Question: Below is a payroll sheet for Otis Import Company for the month of September 2018. The company is allowed a tax rate is income tax

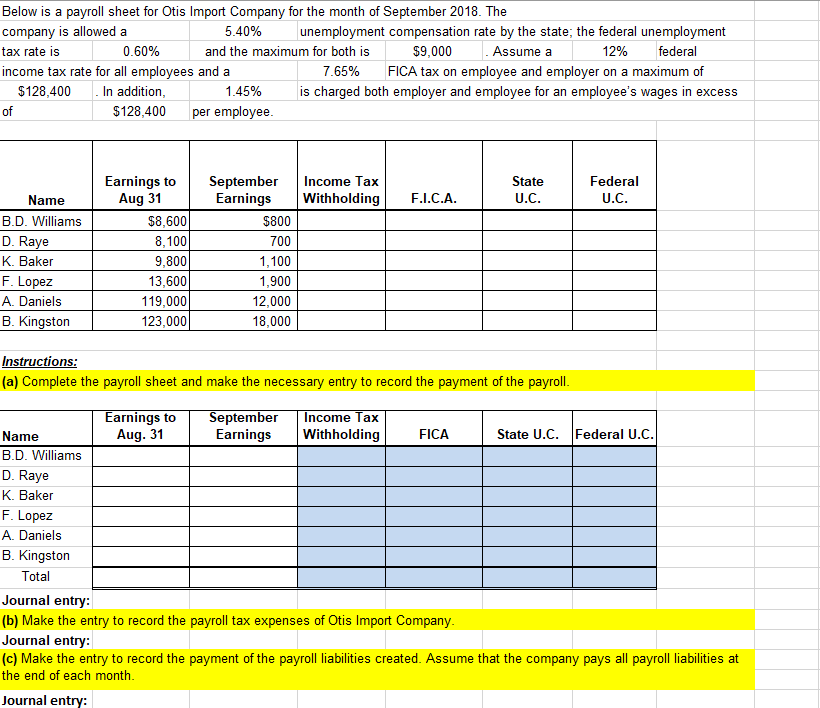

Below is a payroll sheet for Otis Import Company for the month of September 2018. The company is allowed a tax rate is income tax rate for all employees and a 5.40% unemployment compensation rate by the state; the federal unemployment and the maximum for 0.60% both is 7.65% $9,000 Assume a 12% federal FICA tax on employee and employer on a maximum of $128,400 In addition 1.45% is charged both employer and employee for an employee's wages in excess of $128,400 per employee Earnings to Aug 31 September Income Tax Withholding State U.. Federal U.. Name Earnings F.I.C.A B.D. Williams D. Raye K. Baker F. Lopez A. Daniels B. Kingston $8,600 8,100 9,800 13,600 119,000 123,000 $800 700 1,100 1,900 12,000 18,000 Instructions (a) Complete the payroll sheet and make the necessary entry to record the payment of the payroll Earnings to Aug. 31 eptember Earnings Income Tax Withholding FICA State U.. Federal U. Name B.D. Williams D. Raye K. Baker F. Lopez A. Daniels B. Kingston Total Journal entry (b) Make the entry to record the payroll tax expenses of Otis Import Company Journal entry (c) Make the entry to record the payment of the payroll liabilities created. Assume that the company pays all payroll liabilities at the end of each month Journal entry: Below is a payroll sheet for Otis Import Company for the month of September 2018. The company is allowed a tax rate is income tax rate for all employees and a 5.40% unemployment compensation rate by the state; the federal unemployment and the maximum for 0.60% both is 7.65% $9,000 Assume a 12% federal FICA tax on employee and employer on a maximum of $128,400 In addition 1.45% is charged both employer and employee for an employee's wages in excess of $128,400 per employee Earnings to Aug 31 September Income Tax Withholding State U.. Federal U.. Name Earnings F.I.C.A B.D. Williams D. Raye K. Baker F. Lopez A. Daniels B. Kingston $8,600 8,100 9,800 13,600 119,000 123,000 $800 700 1,100 1,900 12,000 18,000 Instructions (a) Complete the payroll sheet and make the necessary entry to record the payment of the payroll Earnings to Aug. 31 eptember Earnings Income Tax Withholding FICA State U.. Federal U. Name B.D. Williams D. Raye K. Baker F. Lopez A. Daniels B. Kingston Total Journal entry (b) Make the entry to record the payroll tax expenses of Otis Import Company Journal entry (c) Make the entry to record the payment of the payroll liabilities created. Assume that the company pays all payroll liabilities at the end of each month Journal entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts