Question: Below are four bond problems that you must solve. Assume the bond face value is $1,000. 1. You are considering the purchase of a

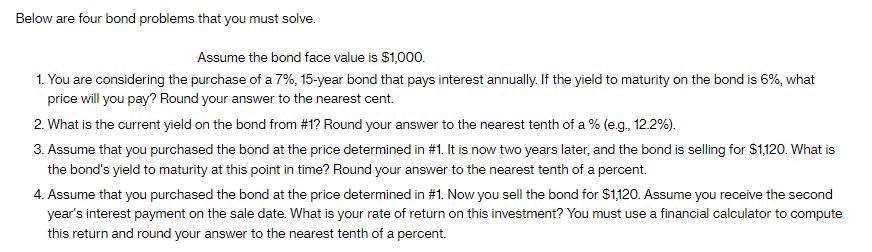

Below are four bond problems that you must solve. Assume the bond face value is $1,000. 1. You are considering the purchase of a 7%, 15-year bond that pays interest annually. If the yield to maturity on the bond is 6%, what price will you pay? Round your answer to the nearest cent. 2. What is the current yield on the bond from #1? Round your answer to the nearest tenth of a % (e.g., 12.2%). 3. Assume that you purchased the bond at the price determined in #1. It is now two years later, and the bond is selling for $1,120. What is the bond's yield to maturity at this point in time? Round your answer to the nearest tenth of a percent. 4. Assume that you purchased the bond at the price determined in #1. Now you sell the bond for $1,120. Assume you receive the second year's interest payment on the sale date. What is your rate of return on this investment? You must use a financial calculator to compute this return and round your answer to the nearest tenth of a percent.

Step by Step Solution

There are 3 Steps involved in it

Sure Id be happy to help you solve these bond problems Lets go through each of them step by step Pro... View full answer

Get step-by-step solutions from verified subject matter experts