Question: Below are instructions for each: 1 ) Utilizing the financial information below for The Cookie Company, complete a budget performance report combining activity variances and

Below are instructions for each:

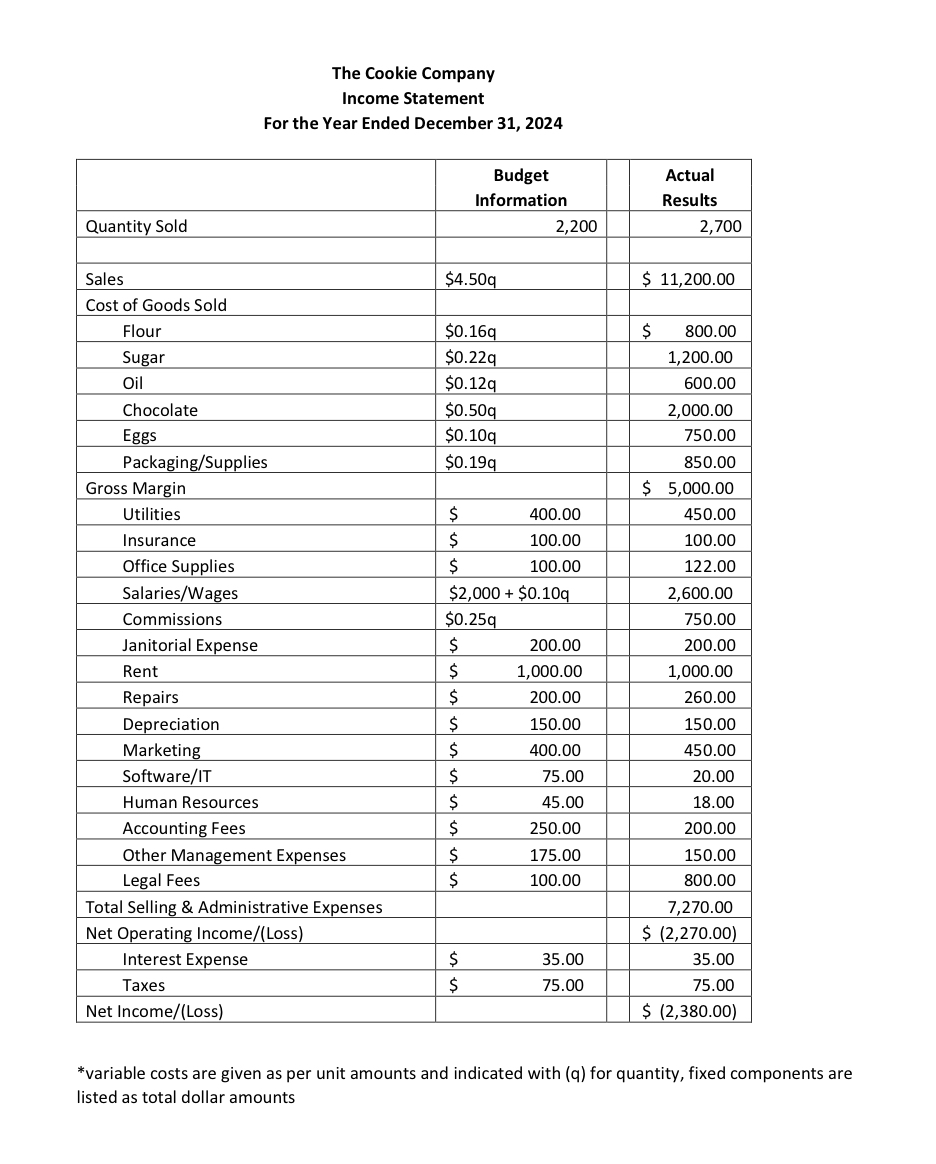

Utilizing the financial information below for The Cookie Company, complete a budget performance report combining activity variances and revenue and spending variances like that in Exhibit on page of the textbook. Please be sure to include Favorable vs Unfavorable indicators for each variance. The report must be created from scratch in Excel. Each student's report should be completely unique even if following similar formats. Formulas MUST be used for ALL calculations, and the final submission must be made in Excel to grade calculations properly.

Feel free to email me your Excel spreadsheet to check your calculations before starting the written paper. I am happy to offer feedback before continuing the project, and this will also help ensure a better final grade.

After completing the spreadsheet, write a page paper analyzing the variances and overall performance of the company. Be sure to highlight how different areas of business ie marketing, H R supply chain, etc. contribute to the overall success or failure of the business. Feel free to make up or assume additional information about the company that is not provided to support your evaluation, as long as it is consistent with the financial data. It is recommended to use pt font Times New Roman, Calibri, or Arial and be doublespaced with oneinch margins. The Cookie Company

Income Statement

For the Year Ended December

begintabularccc

hline & Budget Information & Actual Results

hline Quantity Sold & &

hline Sales & $q & $

hline multicolumnlCost of Goods Sold

hline Flour & $q & $

hline Sugar & $q &

hline Oil & $q &

hline Chocolate & $q &

hline Eggs & $q &

hline PackagingSupplies & $q &

hline Gross Margin & & $

hline Utilities & $ &

hline Insurance & $ &

hline Office Supplies & $ &

hline SalariesWages & $$q &

hline Commissions & $q &

hline Janitorial Expense & $ &

hline Rent & $ &

hline Repairs & $ &

hline Depreciation & $ &

hline Marketing & $ &

hline SoftwareIT & $ &

hline Human Resources & $ &

hline Accounting Fees & $ &

hline Other Management Expenses & $ &

hline Legal Fees & $ &

hline Total Selling & Administrative Expenses & &

hline Net Operating IncomeLoss & & $

hline Interest Expense & $ &

hline Taxes & $ &

hline Net IncomeLoss & & $

hline

endtabular

variable costs are given as per unit amounts and indicated with q for quantity, fixed components are listed as total dollar amounts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock