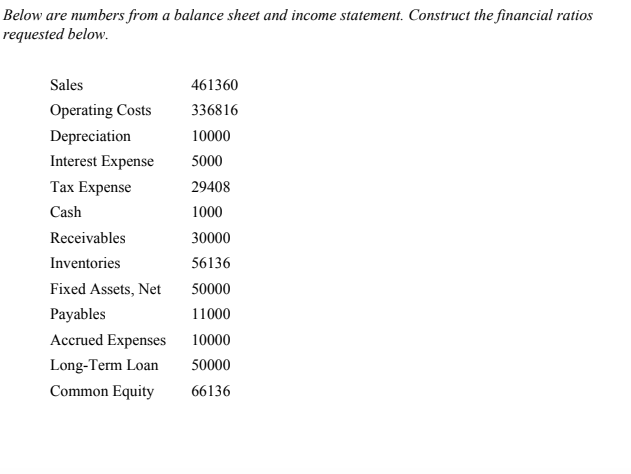

Question: Below are numbers from a balance sheet and income statement. Construct the financial ratios requested below Sales Operating Costs336816 Depreciation Interest Expense Tax Expense Cash

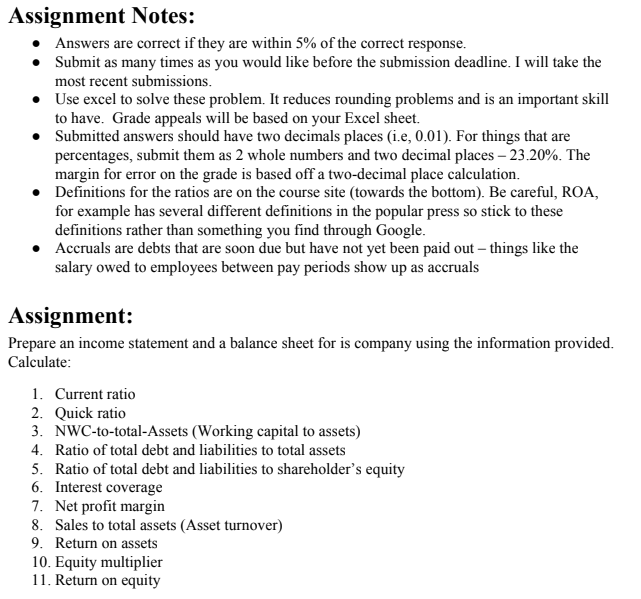

Below are numbers from a balance sheet and income statement. Construct the financial ratios requested below Sales Operating Costs336816 Depreciation Interest Expense Tax Expense Cash Receivables Inventories Fixed Assets, Net 50000 Payables Accrued Expenses 10000 Long-Term Loan 50000 Common Equity 66136 461360 10000 5000 29408 1000 30000 56136 11000 Assignment Notes: Answers are correct if they are within 5% of the correct response. Submit as many times as you would like before the submission deadline. I will take the most recent submissions Use excel to solve these problem. It reduces rounding problems and is an important skill to have. Grade appeals will be based on your Excel sheet. . * Submitted answers should have two decimals places (i.e, 0.01). For things that are percentages, submit them as 2 whole numbers and two decimal places-23.20%. The margin for error on the grade is based off a two-decimal place calculation. Definitions for the ratios are on the course site (towards the bottom). Be careful, ROA, for example has several different definitions in the popular press so stick to these definitions rather than something you find through Google Accruals are debts that are soon due but have not yet been paid out - things like the salary owed to employees between pay periods show up as accruals Assignment: Prepare an income statement and a balance sheet for is company using the information provided Calculate 1. Current ratio 2. Quick ratio 3. NWC-to-total-Assets (Working capital to assets) 4. Ratio of total debt and liabilities to total assets 5. Ratio of total debt and liabilities to shareholder's equity 6. Interest coverage 7. Net profit margin 8. Sales to total assets (Asset turnover) 9. Return on assets 10. Equity multiplier 11. Return on equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts