Question: Below is a hypothetical situation that will allow you to compare two investment options. Your assignment is to review both options and determine which

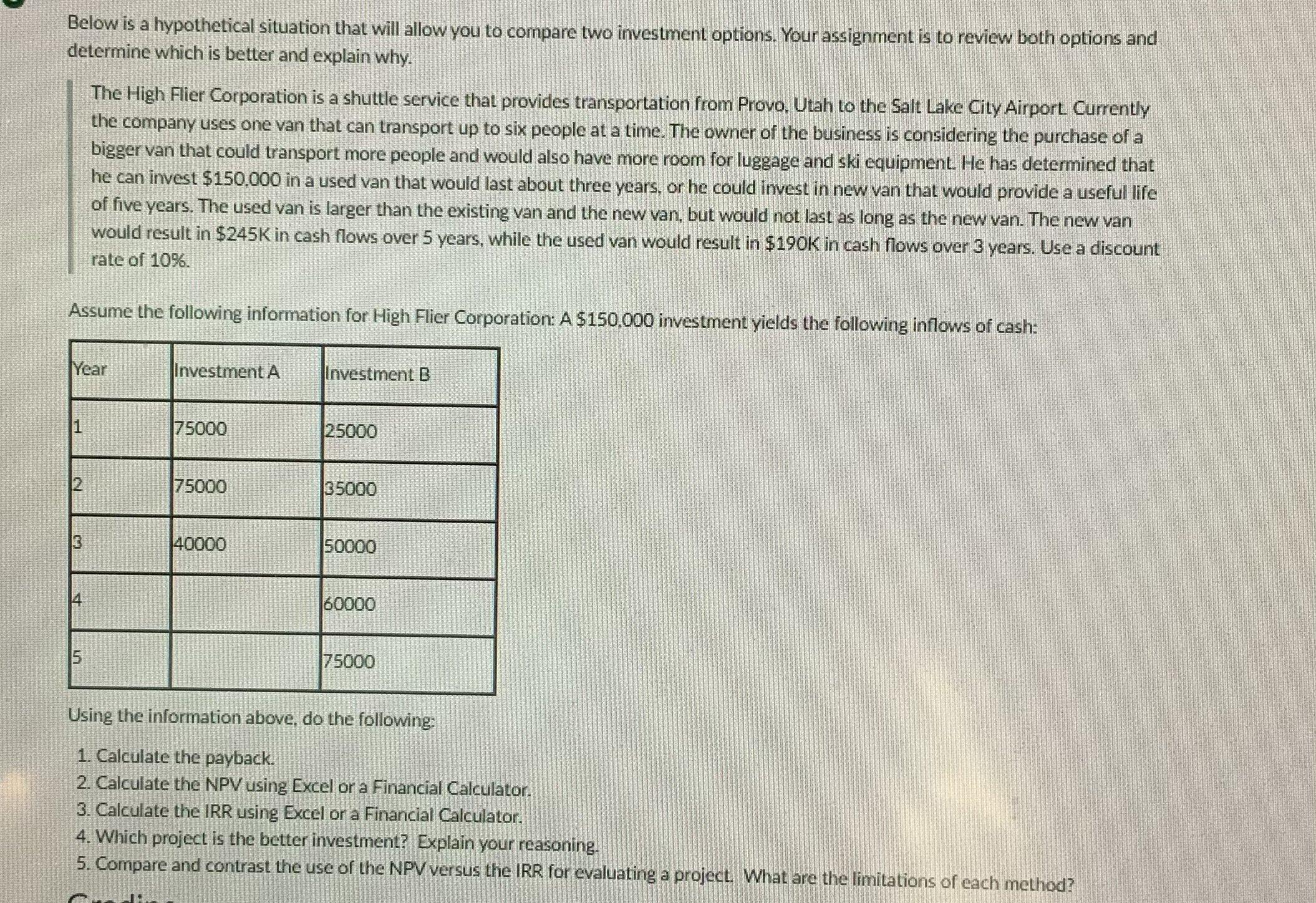

Below is a hypothetical situation that will allow you to compare two investment options. Your assignment is to review both options and determine which is better and explain why. Assume the following information for High Flier Corporation: A $150,000 investment yields the following inflows of cash: Year 3 The High Flier Corporation is a shuttle service that provides transportation from Provo, Utah to the Salt Lake City Airport. Currently the company uses one van that can transport up to six people at a time. The owner of the business is considering the purchase of a bigger van that could transport more people and would also have more room for luggage and ski equipment. He has determined that he can invest $150,000 in a used van that would last about three years, or he could invest in new van that would provide a useful life of five years. The used van is larger than the existing van and the new van, but would not last as long as the new van. The new van would result in $245K in cash flows over 5 years, while the used van would result in $190K in cash flows over 3 years. Use a discount rate of 10%. st 5 Investment A 75000 75000 40000 Investment B 25000 35000 50000 60000 75000 Using the information above, do the following: 1. Calculate the payback. 2. Calculate the NPV using Excel or a Financial Calculator. 3. Calculate the IRR using Excel or a Financial Calculator. 4. Which project is the better investment? Explain your reasoning. 5. Compare and contrast the use of the NPV versus the IRR for evaluating a project. What are the limitations of each method?

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

To compare the two investment options for High Flier Corporation we will calculate the payback NPV and IRR for each option 1 Payback The payback perio... View full answer

Get step-by-step solutions from verified subject matter experts