Question: Below are three situations, each describing a certain risk in banking. For each situation: a. Identify the type of risk from the bank's point of

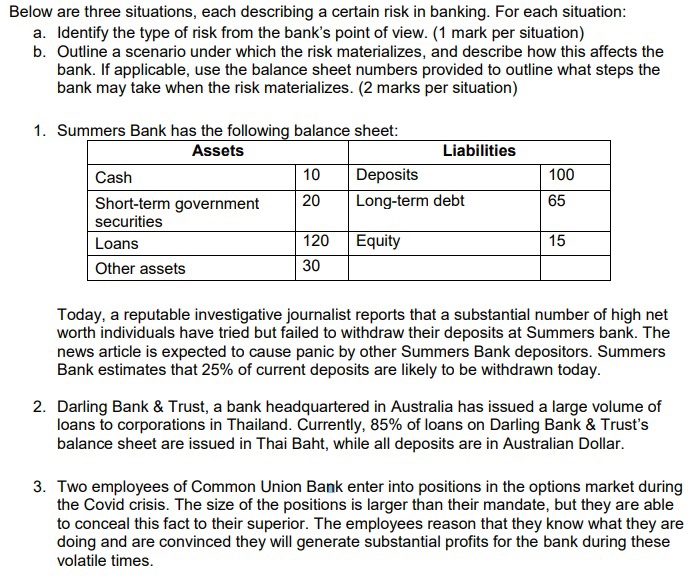

Below are three situations, each describing a certain risk in banking. For each situation: a. Identify the type of risk from the bank's point of view. (1 mark per situation) b. Outline a scenario under which the risk materializes, and describe how this affects the bank. If applicable, use the balance sheet numbers provided to outline what steps the bank may take when the risk materializes. (2 marks per situation) 1. Summers Bank has the following balance sheet: Assets Liabilities Cash 10 Deposits Short-term government 20 Long-term debt securities Loans 120 Equity Other assets 100 65 15 30 Today, a reputable investigative journalist reports that a substantial number of high net worth individuals have tried but failed to withdraw their deposits at Summers bank. The news article is expected to cause panic by other Summers Bank depositors. Summers Bank estimates that 25% of current deposits are likely to be withdrawn today. 2. Darling Bank & Trust, a bank headquartered in Australia has issued a large volume of loans to corporations in Thailand. Currently, 85% of loans on Darling Bank & Trust's balance sheet are issued in Thai Baht, while all deposits are in Australian Dollar. 3. Two employees of Common Union Bank enter into positions in the options market during the Covid crisis. The size of the positions is larger than their mandate, but they are able to conceal this fact to their superior. The employees reason that they know what they are doing and are convinced they will generate substantial profits for the bank during these volatile times. Below are three situations, each describing a certain risk in banking. For each situation: a. Identify the type of risk from the bank's point of view. (1 mark per situation) b. Outline a scenario under which the risk materializes, and describe how this affects the bank. If applicable, use the balance sheet numbers provided to outline what steps the bank may take when the risk materializes. (2 marks per situation) 1. Summers Bank has the following balance sheet: Assets Liabilities Cash 10 Deposits Short-term government 20 Long-term debt securities Loans 120 Equity Other assets 100 65 15 30 Today, a reputable investigative journalist reports that a substantial number of high net worth individuals have tried but failed to withdraw their deposits at Summers bank. The news article is expected to cause panic by other Summers Bank depositors. Summers Bank estimates that 25% of current deposits are likely to be withdrawn today. 2. Darling Bank & Trust, a bank headquartered in Australia has issued a large volume of loans to corporations in Thailand. Currently, 85% of loans on Darling Bank & Trust's balance sheet are issued in Thai Baht, while all deposits are in Australian Dollar. 3. Two employees of Common Union Bank enter into positions in the options market during the Covid crisis. The size of the positions is larger than their mandate, but they are able to conceal this fact to their superior. The employees reason that they know what they are doing and are convinced they will generate substantial profits for the bank during these volatile times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts