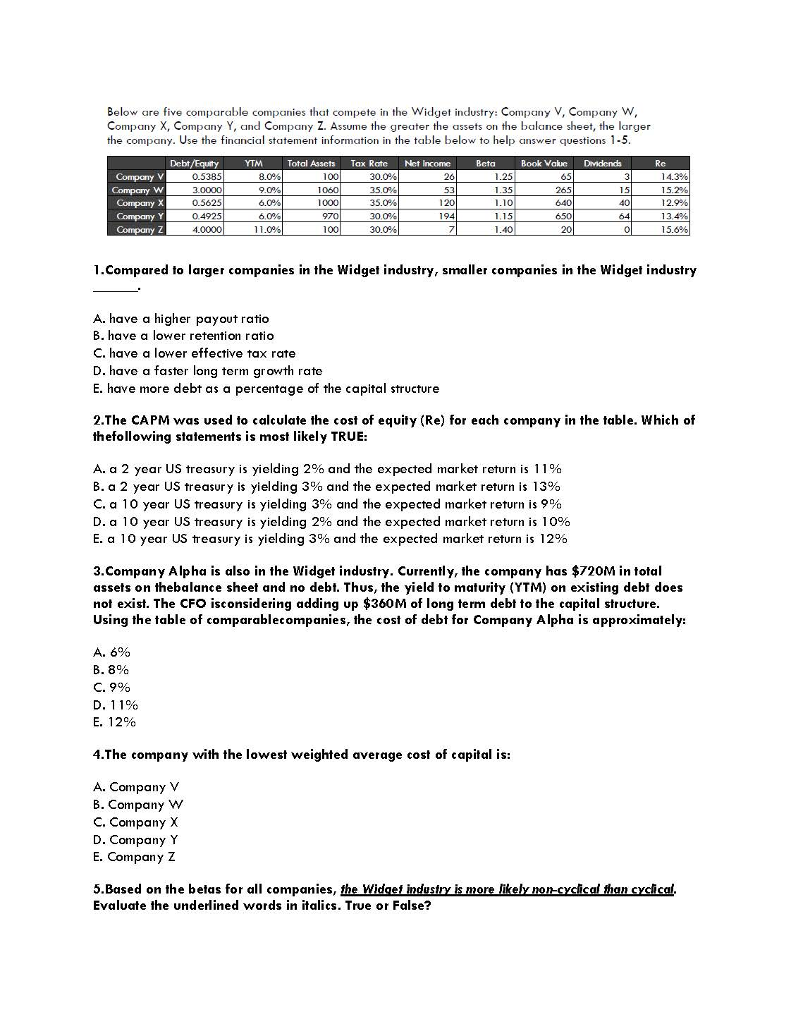

Question: Below are five comparable compaies that compete in the Widget industry: Company V, Company W, Company X, Company Y and Company Z. Assume the greater

Below are five comparable compaies that compete in the Widget industry: Company V, Company W, Company X, Company Y and Company Z. Assume the greater the assets on the balance sheet, the larger the company. Use the financial statement information in the table below to help answer questions 1-5 Debt/Equity YTM Total Asscts Tax Rote Net Incomc Book Vakuc Didends Re Compony V 0.5385 .0000 0.5625 0.4925 4.0000 8.0% 9.0% 6.0% 60% 11.0% 100 1060 1000 970 100 30.0% 35.00% 35.096 30.0% 30.0% 26 53 120 .25 1.35 1.10 1.15 1.40 65 265 640 650 1.5 40 64 15.2% 12.9% 13.4% i 5.096 Company Y Companyz 1.Compared to larger companies in the Widget industry, smaller companies in the Widget industry A. have a higher payout ratio B. have a lower retention ratio C. have a lower effective tax rate D. have a faster long term growth rate E. have more debt as a percentage of the capital structure 2.The CAPM was used to calculate the cost of equity (Re) for each company in the table. Which of thefollowing statements is most likely TRUE A, a 2 year US treasury is yielding 2% and the expected market return is 1 1% B. a 2 year US treasury is yielding 3% and the expected market return is13% C. a 10 year US treasury is yielding 3% and the expected market return is 9% D. a 10 year US treasury is yielding 2% and the expected market return is 10% E. a 10 year US treasury is yielding 3% and the expected market return is 12% 3.Company Alpha is also in the Widget industry. Currently, the company has $720M in total assets on thebalance sheet and no debt. Thus, the yield to maturity (YTM) on existing debt does not exist. The CFO isconsidering adding up $360M of long term debt to the capital structure Using the table of comparablecompanies, the cost of debt for Company Alpha is approximately: B. 8% . 9% D. 11% E. 12% 4.The company with the lowest weighted average cost of capital is: A. Company V B. Company C. Company X D. Company Y E. Company Z 5.Based on the betas for all companies Evaluate the underlined words in italics. True or False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts