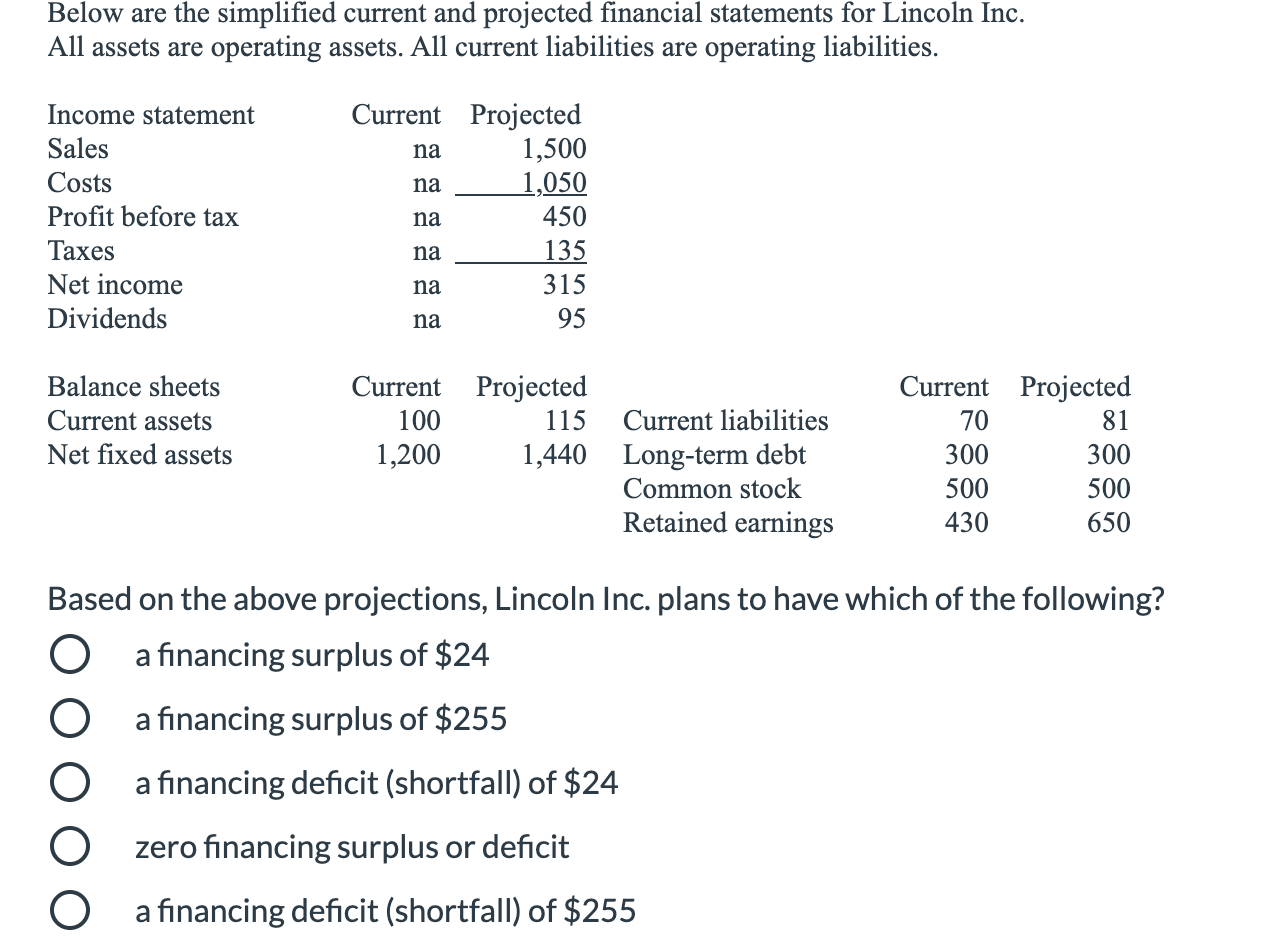

Question: Below are the simplified current and projected financial statements for Lincoln Inc. All assets are operating assets. All current liabilities are operating liabilities. na Income

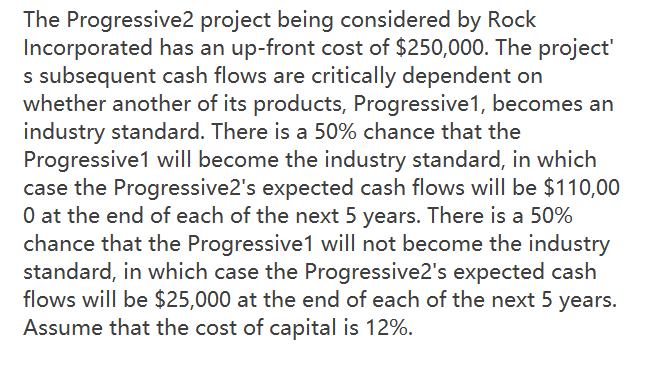

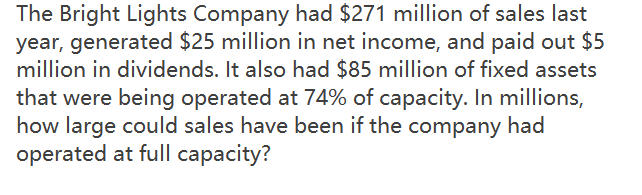

Below are the simplified current and projected financial statements for Lincoln Inc. All assets are operating assets. All current liabilities are operating liabilities. na Income statement Sales Costs Profit before tax Taxes Net income Dividends Current Projected na 1,500 1,050 na 450 na 135 na 315 na 95 Balance sheets Current assets Net fixed assets Current Projected 100 115 Current liabilities 1,200 1,440 Long-term debt Common stock Retained earnings Current Projected 70 81 300 300 500 500 430 650 Based on the above projections, Lincoln Inc. plans to have which of the following? O a financing surplus of $24 a financing surplus of $255 a financing deficit (shortfall) of $24 zero financing surplus or deficit O a financing deficit (shortfall) of $255 The Progressive2 project being considered by Rock Incorporated has an up-front cost of $250,000. The project' s subsequent cash flows are critically dependent on whether another of its products, Progressive1, becomes an industry standard. There is a 50% chance that the Progressive1 will become the industry standard, in which case the Progressive2's expected cash flows will be $110,00 O at the end of each of the next 5 years. There is a 50% chance that the Progressive1 will not become the industry standard, in which case the Progressive2's expected cash flows will be $25,000 at the end of each of the next 5 years. Assume that the cost of capital is 12%. The Bright Lights Company had $271 million of sales last year, generated $25 million in net income, and paid out $5 million in dividends. It also had $85 million of fixed assets that were being operated at 74% of capacity. In millions, how large could sales have been if the company had operated at full capacity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts