Question: Below is an IV FE regression linking log output (ys) to log capital stock (k) and log employment (n) in a firm-level dataset. Employment is

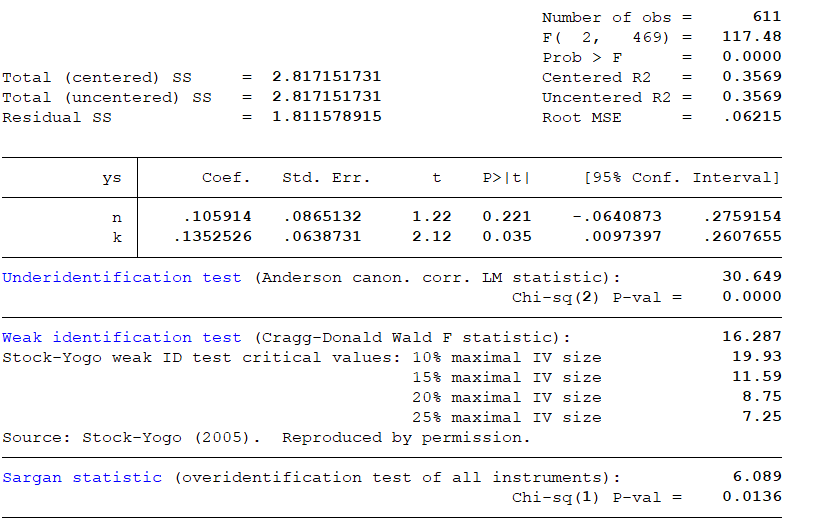

Below is an IV FE regression linking log output (ys) to log capital stock (k) and log employment (n) in a firm-level dataset. Employment is regarded as endogenous and therefore instrumented with two instrumental variables, iv1 and iv2 (not shown). The model is estimated using xtivreg2 command in Stata.

Number of obs = 611 F( 2, 469) = 117 . 48 Prob > F = 0 . 0000 Total (centered) SS = 2 . 817151731 Centered R2 = 0 . 3569 Total (uncentered) SS = 2 . 817151731 Uncentered R2 = 0 . 3569 Residual ss = 1 . 811578915 Root MSE = . 06215 ys Coef. Std. Err. P>Itl [95% Conf. Interval] n . 105914 . 0865132 1 .22 0 . 221 - . 0640873 . 2759154 k . 1352526 . 0638731 2. 12 0 . 035 . 0097397 . 2607655 Underidentification test (Anderson canon. corr. LM statistic) : 30 . 649 Chi-sq (2) P-val = 0 . 0000 Weak identification test (Cragg-Donald Wald F statistic) : 16.287 Stock-Yogo weak ID test critical values: 10% maximal IV size 19.93 15% maximal IV size 11 . 59 20% maximal IV size 8 . 75 25% maximal IV size 7.25 Source: Stock-Yogo (2005) . Reproduced by permission. Sargan statistic (overidentification test of all instruments) : 6. 089 Chi-sq (1) P-val = 0 . 0136

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts