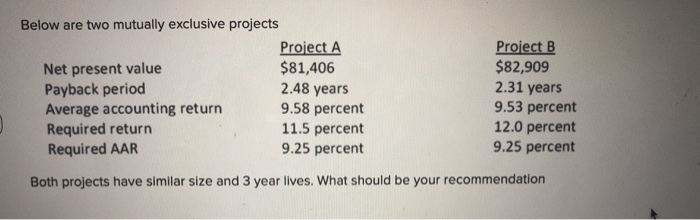

Question: Below are two mutually exclusive projects Project A Net present value $81,406 Payback period Average accounting return 9.58 percent Required return 11.5 percent Required AAR

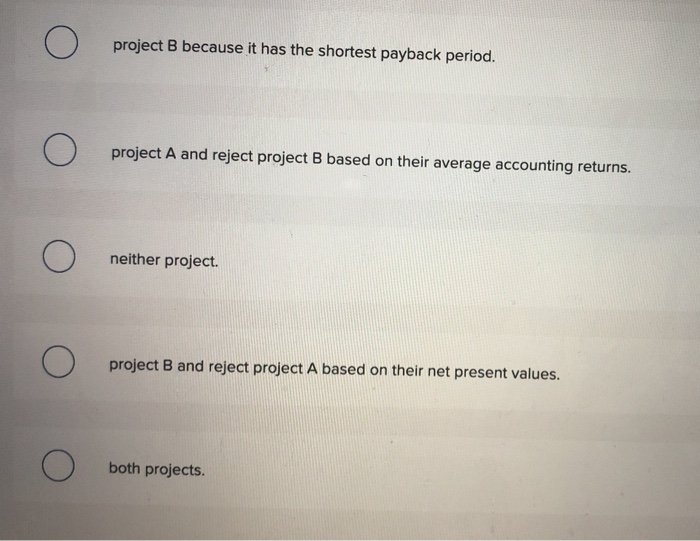

Below are two mutually exclusive projects Project A Net present value $81,406 Payback period Average accounting return 9.58 percent Required return 11.5 percent Required AAR 9.25 percent 2.48 years Project B $82,909 2.31 years 9.53 percent 12.0 percent 9.25 percent Both projects have similar size and 3 year lives. What should be your recommendation O project B because it has the shortest payback period. O project A and reject project B based on their average accounting returns. O neither project. O project B and reject project A based on their net present values. both projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts