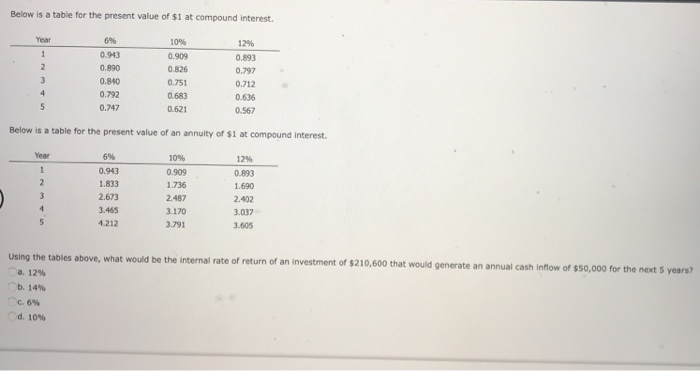

Question: Below is a table for the present value of $1 at compound interest. 0.943 0.890 0.840 0.792 0.747 10% 0.909 0.826 0.751 0.683 0.621 0.893

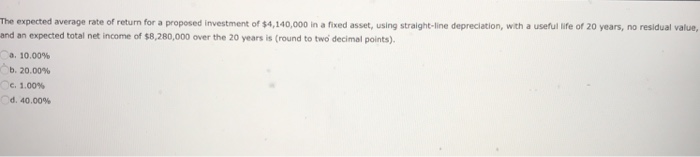

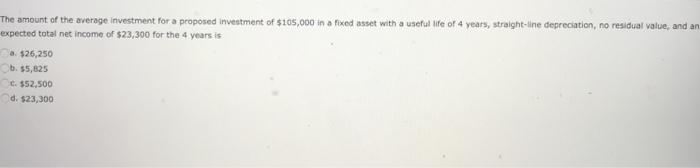

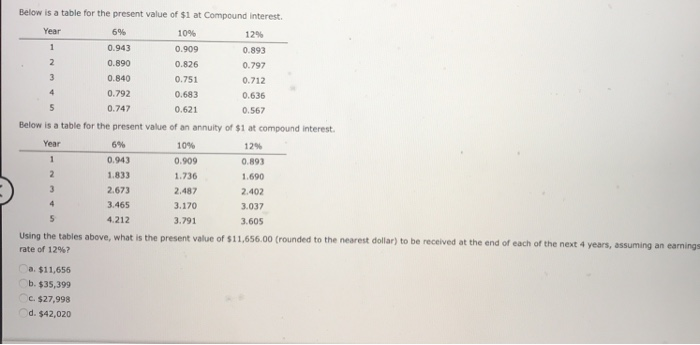

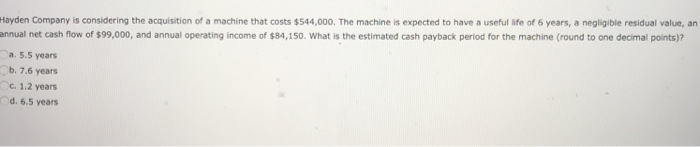

Below is a table for the present value of $1 at compound interest. 0.943 0.890 0.840 0.792 0.747 10% 0.909 0.826 0.751 0.683 0.621 0.893 0,797 0.712 0.636 0.567 Below is a table for the present value of an annuity of $1 at compound interest 0.943 1.833 2.673 3.465 4.212 10% 0.909 1.736 2.487 3.170 3.791 12% 0.893 1.690 2.402 3.037 3.605 Using the tables above, what would be the internal rate of return of an investment of $210,600 that would generate a annual cash inflow of $50,000 for the next 5 years a. 12% , b. 14% "" 6% d. 10% The expected average rate of return for a proposed investment of $4,140,000 in a fixed asset, using straight-line depreciation, with a useful life of 20 years, no residual value, and an expected total net income of $8,280,000 over the 20 years is (round to two decimal points). a. 10.00% b. 20.00% c. 1.00% d. 40.00% , The amount of the average investment for a proposed investment of $105,000 in a fixed asset with a useful life of 4 years, straight-line depreciation, no residual value, and an expected total net income of $23,300 for the 4 years is .$26,250 b. $5,825 C.$52,500 d. $23,300 Below is a table for the present value of $1 at Compound interest 6% 0.943 0.890 0.840 0.792 0.747 10% 0.909 0.826 0.751 0.683 0.621 12% 0.893 .797 0.712 0.636 0.567 Year Below is a table for the present value of an annuity of $1 at compound interest 6% 0.943 1833 2.673 3.465 4.212 10% 0.909 1.736 2.487 3.170 3.791 1296 0.893 1.690 2.402 3.037 3.605 Year Using the tables above, what is the present value of $11,656.00 (rounded to the nearest dollar) to be received at the end of each of the next 4 years, assuming an earnings rate of 12%? a. $11,656 b.$35,399 C.$27,998 d.$42,020 Hayden Company is considering the acquisition of a machine that costs $544,000. The machine is expected to have a useful life of 6 years, a negligible residual value, an annual net cash flow of $99,000, and annual operating income of $84,150. What is the estimated cash payback period for the machine (round to one decimal points)? a. 5.5 years b. 7.6 years C.12 years d. 6.5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts