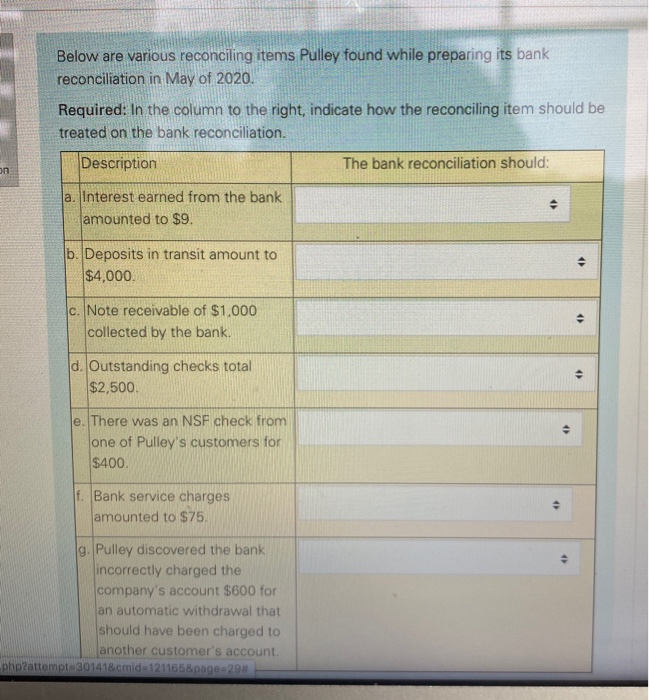

Question: Below are various reconciling items Pulley found while preparing its bank reconciliation in May of 2020. Required: In the column to the right, indicate how

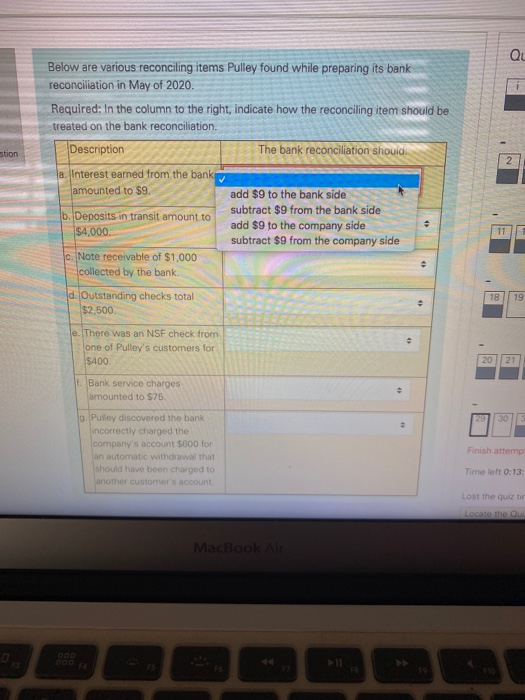

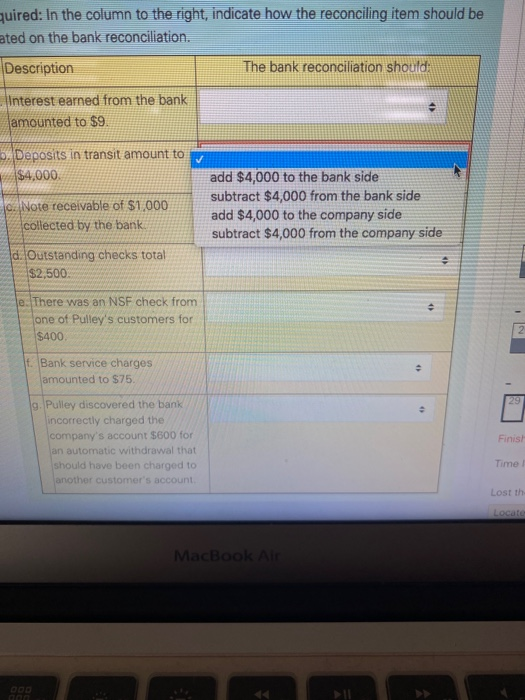

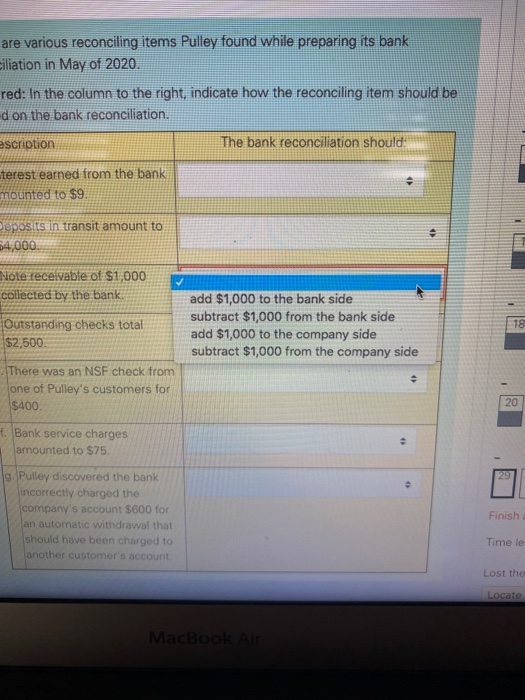

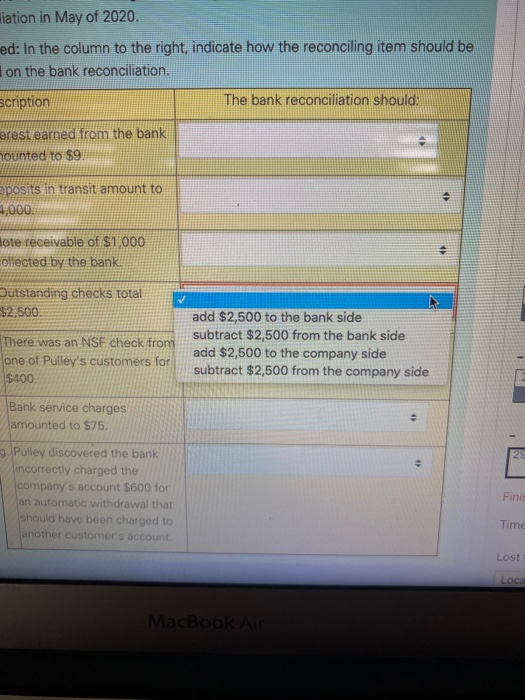

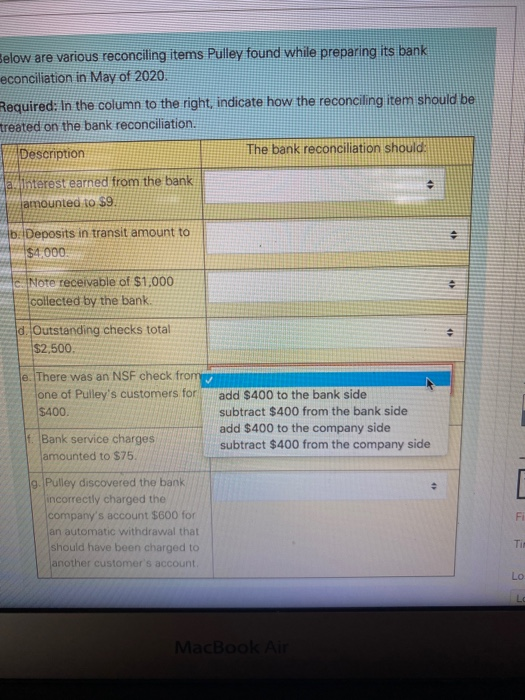

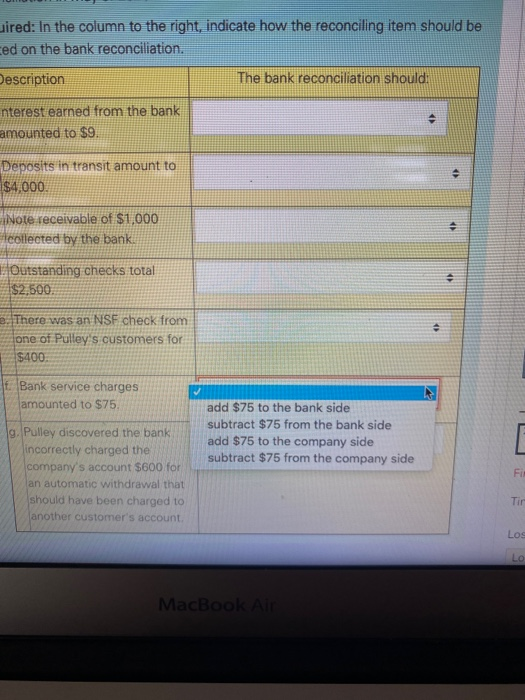

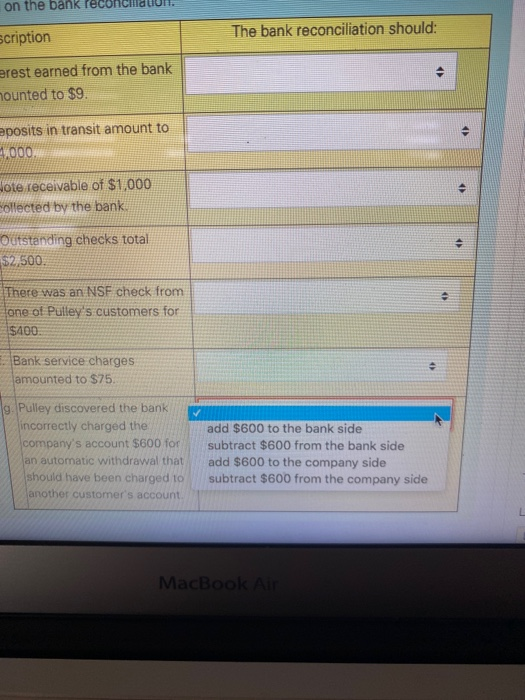

Below are various reconciling items Pulley found while preparing its bank reconciliation in May of 2020. Required: In the column to the right, indicate how the reconciling item should be treated on the bank reconciliation. Description The bank reconciliation should: on a. Interest earned from the bank amounted to $9. b. Deposits in transit amount to $4,000. c. Note receivable of $1,000 collected by the bank. . d. Outstanding checks total $2,500 . e. There was an NSF check from one of Pulley's customers for $400 f. Bank service charges amounted to $75 . g. Pulley discovered the bank incorrectly charged the company's account $600 for an automatic withdrawal that should have been charged to another customer's account. php?attempt. 301418cmid=121165&page=298 QU stion Below are various reconciling items Pulley found while preparing its bank reconciliation in May of 2020. Required: In the column to the right, indicate how the reconciling item should be treated on the bank reconciliation. Description The bank reconciliation should a. Interest earned from the bank amounted to $9. add $9 to the bank side subtract $9 from the bank side b. Deposits in transit amount to add $9 to the company side $4,000 subtract $9 from the company side c. Note receivable of $1,000 collected by the bank. 11 18 19 d. Outstanding checks total $2,500 le. There was an NSF check from one of Pullay's customers for $400 20 21 Bank service charges amounted to $75. 30 9. Pulley discovered the bank incorrectly charged the company's account $600 for an automatic withdrawal that should have been charged to another customers account Finish attemp Time left 0:13 Lost the quilti MacBook Air quired: In the column to the right, indicate how the reconciling item should be ated on the bank reconciliation. Description The bank reconciliation should Interest earned from the bank amounted to $9. 6. Deposits in transit amount to $4,000 jo. Note receivable of $1,000 collected by the bank. add $4,000 to the bank side subtract $4,000 from the bank side add $4,000 to the company side subtract $4,000 from the company side d. Outstanding checks total $2,500 e. There was an NSF check from one of Pulley's customers for $400 4 t. Bank service charges amounted to $75. 29 g. Pulley discovered the bank incorrectly charged the company's account $600 for an automatic withdrawal that should have been charged to another customer's account Finis! Time Lost th Locate MacBook Air are various reconciling items Pulley found while preparing its bank Biliation in May of 2020. red: In the column to the right, indicate how the reconciling item should be d on the bank reconciliation. escription The bank reconciliation should: terest earned from the bank mounted to $9. Deposits in transit amount to 54,000 . Nole receivable of $1,000 collected by the bank Outstanding checks total $2,500 add $1,000 to the bank side subtract $1,000 from the bank side add $1,000 to the company side subtract $1,000 from the company side 18 There was an NSF check from one of Pulley's customers for $400 20 7. Bank service charges amounted to $75. 29 e g. Pulley discovered the bank incorrectly charged the company's account $600 for an automatic withdrawal that should have been charged to another customer's account Finish Time le Lost the Locate MacBook Air liation in May of 2020. ed: In the column to the right, indicate how the reconciling item should be on the bank reconciliation. scription The bank reconciliation should: erest earned from the bank mounted to $9 eposits in transit amount to 1,000 lote receivable of $1,000 Collected by the bank. . utstanding checks total $2,500. There was an NSF check from one of Pulley's customers for $400 add $2,500 to the bank side subtract $2,500 from the bank side add $2,500 to the company side subtract $2,500 from the company side Bank service charges amounted to $75. 29 . 9. Pulley discovered the bank incorrectly charged the company's account $600 for an automatic withdrawal that should have been charged to another customer's account Finis Time Lost LOC! MacBook Air Below are various reconciling items Pulley found while preparing its bank econciliation in May of 2020. Required: In the column to the right indicate how the reconciling item should be treated on the bank reconciliation. Description The bank reconciliation should: Jadinterest earned from the bank amounted to $9 1b: Deposits in transit amount to $4.000 Note receivable of $1,000 collected by the bank. d. Outstanding checks total $2,500. e. There was an NSF check from one of Pulley's customers for $400 add $400 to the bank side subtract $400 from the bank side add $400 to the company side subtract $400 from the company side 1. Bank service charges amounted to $75 FI 9. Pulley discovered the bank incorrectly charged the company's account $600 for an automatic withdrawal that should have been charged to another customer's account Tir LO Lo MacBook Air uired: In the column to the right, indicate how the reconciling item should be ced on the bank reconciliation. Description The bank reconciliation should nterest earned from the bank amounted to $9 Deposits in transit amount to $4,000 Note receivable of $1,000 collected by the bank. - Outstanding checks total $2,500 e. There was an NSF check from one of Pulley's customers for $400. Bank service charges amounted to $75 add $75 to the bank side subtract $75 from the bank side add $75 to the company side subtract $75 from the company side g. Pulley discovered the bank incorrectly charged the company's account $600 for an automatic withdrawal that should have been charged to another customer's account Fi Log LO MacBook Air on the bank lecon scription The bank reconciliation should: erest earned from the bank mounted to $9. e eposits in transit amount to 1000 Hote receivable of $1,000 Collected by the bank. . Outstanding checks total $2,500. . There was an NSF check from one of Pulley's customers for $400 Bank service charges amounted to $75. g. Pulley discovered the bank incorrectly charged the company's account $600 for an automatic withdrawal that should have been charged to anothor customer's account add $600 to the bank side subtract $600 from the bank side add $600 to the company side subtract $600 from the company side MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts