Question: Below is a question and its answer. Could you please explain how did they get to the answer. Please provide as much details as you

Below is a question and its answer. Could you please explain how did they get to the answer. Please provide as much details as you can.

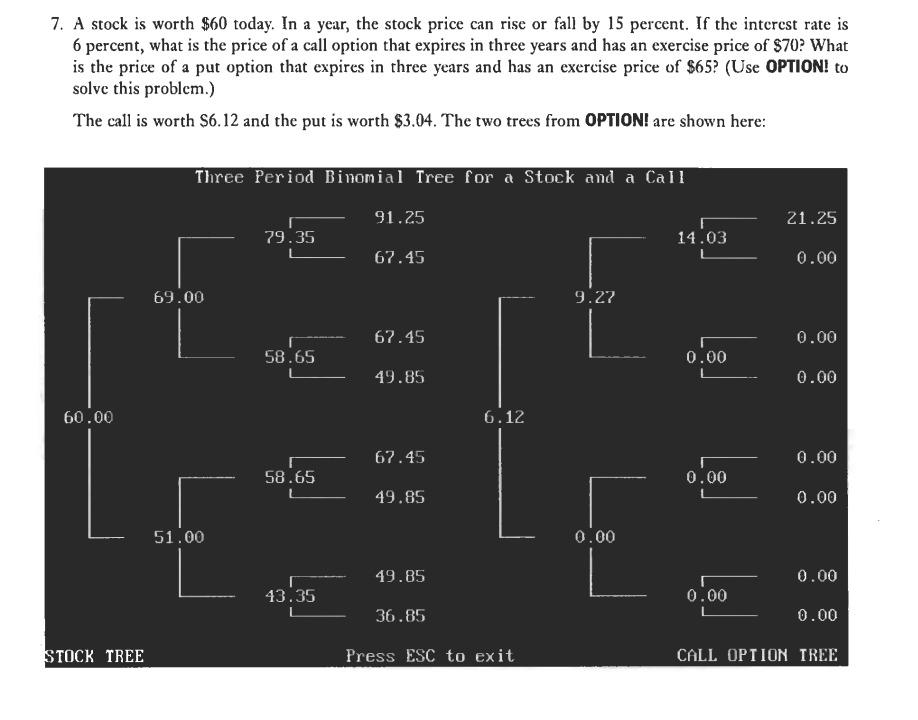

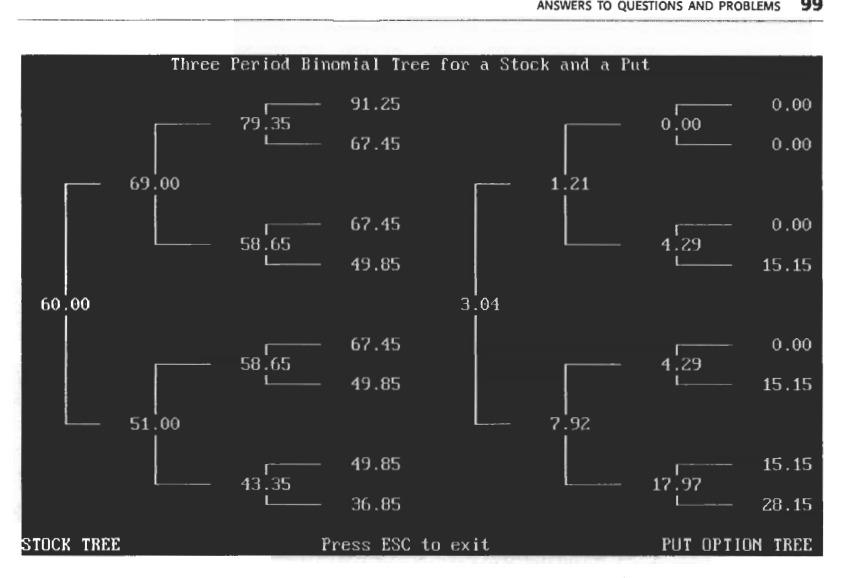

7. A stock is worth $60 today. In a year, the stock price can rise or fall by 15 percent. If the interest rate is 6 percent, what is the price of a call option that expires in three years and has an exercise price of $70? What is the price of a put option that expires in three years and has an exercise price of $65? (Use OPTION! to solve this problem.) The call is worth $6.12 and the put is worth $3.04. The two trees from OPTION! are shown here: Three Period Binonial Tree for a Stock and a Call 91.25 21.25 79.35 14.03 67.45 0.00 69.00 9.27 67.45 0.00 58.65 0.00 49.85 0.00 60.00 6.12 67.45 0.00 58.65 0.00 49.85 0.00 51.00 0.00 49.85 0.00 43.35 0.00 36.85 0.00 STOCK TREE Press ESC to exit CALL OPTION TREE ANSWERS TO QUESTIONS AND PROBLEMS 99 Three Period Binomial Tree for a Stock and a Put 91.25 0.00 79.35 0.00 67.45 0.00 69.00 1.21 67.45 0.00 58.65 4.29 49.85 15.15 60.00 3.04 67.45 0.00 58.65 4.29 49.85 15.15 51.00 7.92 49.85 15.15 43.35 17.97 36.85 28.15 STOCK TREE Press ESC to exit PUT OPTION TREE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts